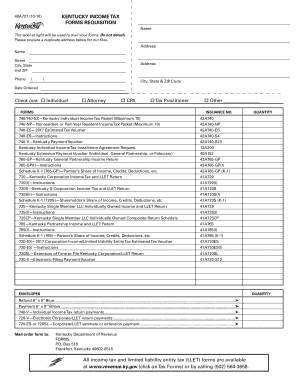

City, State & ZIP Code Revenue Ky 2016

What is the City, State & ZIP Code Revenue Ky

The City, State & ZIP Code Revenue Ky form is a document used primarily for tax purposes within the state of Kentucky. This form serves to collect specific information regarding a business's revenue, including its location details such as city, state, and ZIP code. It is essential for ensuring compliance with local tax regulations and helps the state assess the economic activity within different regions.

How to use the City, State & ZIP Code Revenue Ky

To effectively use the City, State & ZIP Code Revenue Ky form, individuals or businesses must accurately fill out all required fields. This includes providing the correct city name, state designation, and ZIP code associated with the business address. The information collected is crucial for tax assessment and reporting purposes. Users should ensure that the details match official records to avoid discrepancies.

Steps to complete the City, State & ZIP Code Revenue Ky

Completing the City, State & ZIP Code Revenue Ky form involves several key steps:

- Gather necessary information, including your business's legal name and address.

- Identify the correct city, state, and ZIP code where your business operates.

- Fill out the form, ensuring all information is accurate and complete.

- Review the form for any errors or omissions before submission.

- Submit the completed form according to the specified guidelines.

Legal use of the City, State & ZIP Code Revenue Ky

The legal use of the City, State & ZIP Code Revenue Ky form is mandated by Kentucky state law for businesses operating within its jurisdiction. It is essential for businesses to file this form to remain compliant with state tax regulations. Failure to submit the form can lead to penalties and legal repercussions, reinforcing the importance of understanding its legal implications.

Key elements of the City, State & ZIP Code Revenue Ky

Key elements of the City, State & ZIP Code Revenue Ky form include:

- Business identification details, such as name and address.

- Accurate city, state, and ZIP code information.

- Revenue figures that reflect the business's financial activity.

- Signature and date fields to validate the submission.

Filing Deadlines / Important Dates

Filing deadlines for the City, State & ZIP Code Revenue Ky form are typically aligned with the state’s tax calendar. It is crucial for businesses to be aware of these dates to avoid late penalties. Generally, forms must be submitted annually, with specific deadlines varying based on the type of business entity. Keeping track of these important dates ensures compliance and helps maintain good standing with state tax authorities.

Quick guide on how to complete city state amp zip code revenue ky

Finish City, State & ZIP Code Revenue Ky effortlessly on any gadget

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents rapidly without delays. Manage City, State & ZIP Code Revenue Ky on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to alter and eSign City, State & ZIP Code Revenue Ky effortlessly

- Find City, State & ZIP Code Revenue Ky and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and has the same legal authority as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to share your form, through email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document versions. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign City, State & ZIP Code Revenue Ky and guarantee outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct city state amp zip code revenue ky

Create this form in 5 minutes!

How to create an eSignature for the city state amp zip code revenue ky

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to City, State & ZIP Code Revenue Ky?

airSlate SignNow is a powerful eSignature solution that enables businesses to send and sign documents electronically. For those in City, State & ZIP Code Revenue Ky, it offers a streamlined process to manage contracts and agreements efficiently, ensuring compliance and enhancing productivity.

-

How much does airSlate SignNow cost for businesses in City, State & ZIP Code Revenue Ky?

Pricing for airSlate SignNow varies based on the plan selected. Businesses in City, State & ZIP Code Revenue Ky can choose from several tiers, ensuring they find a cost-effective solution that meets their specific needs without compromising on features.

-

What features does airSlate SignNow offer for users in City, State & ZIP Code Revenue Ky?

airSlate SignNow provides a range of features including document templates, real-time tracking, and secure storage. Users in City, State & ZIP Code Revenue Ky can benefit from these tools to enhance their document management processes and improve overall efficiency.

-

Can airSlate SignNow integrate with other software used in City, State & ZIP Code Revenue Ky?

Yes, airSlate SignNow offers integrations with various popular applications such as Google Drive, Salesforce, and more. This flexibility allows businesses in City, State & ZIP Code Revenue Ky to seamlessly incorporate eSigning into their existing workflows.

-

What are the benefits of using airSlate SignNow for businesses in City, State & ZIP Code Revenue Ky?

Using airSlate SignNow provides numerous benefits including faster turnaround times for document signing, reduced paper usage, and enhanced security. For businesses in City, State & ZIP Code Revenue Ky, these advantages translate into improved operational efficiency and cost savings.

-

Is airSlate SignNow compliant with legal standards in City, State & ZIP Code Revenue Ky?

Absolutely, airSlate SignNow complies with all relevant legal standards for electronic signatures, including the ESIGN Act and UETA. This compliance ensures that documents signed through airSlate SignNow are legally binding in City, State & ZIP Code Revenue Ky.

-

How can I get started with airSlate SignNow in City, State & ZIP Code Revenue Ky?

Getting started with airSlate SignNow is simple. Businesses in City, State & ZIP Code Revenue Ky can sign up for a free trial on the website, allowing them to explore the features and benefits before committing to a subscription.

Get more for City, State & ZIP Code Revenue Ky

- Septic reimb finalqxplayout 1qxd westchestergov com form

- Family court disclosure affidavitpdffillercom form

- Application for employment puget sound blood center psbc form

- Pesh 7 form

- Westchester county application form

- Yogurtland job application pdf form

- Wisconsin wb11 form

- Ri 1120x rhode island amended business corporation tax tax state ri form

Find out other City, State & ZIP Code Revenue Ky

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast