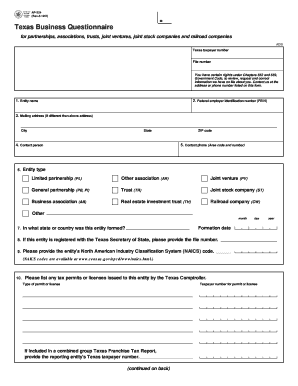

AP 224 Texas Business Questionnaire Texas Comptroller of Public 2012

What is the AP 224 Texas Business Questionnaire?

The AP 224 Texas Business Questionnaire is a form issued by the Texas Comptroller of Public Accounts. It is primarily used by businesses to provide essential information regarding their operations, structure, and tax obligations in Texas. This questionnaire helps the state assess the nature of the business and ensures compliance with state tax laws. Businesses are required to complete this form when applying for a Texas sales tax permit or when there are changes in ownership or business structure.

Steps to Complete the AP 224 Texas Business Questionnaire

Completing the AP 224 Texas Business Questionnaire involves several key steps:

- Gather Required Information: Collect all necessary details about your business, including ownership structure, business activities, and contact information.

- Fill Out the Form: Carefully complete each section of the questionnaire, ensuring accuracy and completeness. Pay attention to specific questions related to your business type.

- Review the Information: Double-check all entries for accuracy to avoid delays in processing.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in person, and ensure it is sent to the appropriate office.

How to Obtain the AP 224 Texas Business Questionnaire

The AP 224 Texas Business Questionnaire can be obtained directly from the Texas Comptroller of Public Accounts website. It is available in a downloadable format, allowing businesses to print and fill it out at their convenience. Additionally, physical copies may be requested from local Comptroller offices or through business resource centers across Texas.

Key Elements of the AP 224 Texas Business Questionnaire

Several key elements are included in the AP 224 Texas Business Questionnaire, which businesses must address:

- Business Name and Address: The official name and physical location of the business.

- Ownership Details: Information about the owners, including names, addresses, and ownership percentages.

- Type of Business Entity: Identification of the business structure, such as LLC, corporation, or partnership.

- Business Activities: A description of the primary activities the business engages in.

- Tax Information: Any relevant tax identification numbers and prior tax compliance history.

Legal Use of the AP 224 Texas Business Questionnaire

The AP 224 Texas Business Questionnaire serves a legal purpose by ensuring that businesses comply with state regulations. It is a vital document for tax registration and helps the state maintain accurate records of business operations. Proper completion of this form is essential for avoiding penalties and ensuring eligibility for various business permits and licenses in Texas.

Form Submission Methods

Businesses have several options for submitting the AP 224 Texas Business Questionnaire:

- Online Submission: The form can be completed and submitted electronically through the Texas Comptroller's online portal.

- Mail Submission: Printed forms can be mailed to the appropriate regional office of the Texas Comptroller.

- In-Person Submission: Businesses may also choose to submit the form in person at designated Comptroller offices.

Quick guide on how to complete ap 224 texas business questionnaire texas comptroller of public

Complete AP 224 Texas Business Questionnaire Texas Comptroller Of Public effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can easily find the right form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Handle AP 224 Texas Business Questionnaire Texas Comptroller Of Public on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The simplest method to modify and eSign AP 224 Texas Business Questionnaire Texas Comptroller Of Public effortlessly

- Find AP 224 Texas Business Questionnaire Texas Comptroller Of Public and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Modify and eSign AP 224 Texas Business Questionnaire Texas Comptroller Of Public and ensure excellent collaboration at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ap 224 texas business questionnaire texas comptroller of public

Create this form in 5 minutes!

How to create an eSignature for the ap 224 texas business questionnaire texas comptroller of public

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the AP 224 Texas Business Questionnaire Texas Comptroller Of Public?

The AP 224 Texas Business Questionnaire Texas Comptroller Of Public is a form required by the Texas Comptroller for businesses to provide essential information. This questionnaire helps ensure compliance with state regulations and is crucial for maintaining good standing. Completing this form accurately is vital for any business operating in Texas.

-

How can airSlate SignNow help with the AP 224 Texas Business Questionnaire Texas Comptroller Of Public?

airSlate SignNow simplifies the process of completing and submitting the AP 224 Texas Business Questionnaire Texas Comptroller Of Public. Our platform allows you to easily fill out, eSign, and send the document securely. This streamlines your workflow and ensures that your submission is timely and compliant.

-

What are the pricing options for using airSlate SignNow for the AP 224 Texas Business Questionnaire Texas Comptroller Of Public?

airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are designed to be cost-effective while providing all the necessary features for managing documents like the AP 224 Texas Business Questionnaire Texas Comptroller Of Public. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for the AP 224 Texas Business Questionnaire Texas Comptroller Of Public?

With airSlate SignNow, you get features like customizable templates, secure eSigning, and document tracking for the AP 224 Texas Business Questionnaire Texas Comptroller Of Public. These features enhance your document management process, making it easier to handle important forms efficiently. Additionally, our user-friendly interface ensures a smooth experience.

-

Are there any benefits to using airSlate SignNow for the AP 224 Texas Business Questionnaire Texas Comptroller Of Public?

Using airSlate SignNow for the AP 224 Texas Business Questionnaire Texas Comptroller Of Public offers numerous benefits, including increased efficiency and reduced paperwork. Our platform helps you save time by automating the signing process and ensuring that all necessary information is captured accurately. This leads to fewer errors and a more streamlined workflow.

-

Can I integrate airSlate SignNow with other tools for the AP 224 Texas Business Questionnaire Texas Comptroller Of Public?

Yes, airSlate SignNow offers integrations with various tools and platforms to enhance your workflow for the AP 224 Texas Business Questionnaire Texas Comptroller Of Public. You can connect with popular applications like Google Drive, Dropbox, and more, allowing for seamless document management and collaboration. This flexibility helps you work more efficiently.

-

Is airSlate SignNow secure for handling the AP 224 Texas Business Questionnaire Texas Comptroller Of Public?

Absolutely! airSlate SignNow prioritizes security, ensuring that your documents, including the AP 224 Texas Business Questionnaire Texas Comptroller Of Public, are protected. We use advanced encryption and security protocols to safeguard your data, giving you peace of mind while managing sensitive information. Your privacy and security are our top priorities.

Get more for AP 224 Texas Business Questionnaire Texas Comptroller Of Public

- Lincoln county washington application for marriage license wei sos wa form

- Business license barboursvilleorg form

- Baseball diamond diagram form

- Dpd cover sheet 2013 form

- Tumwater bo tax form

- Joint petition for dissolution with children packet montana courts courts mt form

- Financial declaration for restitution utah state courts utcourts form

- Petition to enter guilty plea english only district of nebraska form

Find out other AP 224 Texas Business Questionnaire Texas Comptroller Of Public

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now