776 Worksheet California SSMC Adjustments Worksheet Recalculated Federal Adjusted Gross Income California 776 Worksheet Form

What is the 776 Worksheet California SSMC Adjustments Worksheet Recalculated Federal Adjusted Gross Income

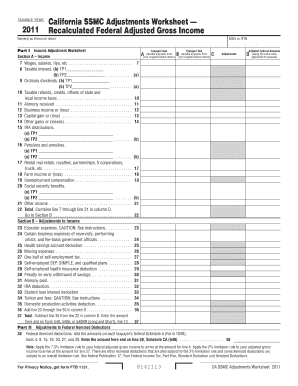

The 776 Worksheet, also known as the California SSMC Adjustments Worksheet, is a critical form used by taxpayers in California to calculate their recalculated federal adjusted gross income. This worksheet is particularly important for individuals who need to adjust their income figures based on specific state guidelines and regulations. It helps ensure accurate reporting of income, which is essential for tax compliance and determining eligibility for various state programs and benefits.

How to use the 776 Worksheet California SSMC Adjustments Worksheet Recalculated Federal Adjusted Gross Income

Using the 776 Worksheet involves several steps to ensure that all necessary information is accurately reported. Begin by gathering your federal tax return and any relevant financial documents. Carefully follow the instructions provided on the worksheet, filling in each section with precise figures from your records. Make sure to check for any adjustments specific to California tax laws that may apply to your situation. Once completed, review the worksheet for accuracy before submitting it as part of your state tax return.

Steps to complete the 776 Worksheet California SSMC Adjustments Worksheet Recalculated Federal Adjusted Gross Income

Completing the 776 Worksheet requires a methodical approach:

- Gather all necessary documents, including your federal tax return and any supporting financial statements.

- Begin with the first section of the worksheet, entering your federal adjusted gross income as reported on your federal return.

- Identify any adjustments that apply to your income based on California tax laws, such as state-specific deductions or credits.

- Calculate your recalculated federal adjusted gross income by applying the necessary adjustments.

- Double-check all entries for accuracy and completeness before finalizing the worksheet.

Key elements of the 776 Worksheet California SSMC Adjustments Worksheet Recalculated Federal Adjusted Gross Income

The 776 Worksheet includes several key elements that are essential for accurate completion:

- Identification of the taxpayer, including name and Social Security number.

- Federal adjusted gross income from the taxpayer's federal return.

- Detailed sections for specific adjustments required by California tax regulations.

- Final recalculated federal adjusted gross income, which reflects all adjustments made.

State-specific rules for the 776 Worksheet California SSMC Adjustments Worksheet Recalculated Federal Adjusted Gross Income

California has unique tax regulations that affect how the 776 Worksheet is completed. Taxpayers must be aware of specific adjustments that differ from federal guidelines. These may include state deductions, credits, and other income modifications that are applicable only within California. Understanding these rules is crucial for ensuring compliance and accurately reporting income on state tax returns.

Eligibility Criteria for using the 776 Worksheet California SSMC Adjustments Worksheet Recalculated Federal Adjusted Gross Income

Eligibility to use the 776 Worksheet typically applies to individuals who are residents of California and need to report their recalculated federal adjusted gross income. This includes various taxpayer scenarios such as self-employed individuals, retirees, and students who may have unique income situations. It is important to review the specific eligibility criteria outlined by the California tax authority to ensure proper use of the worksheet.

Quick guide on how to complete 776 worksheet california ssmc adjustments worksheet recalculated federal adjusted gross income california 776 worksheet

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any device with airSlate SignNow apps available for Android or iOS and enhance any document-related process today.

How to Modify and Electronically Sign [SKS] with Ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the features we provide to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and electronically sign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 776 Worksheet California SSMC Adjustments Worksheet Recalculated Federal Adjusted Gross Income California 776 Worksheet

Create this form in 5 minutes!

How to create an eSignature for the 776 worksheet california ssmc adjustments worksheet recalculated federal adjusted gross income california 776 worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 776 Worksheet California SSMC Adjustments Worksheet?

The 776 Worksheet California SSMC Adjustments Worksheet is a crucial document used to recalculate your Federal Adjusted Gross Income for California tax purposes. It helps ensure that your income is accurately reported and adjusted according to state regulations. Utilizing this worksheet can simplify the tax filing process for California residents.

-

How can I access the 776 Worksheet California SSMC Adjustments Worksheet?

You can easily access the 776 Worksheet California SSMC Adjustments Worksheet through our airSlate SignNow platform. Our user-friendly interface allows you to download and fill out the worksheet seamlessly. This ensures that you have the necessary tools to manage your tax adjustments efficiently.

-

Is there a cost associated with using the 776 Worksheet California SSMC Adjustments Worksheet?

Using the 776 Worksheet California SSMC Adjustments Worksheet is part of our airSlate SignNow subscription, which offers a cost-effective solution for document management. We provide various pricing plans to suit different business needs, ensuring you get the best value for your investment. Check our pricing page for more details.

-

What features does airSlate SignNow offer for the 776 Worksheet California SSMC Adjustments Worksheet?

airSlate SignNow offers features such as eSigning, document templates, and secure storage for the 776 Worksheet California SSMC Adjustments Worksheet. These features streamline the process of completing and submitting your tax documents. Additionally, our platform allows for easy collaboration with tax professionals.

-

How does the 776 Worksheet California SSMC Adjustments Worksheet benefit my business?

The 776 Worksheet California SSMC Adjustments Worksheet helps your business maintain compliance with California tax laws while optimizing your tax filings. By accurately recalculating your Federal Adjusted Gross Income, you can avoid potential penalties and ensure that you maximize your deductions. This ultimately saves you time and money.

-

Can I integrate the 776 Worksheet California SSMC Adjustments Worksheet with other software?

Yes, airSlate SignNow allows for integrations with various accounting and tax software, making it easy to incorporate the 776 Worksheet California SSMC Adjustments Worksheet into your existing workflow. This integration enhances efficiency and ensures that your financial data is consistent across platforms. Check our integrations page for more information.

-

What support is available for users of the 776 Worksheet California SSMC Adjustments Worksheet?

We provide comprehensive support for users of the 776 Worksheet California SSMC Adjustments Worksheet through our customer service team. Whether you have questions about the worksheet or need assistance with our platform, our team is here to help. You can signNow out via chat, email, or phone for prompt assistance.

Get more for 776 Worksheet California SSMC Adjustments Worksheet Recalculated Federal Adjusted Gross Income California 776 Worksheet

Find out other 776 Worksheet California SSMC Adjustments Worksheet Recalculated Federal Adjusted Gross Income California 776 Worksheet

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online