Schedule UBNLD Business Income Tax Corporate Form

What is the Schedule UBNLD Business Income Tax Corporate

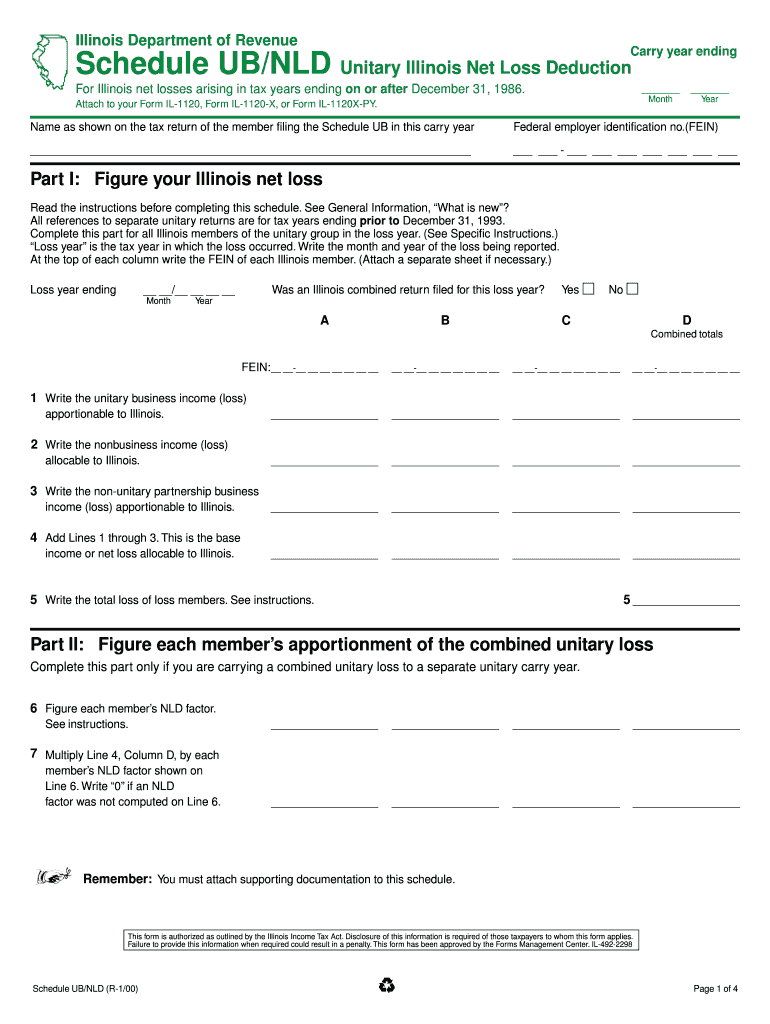

The Schedule UBNLD Business Income Tax Corporate is a specific tax form used by corporations to report their business income to the Internal Revenue Service (IRS). This form is essential for determining the taxable income of a corporation, which includes income from sales, services, and other business activities. Understanding this form is crucial for compliance with federal tax regulations and for accurate financial reporting.

How to use the Schedule UBNLD Business Income Tax Corporate

Using the Schedule UBNLD involves filling out detailed information about the corporation's income, expenses, and deductions. Corporations must accurately report their total revenue and any applicable deductions to calculate their taxable income. It is important to follow the IRS guidelines closely to ensure that all necessary information is provided, which can help avoid potential penalties.

Steps to complete the Schedule UBNLD Business Income Tax Corporate

Completing the Schedule UBNLD requires several key steps:

- Gather financial records, including income statements and expense reports.

- Fill in the corporation's identifying information at the top of the form.

- Report total income from all sources, including sales and services.

- List allowable deductions, such as operating expenses and cost of goods sold.

- Calculate the taxable income by subtracting total deductions from total income.

- Review the form for accuracy before submission.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the Schedule UBNLD. Generally, the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is typically due by April 15. It is essential to mark these dates on your calendar to ensure timely submission and avoid penalties.

Required Documents

To complete the Schedule UBNLD, several documents are necessary:

- Income statements detailing all revenue sources.

- Expense reports that outline all business-related costs.

- Previous tax returns for reference and consistency.

- Any supporting documentation for deductions claimed.

Penalties for Non-Compliance

Failure to file the Schedule UBNLD by the deadline can result in significant penalties. The IRS may impose fines based on the amount of tax owed and the length of the delay. Additionally, inaccurate reporting can lead to audits and further legal complications. It is crucial for corporations to ensure compliance to avoid these potential consequences.

Quick guide on how to complete schedule ubnld business income tax corporate

Effortlessly prepare [SKS] on any device

Managing documents online has gained popularity among businesses and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight relevant sections of the documents or obscure sensitive information with the tools airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Edit and eSign [SKS] and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule ubnld business income tax corporate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule UBNLD Business Income Tax Corporate?

Schedule UBNLD Business Income Tax Corporate is a tax form used by corporations to report their business income and calculate their tax liability. It is essential for compliance with federal tax regulations and helps businesses accurately assess their financial standing.

-

How can airSlate SignNow help with Schedule UBNLD Business Income Tax Corporate?

airSlate SignNow streamlines the process of preparing and submitting your Schedule UBNLD Business Income Tax Corporate by allowing you to easily send and eSign necessary documents. This ensures that your tax forms are completed accurately and submitted on time, reducing the risk of errors.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for small businesses and larger corporations. Each plan provides access to features that facilitate the management of documents, including those related to Schedule UBNLD Business Income Tax Corporate.

-

What features does airSlate SignNow provide for tax document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are particularly useful for managing Schedule UBNLD Business Income Tax Corporate. These tools help ensure that your tax documents are organized and easily accessible.

-

Are there integrations available with airSlate SignNow for accounting software?

Yes, airSlate SignNow integrates seamlessly with various accounting software solutions, making it easier to manage your Schedule UBNLD Business Income Tax Corporate. This integration allows for efficient data transfer and helps maintain accurate financial records.

-

What are the benefits of using airSlate SignNow for corporate tax filings?

Using airSlate SignNow for corporate tax filings, including Schedule UBNLD Business Income Tax Corporate, offers numerous benefits such as increased efficiency, reduced paperwork, and enhanced security. The platform simplifies the eSigning process, ensuring that all necessary approvals are obtained quickly.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely, airSlate SignNow prioritizes security and compliance, employing advanced encryption and authentication measures to protect sensitive tax documents like Schedule UBNLD Business Income Tax Corporate. You can trust that your information is safe while using our platform.

Get more for Schedule UBNLD Business Income Tax Corporate

- How to complete your crest transfer form hargreaves lansdown

- Fl 324 declaration of supervised visitation provider editable and saveable california judicial council forms

- Collegeboard business farm supplement form

- Early decision agreement pdf vassar admissions denison form

- Vacating a judgment and staying enforcement of a writ of restitution washingtonlawhelp form

- Ri pr006 superior court riverside state of california form

- Commercial operations permit application city of santa monica smgov form

- Giro form

Find out other Schedule UBNLD Business Income Tax Corporate

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later