RI 1120X Rhode Island AMENDED Business Corporation Tax Tax State Ri 2013

Understanding the RI 1120X Rhode Island AMENDED Business Corporation Tax

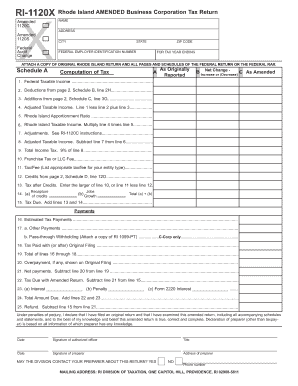

The RI 1120X is an amended tax return form specifically designed for business corporations operating in Rhode Island. This form allows businesses to correct errors or make adjustments to previously filed RI 1120 returns. It is essential for ensuring compliance with state tax laws and can impact a corporation's tax liability significantly. Filing this form correctly helps businesses avoid penalties and ensures accurate reporting of income, deductions, and credits.

Steps to Complete the RI 1120X Rhode Island AMENDED Business Corporation Tax

Completing the RI 1120X involves several key steps to ensure accuracy and compliance. First, gather all relevant financial documents, including the original RI 1120 return and any supporting documentation. Next, clearly indicate the changes being made in the appropriate sections of the form. Ensure that all calculations are accurate and reflect the amended figures. Finally, review the form thoroughly before submission to avoid any potential errors.

Required Documents for Filing the RI 1120X

When preparing to file the RI 1120X, businesses must have specific documents ready. These include:

- The original RI 1120 form that is being amended.

- Supporting documentation for any changes made, such as revised financial statements or receipts.

- Any correspondence from the Rhode Island Division of Taxation that may affect the amended return.

Having these documents on hand will facilitate a smoother filing process and help ensure that all necessary information is included.

Filing Deadlines for the RI 1120X

It is crucial for businesses to be aware of the filing deadlines associated with the RI 1120X. Generally, the amended return must be filed within three years of the original due date of the return being amended. This timeline is important to ensure that businesses can make necessary corrections without incurring penalties. Staying informed about these deadlines helps maintain compliance with Rhode Island tax regulations.

Legal Use of the RI 1120X

The RI 1120X serves a vital role in the legal framework governing business taxation in Rhode Island. It allows corporations to rectify mistakes in their tax filings, ensuring that they are in compliance with state tax laws. Filing this amended return is not only a legal requirement but also a best practice for maintaining accurate financial records and avoiding potential legal issues related to tax discrepancies.

Form Submission Methods for the RI 1120X

Businesses have several options for submitting the RI 1120X. The form can be filed electronically through the Rhode Island Division of Taxation's online portal, which is often the quickest method. Alternatively, businesses may choose to mail the completed form to the appropriate tax office. In-person submissions are also an option, allowing for direct interaction with tax officials if needed. Each method has its own advantages, and businesses should select the one that best suits their needs.

Quick guide on how to complete ri 1120x rhode island amended business corporation tax tax state ri

Complete RI 1120X Rhode Island AMENDED Business Corporation Tax Tax State Ri effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as a perfect eco-friendly substitute for traditional printed and signed paperwork, as you can access the necessary forms and securely store them online. airSlate SignNow provides all the tools required to create, edit, and eSign your documents swiftly without delays. Handle RI 1120X Rhode Island AMENDED Business Corporation Tax Tax State Ri on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The easiest way to edit and eSign RI 1120X Rhode Island AMENDED Business Corporation Tax Tax State Ri without stress

- Find RI 1120X Rhode Island AMENDED Business Corporation Tax Tax State Ri and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you wish to deliver your form: via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choice. Edit and eSign RI 1120X Rhode Island AMENDED Business Corporation Tax Tax State Ri to ensure smooth communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ri 1120x rhode island amended business corporation tax tax state ri

Create this form in 5 minutes!

How to create an eSignature for the ri 1120x rhode island amended business corporation tax tax state ri

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the RI 1120X Rhode Island AMENDED Business Corporation Tax?

The RI 1120X Rhode Island AMENDED Business Corporation Tax is a tax form used by corporations in Rhode Island to amend their previously filed corporate tax returns. This form allows businesses to correct errors or make changes to their tax filings, ensuring compliance with state tax regulations. Understanding this tax is crucial for maintaining accurate financial records and avoiding penalties.

-

How can airSlate SignNow help with the RI 1120X Rhode Island AMENDED Business Corporation Tax?

airSlate SignNow provides an efficient platform for businesses to prepare, sign, and send documents related to the RI 1120X Rhode Island AMENDED Business Corporation Tax. With our easy-to-use interface, you can streamline the amendment process, ensuring that all necessary documents are completed accurately and submitted on time. This helps businesses stay compliant with state tax laws.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans include features that facilitate the management of documents related to the RI 1120X Rhode Island AMENDED Business Corporation Tax, ensuring you get the best value for your investment. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as eSignature capabilities, document templates, and secure cloud storage, all of which are essential for managing the RI 1120X Rhode Island AMENDED Business Corporation Tax. These features simplify the process of preparing and submitting tax documents, making it easier for businesses to stay organized and compliant. Additionally, our platform is designed to enhance collaboration among team members.

-

Is airSlate SignNow compliant with Rhode Island tax regulations?

Yes, airSlate SignNow is designed to comply with all relevant Rhode Island tax regulations, including those pertaining to the RI 1120X Rhode Island AMENDED Business Corporation Tax. Our platform ensures that your documents meet state requirements, helping you avoid potential issues with tax authorities. We prioritize security and compliance to protect your business interests.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with various accounting and tax preparation software, making it easier to manage the RI 1120X Rhode Island AMENDED Business Corporation Tax. This allows you to streamline your workflow and ensure that all your tax documents are in one place. Our integrations enhance productivity and reduce the risk of errors.

-

What are the benefits of using airSlate SignNow for business tax documents?

Using airSlate SignNow for your business tax documents, including the RI 1120X Rhode Island AMENDED Business Corporation Tax, offers numerous benefits. You can save time with automated workflows, reduce paper usage, and enhance document security with our eSignature technology. These advantages contribute to a more efficient and environmentally friendly tax preparation process.

Get more for RI 1120X Rhode Island AMENDED Business Corporation Tax Tax State Ri

Find out other RI 1120X Rhode Island AMENDED Business Corporation Tax Tax State Ri

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free