Business Personal Property Tax Information Aug Indd

What is the Business Personal Property Tax Information Aug indd

The Business Personal Property Tax Information Aug indd is a crucial document that provides essential details regarding the taxation of personal property owned by businesses. This form is designed to help businesses report their personal property accurately to the relevant tax authorities. It typically includes information about the types of property owned, its value, and any applicable exemptions. Understanding this form is vital for compliance with local and state tax regulations.

How to use the Business Personal Property Tax Information Aug indd

Using the Business Personal Property Tax Information Aug indd involves several straightforward steps. First, gather all necessary documentation related to your business's personal property, including purchase receipts and valuation statements. Next, fill out the form accurately, ensuring that all information is complete and correct. After completing the form, submit it to the appropriate tax authority by the specified deadline to avoid any penalties. Keeping a copy for your records is also advisable.

Steps to complete the Business Personal Property Tax Information Aug indd

Completing the Business Personal Property Tax Information Aug indd requires careful attention to detail. Follow these steps:

- Collect all relevant property documentation, including purchase records and appraisals.

- Fill in your business information, including name, address, and tax identification number.

- List all personal property owned by your business, categorizing it as necessary.

- Provide accurate valuations for each item, based on current market values.

- Review the form for accuracy before submission.

- Submit the completed form by the deadline set by your local tax authority.

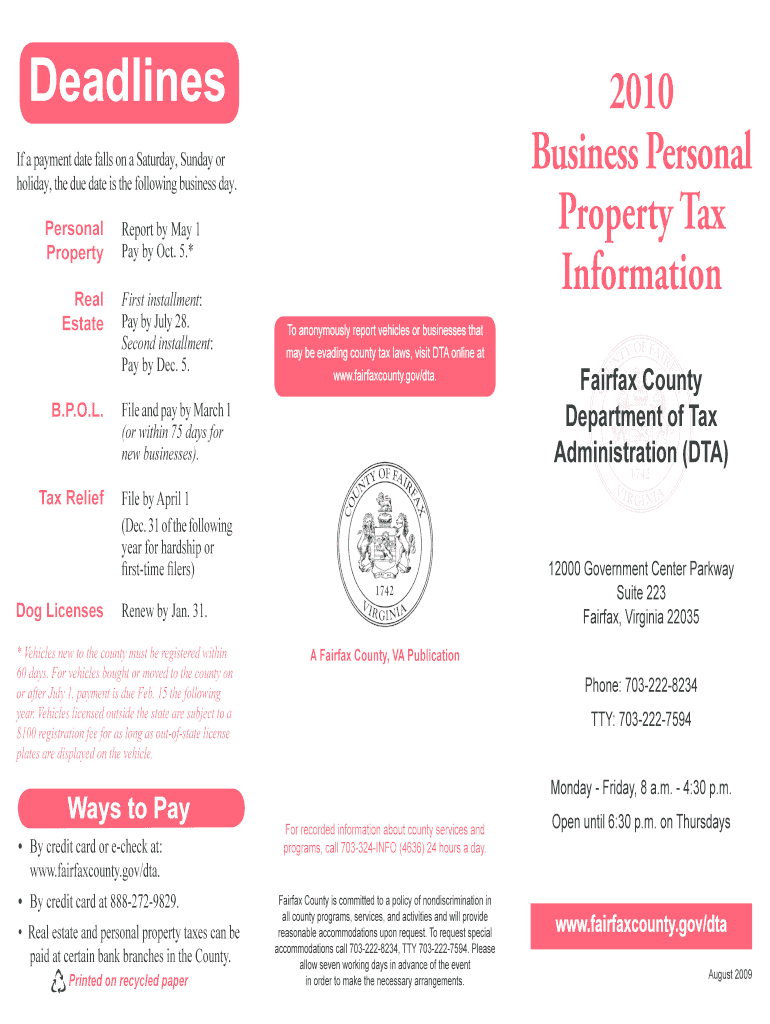

Filing Deadlines / Important Dates

Filing deadlines for the Business Personal Property Tax Information Aug indd vary by state and local jurisdiction. It is essential to be aware of these deadlines to ensure timely submission and avoid penalties. Typically, deadlines fall within the first few months of the year, but specific dates can differ. Always check with your local tax authority for the most accurate and up-to-date information regarding filing dates.

Required Documents

To complete the Business Personal Property Tax Information Aug indd, several documents are typically required. These may include:

- Purchase invoices for all personal property.

- Valuation documents or appraisals for significant assets.

- Previous tax returns related to personal property.

- Any exemption certificates that may apply to your business.

Gathering these documents in advance can streamline the completion process and ensure compliance with tax regulations.

Penalties for Non-Compliance

Failure to file the Business Personal Property Tax Information Aug indd or inaccuracies in the submitted information can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action from tax authorities. It is crucial to ensure that the form is completed accurately and submitted on time to avoid these consequences.

Quick guide on how to complete business personal property tax information aug indd

Complete [SKS] effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely archive it online. airSlate SignNow provides you with all the tools necessary to generate, modify, and eSign your documents swiftly and without complications. Manage [SKS] using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sending your form—via email, text message (SMS), or invitation link, or download it to your computer.

No more lost or mislaid documents, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choice. Edit and eSign [SKS] to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Business Personal Property Tax Information Aug indd

Create this form in 5 minutes!

How to create an eSignature for the business personal property tax information aug indd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Business Personal Property Tax Information Aug indd?

Business Personal Property Tax Information Aug indd refers to the documentation and data related to the taxation of personal property owned by businesses. This information is crucial for compliance with local tax regulations and helps businesses understand their tax obligations. Utilizing airSlate SignNow can streamline the process of managing and signing these documents.

-

How can airSlate SignNow help with Business Personal Property Tax Information Aug indd?

airSlate SignNow simplifies the process of sending and eSigning Business Personal Property Tax Information Aug indd documents. Our platform allows businesses to quickly prepare, send, and receive signed documents, ensuring that all tax-related paperwork is handled efficiently. This not only saves time but also reduces the risk of errors in tax submissions.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. Our plans are designed to provide cost-effective solutions for managing documents, including Business Personal Property Tax Information Aug indd. You can choose a plan that best fits your needs, ensuring you get the most value for your investment.

-

Are there any features specifically for managing tax documents?

Yes, airSlate SignNow includes features tailored for managing tax documents, such as templates for Business Personal Property Tax Information Aug indd. These templates help ensure that all necessary information is included and that documents are compliant with tax regulations. Additionally, our platform offers tracking and reminders to keep you on top of important deadlines.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow for managing Business Personal Property Tax Information Aug indd. Whether you use accounting software or CRM systems, our integrations help streamline document management and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for Business Personal Property Tax Information Aug indd offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are securely stored and easily accessible, allowing for quick retrieval when needed. This ultimately helps businesses stay organized and compliant with tax regulations.

-

Is airSlate SignNow user-friendly for new users?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for new users to navigate and utilize the platform. Our intuitive interface allows users to quickly learn how to send and eSign Business Personal Property Tax Information Aug indd documents without extensive training. We also provide resources and support to assist users in getting started.

Get more for Business Personal Property Tax Information Aug indd

- School bus pre trip inspection form

- Usit payment center dentonisd form

- Employment separation certificate symarco form

- Helpful aspects of therapy form h

- Pre authorized payment form the wynford group

- The law society of alberta form 2 4 certification of character and reputation instructions for completion of certificate of

- Cdph 512 form

- Load letter lipower form

Find out other Business Personal Property Tax Information Aug indd

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online

- Sign West Virginia Car Insurance Quotation Form Online

- Sign Wisconsin Car Insurance Quotation Form Online

- Sign Alabama Life-Insurance Quote Form Free

- Sign California Apply for Lead Pastor Easy

- Sign Rhode Island Certeficate of Insurance Request Free

- Sign Hawaii Life-Insurance Quote Form Fast

- Sign Indiana Life-Insurance Quote Form Free

- Sign Maryland Church Donation Giving Form Later

- Can I Sign New Jersey Life-Insurance Quote Form

- Can I Sign Pennsylvania Church Donation Giving Form

- Sign Oklahoma Life-Insurance Quote Form Later