Instructions for Form 199 California Exempt Organization Annual Information Return References in These Instructions Are to the I

Understanding Form 199 for California Exempt Organizations

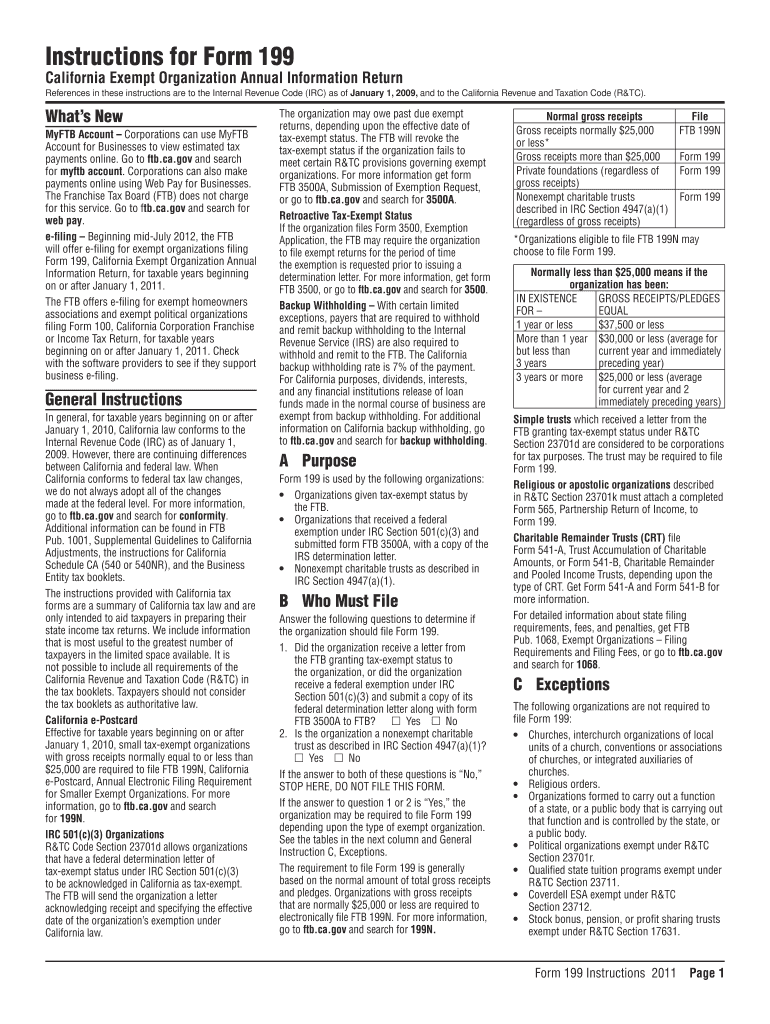

The Instructions for Form 199 serve as a vital resource for exempt organizations in California. This form is specifically designed for organizations that are exempt from federal income tax under Section 501(c) of the Internal Revenue Code (IRC). By filing this form, organizations provide essential information about their financial activities, ensuring compliance with both state and federal regulations. The instructions reference the IRC as of January 1, providing clarity on the legal framework governing these organizations.

How to Complete Form 199

Completing Form 199 requires careful attention to detail. Organizations should gather all necessary financial documents, including income statements, balance sheets, and records of expenditures. The form includes sections that require detailed reporting on revenue, expenses, and any changes in the organization’s structure. Each section must be filled out accurately to avoid potential penalties. It is advisable to review the instructions thoroughly, as they outline specific requirements and provide examples to guide the completion process.

Filing Deadlines for Form 199

Organizations must be aware of the filing deadlines associated with Form 199. Typically, the form is due on the 15th day of the fifth month after the end of the organization’s fiscal year. For organizations operating on a calendar year, this means the form is generally due by May 15. Timely submission is crucial to avoid penalties and maintain good standing with the California Franchise Tax Board.

Required Documents for Submission

When filing Form 199, organizations must prepare and submit several key documents. These include the completed form itself, financial statements, and any additional schedules that may be required based on the organization’s activities. It is important to ensure that all documents are accurate and complete, as incomplete submissions can lead to delays or penalties. Organizations should also keep copies of all submitted documents for their records.

Penalties for Non-Compliance

Failure to comply with the requirements of Form 199 can result in significant penalties. Organizations that do not file on time may face late fees, and repeated non-compliance can lead to the revocation of tax-exempt status. It is essential for organizations to understand these risks and prioritize timely and accurate filing to avoid any adverse consequences.

Digital Submission Options

Organizations have the option to submit Form 199 digitally, which can streamline the filing process. Digital submission allows for faster processing and reduces the risk of lost documents. Organizations can use secure electronic filing methods, ensuring that their information is transmitted safely and efficiently. It is important to follow the specific guidelines for digital submissions to ensure compliance with state requirements.

Quick guide on how to complete instructions for form 199 california exempt organization annual information return references in these instructions are to the

Effortlessly Prepare [SKS] on Any Device

The management of documents online has gained signNow traction among both businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily find the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without any delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and Electronically Sign [SKS] with Ease

- Find [SKS] and then click Get Form to initiate the process.

- Utilize the features we provide to fill out your document.

- Emphasize important sections of your documents or obscure confidential information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign tool, which only takes moments and holds the same legal validity as a conventional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Choose your preferred method for sharing your form, whether by email, SMS, or invitation link, or download it directly to your computer.

Say goodbye to lost or mislaid files, tedious form navigation, or mistakes that require new copies to be printed. airSlate SignNow meets your document management needs with just a few clicks from any device you select. Edit and electronically sign [SKS] and ensure superb communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Instructions For Form 199 California Exempt Organization Annual Information Return References In These Instructions Are To The I

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 199 california exempt organization annual information return references in these instructions are to the

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the Instructions For Form 199 California Exempt Organization Annual Information Return?

The Instructions For Form 199 California Exempt Organization Annual Information Return provide guidance for exempt organizations to report their financial activities. These instructions reference the Internal Revenue Code (IRC) as of January 1, ensuring compliance with federal regulations. Understanding these instructions is crucial for maintaining your organization's tax-exempt status.

-

How can airSlate SignNow assist with completing Form 199?

airSlate SignNow simplifies the process of completing Form 199 by allowing users to eSign and send documents securely. With our platform, you can easily manage your organization's paperwork while adhering to the Instructions For Form 199 California Exempt Organization Annual Information Return References In These Instructions Are To The Internal Revenue Code IRC As Of January 1. This streamlines your compliance efforts and saves time.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers a range of features including eSigning, document templates, and secure storage. These tools help organizations efficiently manage their documents, including those related to the Instructions For Form 199 California Exempt Organization Annual Information Return. Our platform is designed to enhance productivity while ensuring compliance with relevant regulations.

-

Is airSlate SignNow cost-effective for small organizations?

Yes, airSlate SignNow is a cost-effective solution for small organizations looking to manage their documents efficiently. Our pricing plans are designed to accommodate various budgets, making it easier for organizations to comply with the Instructions For Form 199 California Exempt Organization Annual Information Return. Investing in our platform can save you time and resources in the long run.

-

Can airSlate SignNow integrate with other software?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow. This means you can easily incorporate our eSigning capabilities into your existing systems while ensuring compliance with the Instructions For Form 199 California Exempt Organization Annual Information Return. Our integrations help streamline your processes and improve efficiency.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow for eSigning provides numerous benefits, including enhanced security, ease of use, and compliance with legal standards. Our platform ensures that your documents, including those related to the Instructions For Form 199 California Exempt Organization Annual Information Return, are signed securely and efficiently. This not only saves time but also reduces the risk of errors.

-

How does airSlate SignNow ensure document security?

airSlate SignNow prioritizes document security by employing advanced encryption and secure storage solutions. This ensures that all documents, including those pertaining to the Instructions For Form 199 California Exempt Organization Annual Information Return, are protected from unauthorized access. Our commitment to security helps organizations maintain compliance and safeguard sensitive information.

Get more for Instructions For Form 199 California Exempt Organization Annual Information Return References In These Instructions Are To The I

- Gc 341 form

- Virginia sales tax exemption form st 12 2006

- Sc 112a proof of service by mail small claims judicial council forms courtinfo ca

- Wv 120 response to petition for workplace violence restraining courts ca form

- Transcript request kauai community college info kauaicc hawaii form

- Acknowledgement rate form

- Form va 8453 virginia department of taxation tax virginia

- St 9 2013 form

Find out other Instructions For Form 199 California Exempt Organization Annual Information Return References In These Instructions Are To The I

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online