Form AP 224, Texas Business Questionnaire Texas Comptroller 2017-2026

What is the Form AP 224, Texas Business Questionnaire Texas Comptroller

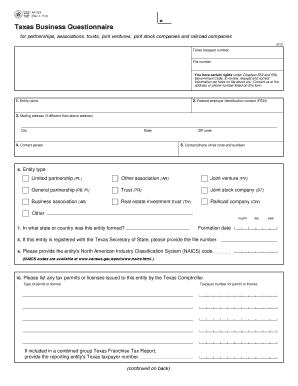

The Form AP 224, known as the Texas Business Questionnaire, is a document required by the Texas Comptroller of Public Accounts. This form is essential for businesses operating in Texas, as it collects vital information about the business entity, including its structure, ownership, and operational details. The information provided helps the Comptroller's office assess tax obligations and compliance with state regulations. It is particularly relevant for new businesses, as it aids in establishing a formal record with the state.

How to use the Form AP 224, Texas Business Questionnaire Texas Comptroller

Using the Form AP 224 involves filling out specific sections that detail your business's structure and operations. The form requires information such as the business name, type of entity (e.g., LLC, corporation, partnership), and the names of the owners or officers. After completing the form, it must be submitted to the Texas Comptroller's office to ensure compliance with state regulations. This submission can often be done electronically, streamlining the process for business owners.

Steps to complete the Form AP 224, Texas Business Questionnaire Texas Comptroller

Completing the Form AP 224 requires careful attention to detail. Here are the steps to follow:

- Gather necessary information about your business, including its legal name, structure, and ownership details.

- Access the Form AP 224 from the Texas Comptroller's website or other official sources.

- Fill in the required fields accurately, ensuring that all information is up-to-date.

- Review the completed form for any errors or omissions.

- Submit the form electronically or by mail, following the instructions provided by the Comptroller's office.

Key elements of the Form AP 224, Texas Business Questionnaire Texas Comptroller

The Form AP 224 includes several key elements that are crucial for accurate submission. These elements typically consist of:

- Business Information: Legal name, trade name, and physical address.

- Entity Type: Identification of the business structure, such as LLC, corporation, or partnership.

- Ownership Details: Names and addresses of the owners or principal officers.

- Tax Identification Number: The federal Employer Identification Number (EIN) if applicable.

Form Submission Methods (Online / Mail / In-Person)

The Form AP 224 can be submitted through various methods, providing flexibility for business owners. The available submission methods include:

- Online Submission: Many businesses opt for electronic submission through the Texas Comptroller's website, which is often the fastest method.

- Mail: The completed form can be printed and mailed to the appropriate address specified by the Comptroller's office.

- In-Person: Businesses may also choose to submit the form in person at designated Comptroller offices, allowing for immediate confirmation of receipt.

Eligibility Criteria

To file the Form AP 224, businesses must meet certain eligibility criteria. Typically, these criteria include:

- The business must be legally registered in Texas.

- It must have a valid Texas business license or permit, if applicable.

- All owners or officers must provide accurate identification information.

Quick guide on how to complete form ap 224 texas business questionnaire texas comptroller

Complete Form AP 224, Texas Business Questionnaire Texas Comptroller effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the correct template and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any hold-ups. Manage Form AP 224, Texas Business Questionnaire Texas Comptroller on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign Form AP 224, Texas Business Questionnaire Texas Comptroller with ease

- Acquire Form AP 224, Texas Business Questionnaire Texas Comptroller and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

No need to worry about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Modify and eSign Form AP 224, Texas Business Questionnaire Texas Comptroller to ensure exceptional communication at any stage of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ap 224 texas business questionnaire texas comptroller

Create this form in 5 minutes!

How to create an eSignature for the form ap 224 texas business questionnaire texas comptroller

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form AP 224, Texas Business Questionnaire?

Form AP 224, Texas Business Questionnaire, is a document required by the Texas Comptroller for businesses to provide information about their ownership and operations. This form helps the Comptroller assess the tax obligations of the business. Completing this form accurately is essential for compliance with Texas tax laws.

-

How can airSlate SignNow help with Form AP 224, Texas Business Questionnaire?

airSlate SignNow simplifies the process of completing and submitting Form AP 224, Texas Business Questionnaire, by allowing users to eSign and send documents securely. Our platform provides templates and easy-to-use tools that streamline the completion of this form. This ensures that businesses can focus on their operations while staying compliant.

-

Is there a cost associated with using airSlate SignNow for Form AP 224, Texas Business Questionnaire?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and provides access to features that facilitate the completion of Form AP 224, Texas Business Questionnaire. Investing in our solution can save time and reduce the hassle of document management.

-

What features does airSlate SignNow offer for managing Form AP 224, Texas Business Questionnaire?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are essential for managing Form AP 224, Texas Business Questionnaire. These features enhance efficiency and ensure that all necessary information is captured accurately. Additionally, users can collaborate in real-time, making the process smoother.

-

Can I integrate airSlate SignNow with other software for Form AP 224, Texas Business Questionnaire?

Yes, airSlate SignNow offers integrations with various software applications, allowing for seamless data transfer and document management. This means you can easily incorporate Form AP 224, Texas Business Questionnaire into your existing workflows. Integrations enhance productivity and ensure that all business processes are connected.

-

What are the benefits of using airSlate SignNow for Form AP 224, Texas Business Questionnaire?

Using airSlate SignNow for Form AP 224, Texas Business Questionnaire provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are stored safely and can be accessed anytime. Additionally, the eSigning feature speeds up the approval process, allowing businesses to operate more effectively.

-

How secure is airSlate SignNow when handling Form AP 224, Texas Business Questionnaire?

airSlate SignNow prioritizes security and compliance, ensuring that all documents, including Form AP 224, Texas Business Questionnaire, are protected with advanced encryption. Our platform adheres to industry standards for data protection, giving users peace of mind. You can trust that your sensitive information is safe with us.

Get more for Form AP 224, Texas Business Questionnaire Texas Comptroller

- Informed consent for exercise participation spring branch isd

- Camelback east little league sponsor form eteamz

- The panama american uf digital collections university of form

- Completion report montana office of public instruction opi mt form

- Keys drivingsch ool form

- Funding application hyra us form

- Municipal center building 2 room 100 2405 courtho form

- Burlington county custodian of records administrat form

Find out other Form AP 224, Texas Business Questionnaire Texas Comptroller

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now