Delaware Withholding Monthly and Quarterly Annual Form

What is the Delaware Withholding Monthly And Quarterly Annual

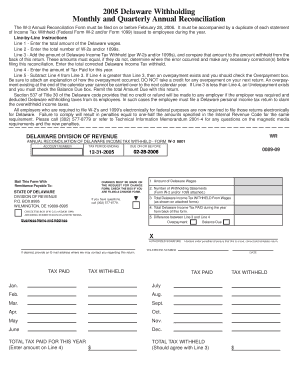

The Delaware Withholding Monthly and Quarterly Annual is a tax form used by employers in Delaware to report and remit state income tax withheld from employees' wages. This form is essential for ensuring compliance with state tax regulations and helps maintain accurate records of tax liabilities. Employers must determine whether to file monthly or quarterly based on the amount of withholding tax they collect. This classification helps streamline the reporting process and ensures timely payments to the state.

How to use the Delaware Withholding Monthly And Quarterly Annual

To effectively use the Delaware Withholding Monthly and Quarterly Annual, employers should first assess their withholding tax obligations. Depending on their total withholding amounts, they will choose either the monthly or quarterly filing schedule. Employers need to accurately report the total amount withheld for each period, along with any adjustments or corrections. It is crucial to ensure that the information is complete and accurate to avoid penalties. After completing the form, employers can submit it through the appropriate channels as outlined by the Delaware Division of Revenue.

Steps to complete the Delaware Withholding Monthly And Quarterly Annual

Completing the Delaware Withholding Monthly and Quarterly Annual involves several key steps:

- Gather necessary information, including total wages paid and the amount of state tax withheld.

- Select the appropriate filing period (monthly or quarterly) based on your withholding amounts.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form to the Delaware Division of Revenue by the specified deadline.

Filing Deadlines / Important Dates

Filing deadlines for the Delaware Withholding Monthly and Quarterly Annual vary based on the chosen reporting frequency. Monthly filers must submit their forms by the 15th of the following month, while quarterly filers have until the last day of the month following the end of the quarter. It is essential for employers to stay informed about these deadlines to avoid late fees and penalties. Marking these dates on a calendar can help ensure timely submissions.

Required Documents

When completing the Delaware Withholding Monthly and Quarterly Annual, employers need to have specific documents on hand. These include:

- Payroll records that detail employee wages and the corresponding state tax withheld.

- Previous withholding forms, if applicable, to ensure consistency in reporting.

- Any correspondence from the Delaware Division of Revenue regarding withholding requirements.

Having these documents readily available can streamline the completion process and enhance accuracy.

Penalties for Non-Compliance

Failure to comply with the filing requirements for the Delaware Withholding Monthly and Quarterly Annual can result in significant penalties. Employers may face fines for late submissions, inaccurate reporting, or failure to remit the correct amount of withheld taxes. These penalties can accumulate over time, leading to increased financial liability. It is crucial for employers to understand their obligations and maintain compliance to avoid these consequences.

Who Issues the Form

The Delaware Division of Revenue is responsible for issuing the Delaware Withholding Monthly and Quarterly Annual. This state agency oversees the collection of state taxes and ensures that employers comply with withholding regulations. Employers can obtain the form directly from the Division of Revenue's official website or through their local offices. It is important to use the most current version of the form to ensure compliance with state laws.

Quick guide on how to complete delaware withholding monthly and quarterly annual

Fill out [SKS] effortlessly on any gadget

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an optimal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely save it in the cloud. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without any hold-ups. Handle [SKS] on any gadget with airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The easiest method to modify and eSign [SKS] smoothly

- Find [SKS] and click on Get Form to begin.

- Use the tools we provide to finalize your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Decide how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] to guarantee effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Delaware Withholding Monthly And Quarterly Annual

Create this form in 5 minutes!

How to create an eSignature for the delaware withholding monthly and quarterly annual

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Delaware Withholding Monthly And Quarterly Annual?

Delaware Withholding Monthly And Quarterly Annual refers to the tax obligations businesses must fulfill regarding employee income tax withholdings. Understanding these requirements is crucial for compliance and avoiding penalties. airSlate SignNow provides tools to help manage these withholdings efficiently.

-

How can airSlate SignNow assist with Delaware Withholding Monthly And Quarterly Annual?

airSlate SignNow offers a streamlined solution for managing Delaware Withholding Monthly And Quarterly Annual by allowing businesses to easily send and eSign necessary documents. This simplifies the process of maintaining compliance with state tax regulations. Our platform ensures that all documents are securely stored and easily accessible.

-

What are the pricing options for airSlate SignNow related to Delaware Withholding Monthly And Quarterly Annual?

airSlate SignNow offers competitive pricing plans tailored to meet the needs of businesses handling Delaware Withholding Monthly And Quarterly Annual. Our plans are designed to be cost-effective while providing essential features for document management and eSigning. You can choose a plan that best fits your business size and requirements.

-

What features does airSlate SignNow provide for managing Delaware Withholding Monthly And Quarterly Annual?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning to facilitate the management of Delaware Withholding Monthly And Quarterly Annual. These features help streamline the documentation process, ensuring that all tax-related forms are completed accurately and efficiently.

-

Are there any integrations available with airSlate SignNow for Delaware Withholding Monthly And Quarterly Annual?

Yes, airSlate SignNow integrates seamlessly with various accounting and payroll software to assist with Delaware Withholding Monthly And Quarterly Annual. This integration allows for automatic updates and data synchronization, reducing the risk of errors. You can easily connect your existing tools to enhance your workflow.

-

What are the benefits of using airSlate SignNow for Delaware Withholding Monthly And Quarterly Annual?

Using airSlate SignNow for Delaware Withholding Monthly And Quarterly Annual offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. Our platform simplifies the eSigning process, allowing for faster turnaround times on important documents. This ultimately helps businesses save time and resources.

-

How secure is airSlate SignNow when handling Delaware Withholding Monthly And Quarterly Annual documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your Delaware Withholding Monthly And Quarterly Annual documents. Our platform ensures that all sensitive information is safeguarded against unauthorized access. You can trust that your data is secure while using our services.

Get more for Delaware Withholding Monthly And Quarterly Annual

- Audition registration forms pdf peninsula youth theatre pytnet

- Divorce forms indiana

- Prospective tenant form

- Illinois support form

- Form nfp 1051010520 rev dec 2003 cyberdrive illinois cyberdriveillinois

- Form nfp 1041520 rev aug 2014 cyberdrive illinois cyberdriveillinois

- Temporary guardianship packet cherokee county government form

- Status conference report form

Find out other Delaware Withholding Monthly And Quarterly Annual

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed