IL 2210 Income Tax Individual Form

What is the IL 2210 Income Tax Individual

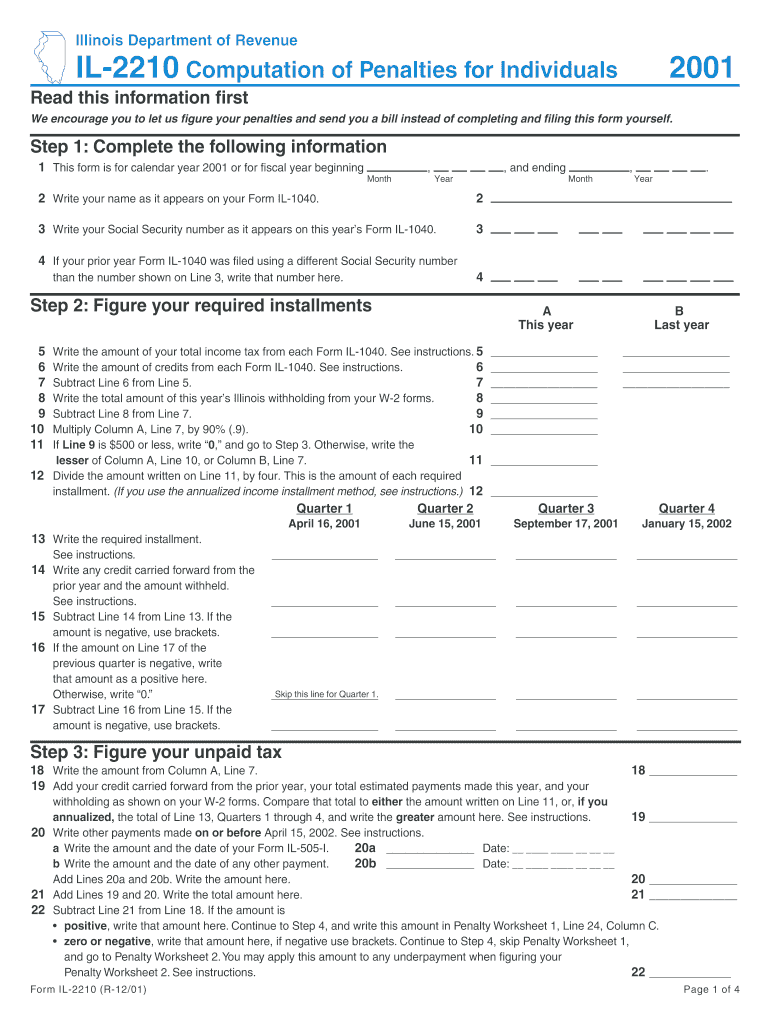

The IL 2210 Income Tax Individual form is a state tax document used by residents of Illinois to calculate penalties for underpayment of their income tax. This form is specifically designed for individual taxpayers who may not have paid enough tax throughout the year, either through withholding or estimated payments. By using this form, taxpayers can determine if they owe a penalty and how much that penalty will be. Understanding this form is essential for ensuring compliance with Illinois tax laws and avoiding unnecessary penalties.

How to use the IL 2210 Income Tax Individual

Using the IL 2210 Income Tax Individual form involves several steps. First, taxpayers must gather their income information and tax payments for the year. Next, they need to calculate their total tax liability and compare it with the amount they have already paid. If there is a discrepancy indicating underpayment, the IL 2210 form can be filled out to assess any penalties. It is important to follow the instructions carefully to ensure accurate calculations and compliance with state regulations.

Steps to complete the IL 2210 Income Tax Individual

Completing the IL 2210 Income Tax Individual form requires a systematic approach:

- Gather all necessary financial documents, including W-2s and 1099s.

- Calculate your total income and determine your total tax liability.

- Review your tax payments made throughout the year, including withholding and estimated payments.

- Use the form's worksheet to calculate any potential underpayment penalties.

- Complete the form, ensuring all calculations are accurate.

- Submit the form along with your tax return or as a standalone document if required.

Filing Deadlines / Important Dates

It is crucial for taxpayers to be aware of the filing deadlines associated with the IL 2210 Income Tax Individual form. Typically, the form must be filed by the same deadline as the individual income tax return, which is usually April 15. If taxpayers are unable to meet this deadline, they may request an extension. However, any penalties for underpayment are still applicable, so timely submission is important to avoid additional charges.

Key elements of the IL 2210 Income Tax Individual

Several key elements are essential to understand when working with the IL 2210 Income Tax Individual form. These include:

- Taxpayer Information: Basic details such as name, address, and Social Security number.

- Income Details: Total income for the year, including wages and other earnings.

- Tax Payments: Total payments made, including withholding and estimated taxes.

- Penalty Calculation: A section to compute any penalties due for underpayment.

Who Issues the Form

The IL 2210 Income Tax Individual form is issued by the Illinois Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. The department provides resources and guidance to help individuals understand their tax obligations, including the use of the IL 2210 form for underpayment penalties.

Quick guide on how to complete il 2210 income tax individual

Effortlessly Prepare [SKS] on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can obtain the correct form and securely store it on the internet. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage [SKS] across any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

Steps to Modify and Electronically Sign [SKS] with Ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark signNow sections of your documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred delivery method for your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, monotonous form navigation, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to IL 2210 Income Tax Individual

Create this form in 5 minutes!

How to create an eSignature for the il 2210 income tax individual

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IL 2210 Income Tax Individual form?

The IL 2210 Income Tax Individual form is used by taxpayers in Illinois to calculate any penalties for underpayment of estimated tax. This form helps individuals ensure compliance with state tax laws and avoid unnecessary penalties. Understanding how to fill out the IL 2210 is crucial for accurate tax reporting.

-

How can airSlate SignNow assist with the IL 2210 Income Tax Individual form?

airSlate SignNow provides a seamless way to eSign and send the IL 2210 Income Tax Individual form electronically. Our platform simplifies the document management process, allowing users to complete and submit their tax forms efficiently. With airSlate SignNow, you can ensure your tax documents are signed and sent securely.

-

What are the pricing options for using airSlate SignNow for IL 2210 Income Tax Individual?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including those who need to manage the IL 2210 Income Tax Individual form. Our cost-effective solutions ensure that you can eSign and send documents without breaking the bank. Check our website for detailed pricing information tailored to your requirements.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are essential for managing the IL 2210 Income Tax Individual form. These features enhance efficiency and ensure that your tax documents are handled with care. Our platform is designed to streamline your workflow and improve productivity.

-

Is airSlate SignNow compliant with tax regulations for the IL 2210 Income Tax Individual?

Yes, airSlate SignNow is compliant with all relevant tax regulations, ensuring that your IL 2210 Income Tax Individual form is processed according to legal standards. Our platform prioritizes security and compliance, giving you peace of mind when handling sensitive tax documents. Trust us to keep your information safe and secure.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with various tax preparation software, making it easy to manage your IL 2210 Income Tax Individual form alongside your other financial documents. This integration streamlines your workflow and enhances productivity, allowing you to focus on what matters most—your business.

-

What are the benefits of using airSlate SignNow for the IL 2210 Income Tax Individual form?

Using airSlate SignNow for the IL 2210 Income Tax Individual form provides numerous benefits, including time savings, enhanced security, and ease of use. Our platform allows you to eSign documents quickly and efficiently, reducing the hassle of traditional paper methods. Experience the convenience of digital document management with airSlate SignNow.

Get more for IL 2210 Income Tax Individual

- Berapa gran gas h2 pada karutan asam jika arusbang duberikan 965a selama 5menit form

- Limited warranty on materials comts589 gaf form

- Ciis human research review committee hrrc application ciis form

- Professional opinion letter form

- Backflow test report city of waxahachie form

- Sample letter selective service form

- Employer quarterly gross earnings report directors guild of dga form

- English language reference form general medical council gmc uk

Find out other IL 2210 Income Tax Individual

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP