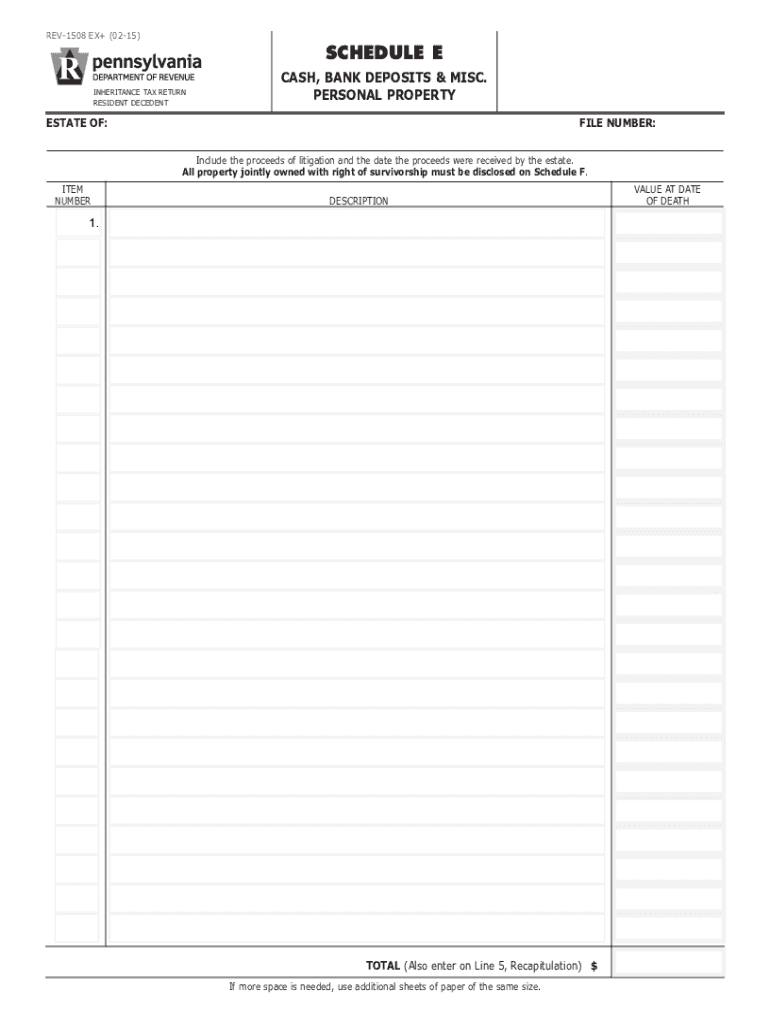

Schedule E Cash, Bank Deposits & Misc Personal Property REV 1508 FormsPublications 2015-2026

Understanding the REV 1508 Schedule E

The REV 1508 Schedule E form is essential for reporting cash, bank deposits, and miscellaneous personal property in the state of Pennsylvania. This form is primarily used by individuals to declare their financial assets, ensuring compliance with state regulations. The information collected on this form helps the state assess the individual's overall financial situation, which can impact tax obligations and eligibility for various programs.

Steps to Complete the REV 1508 Schedule E

Completing the REV 1508 Schedule E involves several key steps:

- Gather Required Information: Collect all relevant financial documents, including bank statements, cash records, and any other documentation related to personal property.

- Fill Out the Form: Carefully input your financial data into the form, ensuring accuracy to avoid potential penalties.

- Review Your Entries: Double-check all information for completeness and correctness before submission.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in person.

Legal Use of the REV 1508 Schedule E

The REV 1508 Schedule E is legally required for residents of Pennsylvania who possess certain assets. Filing this form accurately is crucial for compliance with state tax laws. Failure to report required information can lead to penalties, including fines or additional taxes owed. It is important to understand the legal implications of the information provided on this form to avoid complications with state authorities.

Obtaining the REV 1508 Schedule E Form

The REV 1508 Schedule E form can be obtained through various channels:

- Visit the Pennsylvania Department of Revenue website for downloadable PDF versions.

- Request a physical copy by contacting the department directly.

- Access local tax offices that may provide printed forms for residents.

Key Elements of the REV 1508 Schedule E

Key elements of the REV 1508 Schedule E include:

- Personal Information: Name, address, and identification number of the filer.

- Financial Data: Detailed reporting of cash, bank deposits, and other personal property.

- Signature: Required signature of the filer to validate the information provided.

Filing Deadlines for the REV 1508 Schedule E

It is important to be aware of the filing deadlines associated with the REV 1508 Schedule E. Typically, the form must be submitted by the tax filing deadline, which aligns with the annual income tax return due date. Missing the deadline can result in penalties, so timely submission is crucial for compliance.

Quick guide on how to complete schedule e cash bank deposits misc personal property rev 1508 formspublications

Complete Schedule E Cash, Bank Deposits & Misc Personal Property REV 1508 FormsPublications seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, enabling you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents rapidly without delays. Manage Schedule E Cash, Bank Deposits & Misc Personal Property REV 1508 FormsPublications on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Schedule E Cash, Bank Deposits & Misc Personal Property REV 1508 FormsPublications effortlessly

- Find Schedule E Cash, Bank Deposits & Misc Personal Property REV 1508 FormsPublications and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional hand-signed signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Schedule E Cash, Bank Deposits & Misc Personal Property REV 1508 FormsPublications and ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule e cash bank deposits misc personal property rev 1508 formspublications

Create this form in 5 minutes!

How to create an eSignature for the schedule e cash bank deposits misc personal property rev 1508 formspublications

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is rev 1508 in relation to airSlate SignNow?

Rev 1508 refers to a specific version of the airSlate SignNow platform that includes enhanced features for document management and eSigning. This version is designed to streamline workflows and improve user experience, making it easier for businesses to manage their documents efficiently.

-

How does rev 1508 improve document security?

Rev 1508 incorporates advanced security measures such as encryption and secure access controls to protect sensitive documents. With this version, businesses can confidently send and eSign documents, knowing that their information is safeguarded against unauthorized access.

-

What are the pricing options for rev 1508?

The pricing for rev 1508 is competitive and designed to fit various business needs. airSlate SignNow offers flexible subscription plans that allow businesses to choose the features they require, ensuring they get the best value for their investment in document management solutions.

-

What features are included in rev 1508?

Rev 1508 includes a range of features such as customizable templates, automated workflows, and real-time tracking of document status. These features help businesses streamline their processes and enhance productivity when sending and eSigning documents.

-

Can rev 1508 integrate with other software?

Yes, rev 1508 is designed to integrate seamlessly with various third-party applications, including CRM and project management tools. This integration capability allows businesses to enhance their workflows and improve collaboration across different platforms.

-

What are the benefits of using rev 1508 for eSigning?

Using rev 1508 for eSigning offers numerous benefits, including faster turnaround times and reduced paper usage. Businesses can quickly send documents for signature, track their progress, and store them securely, all within a single platform, enhancing overall efficiency.

-

Is there customer support available for rev 1508 users?

Absolutely! airSlate SignNow provides dedicated customer support for users of rev 1508. Whether you have questions about features or need assistance with integration, our support team is available to help you maximize your experience with the platform.

Get more for Schedule E Cash, Bank Deposits & Misc Personal Property REV 1508 FormsPublications

Find out other Schedule E Cash, Bank Deposits & Misc Personal Property REV 1508 FormsPublications

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed