Estimated Income Tax Payments for Individuals Form

What is the Estimated Income Tax Payments For Individuals

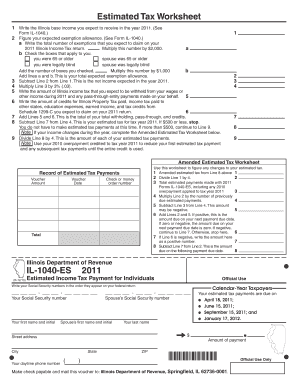

The Estimated Income Tax Payments For Individuals is a method for taxpayers to pay their federal income tax throughout the year, rather than in a lump sum at tax time. This system is particularly relevant for self-employed individuals, freelancers, or those with significant income not subject to withholding. By making estimated payments, taxpayers can avoid underpayment penalties and ensure they meet their tax obligations in a timely manner.

How to Use the Estimated Income Tax Payments For Individuals

To effectively use the Estimated Income Tax Payments For Individuals, taxpayers should first calculate their expected tax liability for the year. This involves estimating income, deductions, and credits. Once the total tax is determined, individuals can divide this amount into four quarterly payments. These payments are typically due in April, June, September, and January of the following year. It's essential to keep accurate records of these payments for future reference and to ensure compliance with IRS regulations.

Steps to Complete the Estimated Income Tax Payments For Individuals

Completing the Estimated Income Tax Payments For Individuals involves several key steps:

- Estimate your total income for the year, including wages, self-employment income, and any other sources.

- Determine applicable deductions and credits to calculate your taxable income.

- Use IRS Form 1040-ES to compute your estimated tax liability.

- Divide the estimated tax by four to find the amount due for each quarter.

- Submit your payments using the IRS payment options, such as online payments, checks, or money orders.

IRS Guidelines

The IRS provides specific guidelines for making estimated income tax payments. Taxpayers should refer to IRS Publication 505 for detailed instructions on how to calculate and submit these payments. The guidelines outline eligibility criteria, payment methods, and potential penalties for underpayment. Staying informed about these regulations helps individuals comply with tax laws and avoid unnecessary fines.

Filing Deadlines / Important Dates

Timely submission of estimated income tax payments is crucial. The typical deadlines for these payments are:

- First quarter: April 15

- Second quarter: June 15

- Third quarter: September 15

- Fourth quarter: January 15 of the following year

If a deadline falls on a weekend or holiday, the due date is usually extended to the next business day. Keeping track of these dates helps individuals avoid late fees and penalties.

Penalties for Non-Compliance

Failing to make estimated income tax payments can result in penalties from the IRS. If a taxpayer underpays their estimated tax, they may incur a penalty based on the amount owed and the duration of the underpayment. It is important to ensure that estimated payments are made accurately and on time to avoid these financial repercussions. Taxpayers may also be subject to interest charges on unpaid amounts.

Quick guide on how to complete estimated income tax payments for individuals

Effortlessly prepare [SKS] on any device

Online document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can access the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle [SKS] on any platform with airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to edit and eSign [SKS] with ease

- Find [SKS] and click on Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or censor sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Alter and eSign [SKS] and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Estimated Income Tax Payments For Individuals

Create this form in 5 minutes!

How to create an eSignature for the estimated income tax payments for individuals

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Estimated Income Tax Payments For Individuals?

Estimated Income Tax Payments For Individuals are prepayments made to the IRS based on expected income for the year. These payments help individuals avoid penalties for underpayment when filing their annual tax returns. Understanding these payments is crucial for effective tax planning.

-

How can airSlate SignNow assist with Estimated Income Tax Payments For Individuals?

airSlate SignNow provides a streamlined solution for managing documents related to Estimated Income Tax Payments For Individuals. Users can easily create, send, and eSign necessary tax documents, ensuring compliance and timely submissions. This simplifies the process and reduces the risk of errors.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing Estimated Income Tax Payments For Individuals. These tools enhance efficiency and ensure that all documents are handled securely and professionally. Users can also integrate with various accounting software for seamless operations.

-

Is airSlate SignNow cost-effective for managing tax documents?

Yes, airSlate SignNow is a cost-effective solution for managing documents related to Estimated Income Tax Payments For Individuals. With flexible pricing plans, users can choose the option that best fits their needs without compromising on features. This affordability makes it accessible for individuals and small businesses alike.

-

Can I integrate airSlate SignNow with other financial tools?

Absolutely! airSlate SignNow integrates with various financial tools and software, making it easier to manage Estimated Income Tax Payments For Individuals. This integration allows users to sync data, automate workflows, and enhance overall productivity. Popular integrations include QuickBooks and Salesforce.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for managing Estimated Income Tax Payments For Individuals offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform ensures that all documents are stored securely and can be accessed anytime, streamlining the entire tax preparation process. Additionally, eSigning speeds up approvals and submissions.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your documents related to Estimated Income Tax Payments For Individuals by employing advanced encryption and secure cloud storage. This ensures that sensitive information remains confidential and protected from unauthorized access. Regular security audits further enhance the platform's reliability.

Get more for Estimated Income Tax Payments For Individuals

Find out other Estimated Income Tax Payments For Individuals

- Can I Sign Wisconsin Freelance Contract

- Sign Hawaii Employee Performance Review Template Simple

- Sign Indiana Termination Letter Template Simple

- Sign Michigan Termination Letter Template Free

- Sign Colorado Independent Contractor Agreement Template Simple

- How Can I Sign Florida Independent Contractor Agreement Template

- Sign Georgia Independent Contractor Agreement Template Fast

- Help Me With Sign Nevada Termination Letter Template

- How Can I Sign Michigan Independent Contractor Agreement Template

- Sign Montana Independent Contractor Agreement Template Simple

- Sign Vermont Independent Contractor Agreement Template Free

- Sign Wisconsin Termination Letter Template Free

- How To Sign Rhode Island Emergency Contact Form

- Can I Sign Utah Executive Summary Template

- Sign Washington Executive Summary Template Free

- Sign Connecticut New Hire Onboarding Mobile

- Help Me With Sign Wyoming CV Form Template

- Sign Mississippi New Hire Onboarding Simple

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now