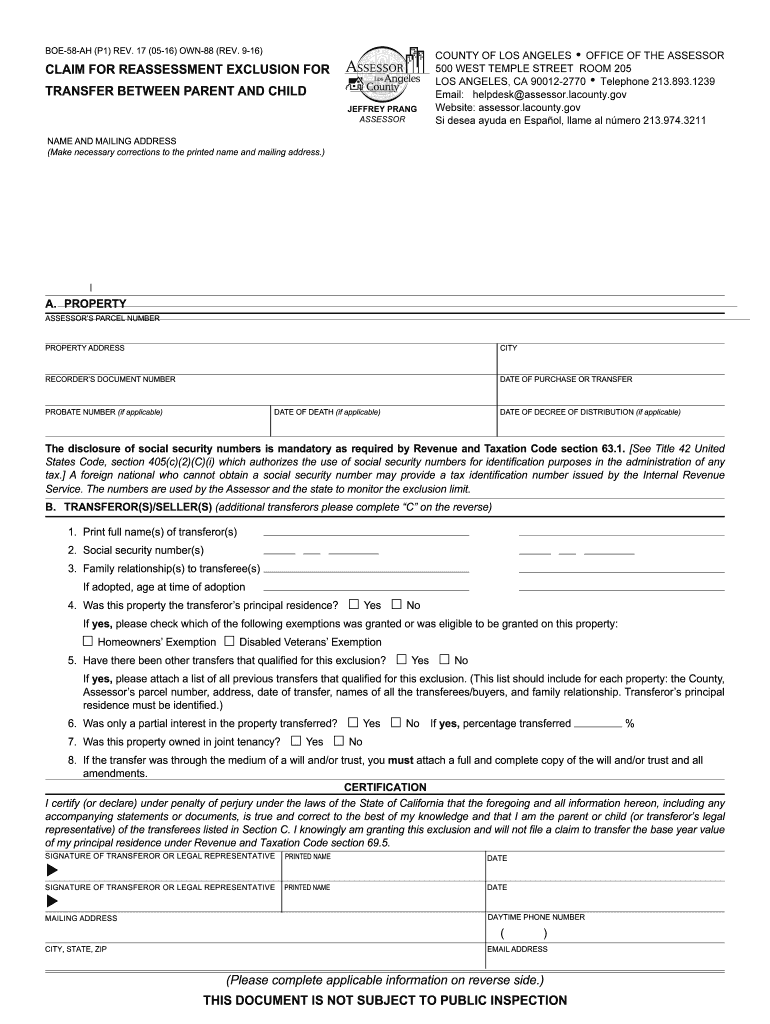

Boe 58 Ah Los Angeles County 2016-2025 Form

What makes the boe 58 form legally valid?

Real estate specialists deal with the buying and selling of property, thus, all agreements and forms, which they prepare for their clients, must be properly drafted and be legally binding when executed. This kind of documents are legitimate if they include all information about both buyer and seller, identify the description of the property, its address and price, and contain dates of transaction with signatures of all parties affirming they accept the terms. For electronic samples, there's also a requirement to create and sign them with a compliant tool that fully fulfills eSignature and data security standards.

To make your electronic own 88 legally valid, use airSlate SignNow, a reliable eSignature platform that meets all key industry laws and regulations. Obtain the template from the forms catalog, include fillable fields for different types of data, assign Roles to them, and collect legitimate electronic signatures from your parties. All document transactions will be registered in the detailed Audit Trail.

How to protect your boe 58 ah los angeles when completing it online

Many people still have concerns when dealing with electronic forms and signing them online, stressing about the security of their records and signers' identification. To make them feel safer, airSlate SignNow provides users with supplementary methods of document protection. While preparing your ca 58 form for an eSignature invite, use one of the following features to exclude unsanctioned access to your samples:

- Lock each template with a password and give it directly to your recipients;

- Ask signers to authenticate themselves with a phone call or SMS code to confirm their identity before filling out and signing your sample;

- Set up the session duration after which a signer must re-login and authenticate themselves again.

Quick guide on how to complete 58 claim form

Perfect your documentation on Form boe 58 ah los angeles county

Negotiating agreements, managing listings, coordinating meetings, and property viewings—realtors and real estate professionals balance a multitude of responsibilities each day. Many of these responsibilities involve substantial documentation, such as boe 58, which must be completed within specified timeframes and with high precision.

airSlate SignNow is a comprehensive tool that enables real estate professionals to alleviate the burden of paperwork, allowing them to concentrate more on their clients' objectives throughout the entire negotiation journey and empower them to secure optimal terms in the deal.

Steps to complete boe 58 form with airSlate SignNow:

- Access the own 88 page or utilize our library’s search features to find what you require.

- Select Get form—you will be promptly taken to the editor.

- Begin filling out the form by selecting interactive fields and entering your information.

- Add additional text and modify its settings if necessary.

- Select the Sign option in the upper toolbar to create your eSignature.

- Explore other available tools that let you annotate and enhance your document, such as drawing, highlighting, inserting shapes, and more.

- Go to the comment section and provide feedback regarding your form.

- Conclude the process by downloading, sharing, or sending your document to the relevant users or parties.

Eliminate paper usage entirely and streamline the homebuying process with our user-friendly and powerful solution. Experience enhanced convenience when signNowing boe 58 ah los angeles and other real estate documents online. Try our solution today!

Create this form in 5 minutes or less

Video instructions and help with filling out and completing 58 Form

Instructions and help about 58 ah form

Find and fill out the correct ca boe 58ah

FAQs exclusion between parent

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

How do I fill out Form 16 if I'm not eligible for IT returns and just want to receive the TDS cut for the 6 months that I've worked?

use File Income Tax Return Online in India: ClearTax | e-Filing Income Tax in 15 minutes | Tax filing | Income Tax Returns | E-file Tax Returns for 2014-15It is free and simple.

-

So I got some iTunes cards for a total of 50$ and as I purchased a book I realized it came out to over 16$ which is what I had, it cost 17.48$ but I had 16.88$ what will happen and how is this possible?

The balance was charged to whatever credit card or debit card you have on file with iTunes. And you do have one on file with iTunes even if you don’t remember it becsuse you wouldn’t be able to use the gift card without it.

Related searches to 58 ah reassessment

Create this form in 5 minutes!

How to create an eSignature for the ca boe 58

How to generate an electronic signature for the 17 05 16 Own 88 Rev in the online mode

How to make an eSignature for the 17 05 16 Own 88 Rev in Google Chrome

How to make an eSignature for putting it on the 17 05 16 Own 88 Rev in Gmail

How to make an eSignature for the 17 05 16 Own 88 Rev straight from your smart phone

How to create an electronic signature for the 17 05 16 Own 88 Rev on iOS devices

How to create an eSignature for the 17 05 16 Own 88 Rev on Android devices

People also ask ca own exclusion

-

What is the form boe 58 ah los angeles county used for?

The form boe 58 ah los angeles county is a property tax exemption application that allows qualifying homeowners to claim a reduction in their property taxes. It is essential for those who want to take advantage of available exemptions and reduce their tax burden effectively.

-

How can airSlate SignNow help me with the form boe 58 ah los angeles county?

airSlate SignNow simplifies the process of filling out and submitting the form boe 58 ah los angeles county by providing an intuitive eSignature platform. You can easily complete, sign, and send your documents securely from any device, ensuring a smooth experience.

-

What are the pricing options for using airSlate SignNow to complete the form boe 58 ah los angeles county?

airSlate SignNow offers flexible pricing options, allowing businesses to choose plans based on their specific needs. You can start with a free trial and later upgrade to a plan that best suits your requirements for handling the form boe 58 ah los angeles county.

-

Is airSlate SignNow user-friendly for completing the form boe 58 ah los angeles county?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete the form boe 58 ah los angeles county. The platform's straightforward interface allows users to navigate seamlessly through documents without any hassle.

-

Can I track the status of my form boe 58 ah los angeles county submissions with airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your form boe 58 ah los angeles county submissions in real time. This ensures that you stay updated on the progress and can follow up if necessary.

-

Does airSlate SignNow integrate with other applications for processing the form boe 58 ah los angeles county?

Yes, airSlate SignNow offers integrations with various applications, making it easy to connect and streamline the process of handling the form boe 58 ah los angeles county. Whether you use CRMs, document management systems, or email platforms, airSlate SignNow can enhance your workflow.

-

What are the main benefits of using airSlate SignNow for the form boe 58 ah los angeles county?

Using airSlate SignNow for the form boe 58 ah los angeles county provides numerous benefits, including improved efficiency, cost-effectiveness, and enhanced security for your documents. This means you can save time while ensuring that your sensitive information remains protected.

Get more for boe 58 claim

Find out other california boe 58ah

- eSign Mississippi Affidavit of Death Online

- eSign Florida Child Custody Agreement Template Easy

- eSign Mississippi Affidavit of Death Computer

- eSign Mississippi Affidavit of Death Mobile

- eSign Montana Prenuptial Agreement Template Now

- eSign Florida Child Custody Agreement Template Safe

- eSign Mississippi Affidavit of Death Now

- eSign Mississippi Affidavit of Death Later

- eSign Mississippi Affidavit of Death Myself

- eSign Mississippi Affidavit of Death Free

- eSign Montana Prenuptial Agreement Template Later

- eSign Mississippi Affidavit of Death Secure

- eSign Mississippi Affidavit of Death Fast

- eSign Mississippi Affidavit of Death Simple

- eSign Montana Prenuptial Agreement Template Myself

- eSign Nebraska Prenuptial Agreement Template Online

- eSign Mississippi Affidavit of Death Easy

- eSign Mississippi Affidavit of Death Safe

- eSign Montana Prenuptial Agreement Template Free

- eSign Nebraska Prenuptial Agreement Template Computer