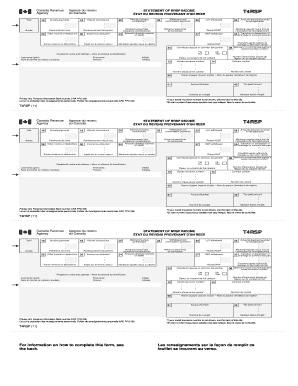

T4rsp 2011

What is the T4rsp

The T4rsp is a specific tax form used primarily for reporting certain types of income and deductions. This form is essential for taxpayers who need to disclose specific financial information to the Internal Revenue Service (IRS). Understanding the T4rsp is crucial for accurate tax filing and compliance with federal regulations.

How to use the T4rsp

Using the T4rsp involves several steps to ensure proper completion and submission. Taxpayers must first gather all necessary financial documents, including income statements and records of any deductions they plan to claim. Once the required information is collected, the form can be filled out accurately, ensuring that all sections are completed according to IRS guidelines. After filling out the form, it should be reviewed for any errors before submission.

Steps to complete the T4rsp

To complete the T4rsp, follow these steps:

- Collect all relevant financial documents, including income statements and deduction records.

- Fill out the form, ensuring that all sections are completed accurately.

- Double-check the information for any errors or omissions.

- Sign and date the form to validate it.

- Submit the form either electronically or by mail, depending on your preference.

Key elements of the T4rsp

The T4rsp includes several key elements that must be understood for proper use. These elements typically consist of personal information, income details, and specific deductions that can be claimed. Each section of the form has specific instructions that guide the taxpayer in providing accurate information. Understanding these key components is essential for compliance and to avoid potential penalties.

Legal use of the T4rsp

The T4rsp must be used in accordance with IRS regulations to ensure legal compliance. This means that taxpayers should only report income and deductions that are legitimate and supported by documentation. Misuse of the form can lead to legal repercussions, including fines or audits. It is important for users to be aware of the legal implications of their submissions.

Examples of using the T4rsp

Examples of using the T4rsp can provide clarity on its application. For instance, a self-employed individual might use the T4rsp to report income earned from freelance work and claim related business expenses. Similarly, a retiree may utilize the form to report pension income and any applicable deductions. These examples illustrate the versatility of the T4rsp in various financial situations.

Quick guide on how to complete t4rsp

Complete T4rsp effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can find the correct form and securely store it online. airSlate SignNow provides you with all the features you need to create, edit, and eSign your documents quickly without delays. Manage T4rsp on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to edit and eSign T4rsp with ease

- Find T4rsp and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information thoroughly and then click on the Done button to save your updates.

- Select how you would like to share your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in a few clicks from any device you choose. Edit and eSign T4rsp and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t4rsp

Create this form in 5 minutes!

How to create an eSignature for the t4rsp

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is t4rsp and how does it benefit my business?

t4rsp is an innovative solution offered by airSlate SignNow that enables businesses to streamline their document signing processes. By utilizing t4rsp, companies can enhance efficiency, reduce turnaround times, and improve overall productivity. This tool is designed to simplify the eSigning experience for both senders and recipients.

-

How much does t4rsp cost?

The pricing for t4rsp varies based on the plan you choose. airSlate SignNow offers flexible pricing options to accommodate businesses of all sizes, ensuring that you get the best value for your investment. You can explore different plans on our website to find one that fits your budget and needs.

-

What features are included with t4rsp?

t4rsp includes a variety of features designed to enhance your document management experience. Key features include customizable templates, real-time tracking, and secure cloud storage. These functionalities make it easier for businesses to manage their documents efficiently and securely.

-

Can t4rsp integrate with other software?

Yes, t4rsp is designed to integrate seamlessly with various software applications, enhancing its functionality. Whether you use CRM systems, project management tools, or other business applications, t4rsp can connect with them to streamline your workflows. This integration capability helps businesses maintain a cohesive operational environment.

-

Is t4rsp secure for sensitive documents?

Absolutely, t4rsp prioritizes the security of your documents. airSlate SignNow employs advanced encryption and security protocols to ensure that all data is protected. You can confidently use t4rsp for sensitive documents, knowing that your information is safe from unauthorized access.

-

How does t4rsp improve the eSigning process?

t4rsp signNowly improves the eSigning process by providing a user-friendly interface and efficient workflows. With t4rsp, users can easily send, sign, and manage documents from any device, reducing the time it takes to complete transactions. This streamlined approach enhances user satisfaction and accelerates business operations.

-

What types of businesses can benefit from t4rsp?

t4rsp is beneficial for businesses of all sizes and industries. Whether you are a small startup or a large enterprise, t4rsp can help you manage your document signing needs effectively. Its versatility makes it an ideal solution for various sectors, including finance, healthcare, and real estate.

Get more for T4rsp

- Mensa certificate template form

- Application for certificate of fitness the los angeles fire department form

- Info on the statutory declaration of common law union single signature 2011 form

- Illinois driving record sheet for illinois 2006 form

- Non profit application form

- Florida workers compensation exemption form pdf

- Gaca forms

- Hotel bill format in excel sheet

Find out other T4rsp

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT