UK Tax on a Canadian RRSP the HMRC Community Forums 2023-2026

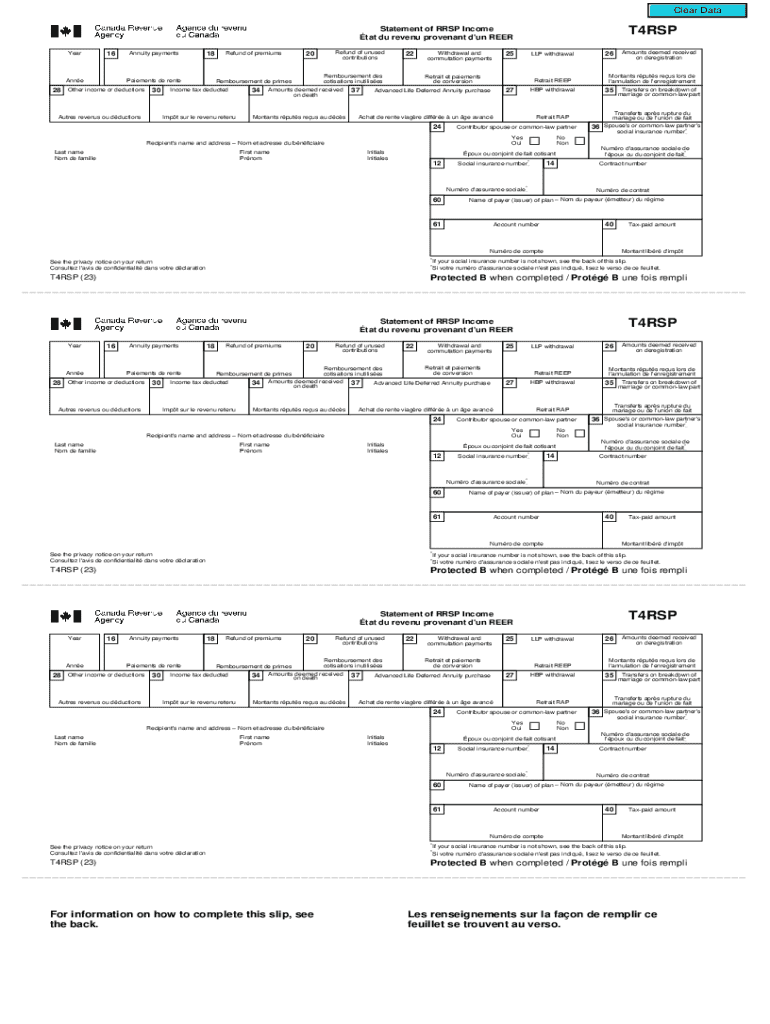

Understanding the T4RSP Form

The T4RSP form is essential for reporting income from a registered retirement savings plan (RRSP) in Canada. It is issued by financial institutions to individuals who have withdrawn funds from their RRSP. This form includes crucial information such as the total amount withdrawn, any taxes withheld, and the recipient's personal details. Understanding this form is vital for accurate tax reporting and compliance with the Canada Revenue Agency (CRA).

Key Information on T4RSP Reporting

When completing your tax return, the information on the T4RSP form must be reported accurately. The total amount of withdrawals is considered taxable income and should be included in your annual income. Additionally, any taxes that have been withheld will be reported on this form, which may affect your overall tax liability. It is important to keep this form for your records, as it may be needed for future reference or audits.

Eligibility Criteria for T4RSP Withdrawals

To be eligible for a T4RSP withdrawal, individuals must have a registered retirement savings plan. Withdrawals can be made for various reasons, including retirement, purchasing a home, or funding education. However, it is essential to be aware of the tax implications associated with these withdrawals, as they may impact your financial situation and tax obligations.

Steps to Complete Your T4RSP Form

Completing the T4RSP form involves several steps:

- Gather all relevant financial documents, including your RRSP account statements.

- Fill in your personal information accurately, including your name, address, and social security number.

- Report the total amount withdrawn from your RRSP during the tax year.

- Indicate any taxes that were withheld at the time of withdrawal.

- Double-check all entries for accuracy before submitting the form.

Filing Deadlines for T4RSP Forms

It is important to be aware of the filing deadlines associated with the T4RSP form. Typically, the T4RSP must be included with your annual tax return, which is due by April 15 for most individuals. If you miss this deadline, you may incur penalties or interest on any taxes owed. Staying informed about these deadlines can help ensure compliance and avoid unnecessary fees.

Common Scenarios for T4RSP Use

Individuals may encounter various scenarios when dealing with the T4RSP form. For example, retirees withdrawing funds to supplement their income will need to report these withdrawals accurately. Similarly, individuals using RRSP funds for educational expenses must understand the tax implications and ensure proper reporting. Each scenario may have unique considerations regarding eligibility and tax obligations.

Quick guide on how to complete uk tax on a canadian rrsp the hmrc community forums

Accomplish UK Tax On A Canadian RRSP The HMRC Community Forums effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the right form and safely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your files swiftly without delay. Handle UK Tax On A Canadian RRSP The HMRC Community Forums on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and electronically sign UK Tax On A Canadian RRSP The HMRC Community Forums with ease

- Find UK Tax On A Canadian RRSP The HMRC Community Forums and click on Retrieve Form to commence.

- Utilize the tools we provide to fill out your form.

- Emphasize necessary sections of the documents or obscure sensitive data with tools that airSlate SignNow supplies specifically for that aim.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click the Finish button to store your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiresome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your preference. Edit and electronically sign UK Tax On A Canadian RRSP The HMRC Community Forums and ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct uk tax on a canadian rrsp the hmrc community forums

Create this form in 5 minutes!

How to create an eSignature for the uk tax on a canadian rrsp the hmrc community forums

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is t4rsp and how does it benefit my business?

t4rsp is an innovative solution offered by airSlate SignNow that streamlines the process of sending and eSigning documents. By utilizing t4rsp, businesses can enhance their workflow efficiency, reduce turnaround times, and improve overall productivity. This cost-effective solution is designed to meet the needs of various industries, making document management simpler and more effective.

-

How much does t4rsp cost?

The pricing for t4rsp varies based on the specific plan you choose. airSlate SignNow offers flexible pricing options that cater to businesses of all sizes, ensuring that you can find a plan that fits your budget. By investing in t4rsp, you gain access to a powerful tool that can save your business time and money.

-

What features are included with t4rsp?

t4rsp includes a variety of features designed to enhance your document management experience. Key features include customizable templates, real-time tracking, and secure cloud storage. These functionalities ensure that your documents are handled efficiently and securely, making t4rsp a comprehensive solution for your business needs.

-

Can t4rsp integrate with other software?

Yes, t4rsp seamlessly integrates with a wide range of software applications, enhancing its functionality. Whether you use CRM systems, project management tools, or other business applications, t4rsp can connect with them to streamline your processes. This integration capability allows for a more cohesive workflow across your organization.

-

Is t4rsp suitable for small businesses?

Absolutely! t4rsp is designed to cater to businesses of all sizes, including small businesses. Its user-friendly interface and cost-effective pricing make it an ideal choice for small enterprises looking to improve their document management processes without breaking the bank.

-

How secure is t4rsp for handling sensitive documents?

t4rsp prioritizes security, employing advanced encryption and compliance measures to protect your sensitive documents. With airSlate SignNow, you can trust that your data is safe and secure throughout the eSigning process. This commitment to security ensures that your business can operate with confidence.

-

What are the benefits of using t4rsp for eSigning?

Using t4rsp for eSigning offers numerous benefits, including faster turnaround times and reduced paper usage. This digital solution not only enhances efficiency but also contributes to a more sustainable business model. By adopting t4rsp, you can streamline your signing processes and improve customer satisfaction.

Get more for UK Tax On A Canadian RRSP The HMRC Community Forums

Find out other UK Tax On A Canadian RRSP The HMRC Community Forums

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment