Schedule K 1 P2 Income Tax Business Tax Illinois Form

What is the Schedule K-1 P2 Income Tax Business Tax Illinois

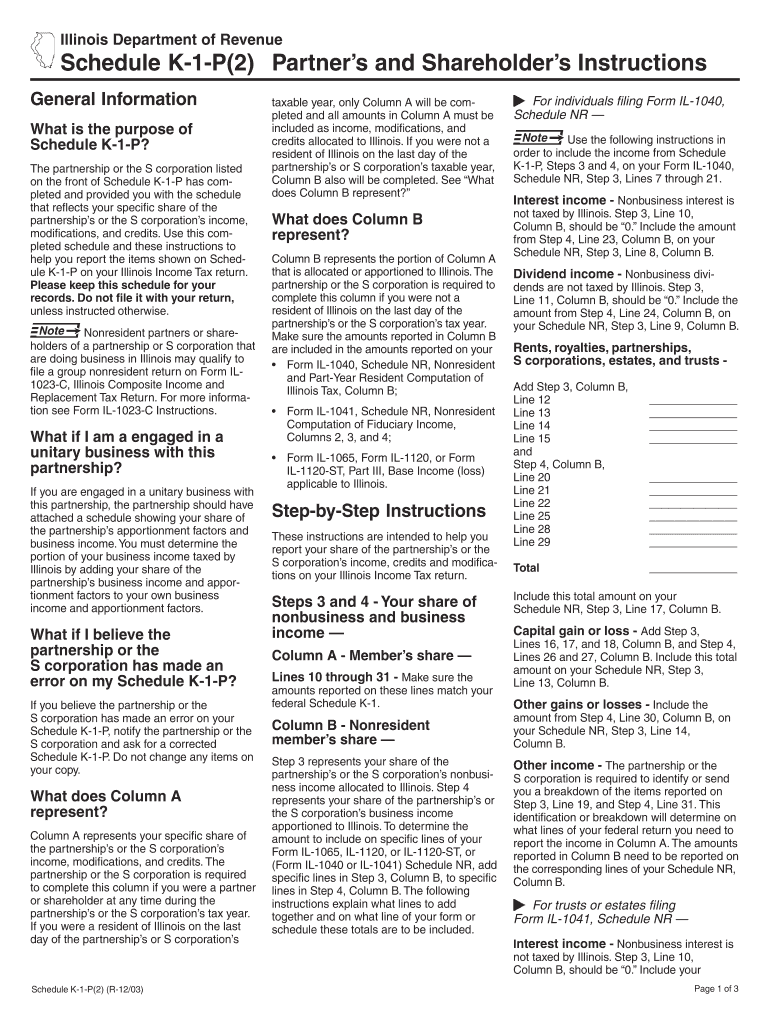

The Schedule K-1 P2 is a tax form used in Illinois for reporting income, deductions, and credits from partnerships or S corporations. This form is essential for individuals who have received income from these business entities, as it provides detailed information on their share of the entity's income, losses, and other tax-related items. The K-1 P2 specifically pertains to the business tax obligations of partnerships and S corporations within the state, ensuring that all income is accurately reported to the Illinois Department of Revenue.

How to use the Schedule K-1 P2 Income Tax Business Tax Illinois

Using the Schedule K-1 P2 involves several steps for taxpayers. First, individuals must receive their K-1 from the partnership or S corporation they are involved with. This document outlines their share of the income and any deductions or credits applicable. Taxpayers should then incorporate the information from the K-1 into their personal income tax returns. It is crucial to ensure that all reported figures align with the K-1 to avoid discrepancies that could trigger audits or penalties.

Steps to complete the Schedule K-1 P2 Income Tax Business Tax Illinois

Completing the Schedule K-1 P2 requires careful attention to detail. Here are the general steps:

- Obtain the K-1 from the partnership or S corporation.

- Review the K-1 for accuracy, ensuring all income, deductions, and credits are correctly reported.

- Fill out your personal income tax return, incorporating the K-1 information where applicable.

- Submit your tax return by the appropriate deadline, ensuring all forms are included.

- Keep a copy of the K-1 and your tax return for your records.

Legal use of the Schedule K-1 P2 Income Tax Business Tax Illinois

The Schedule K-1 P2 is legally required for reporting income from partnerships and S corporations in Illinois. Failure to accurately report this income can lead to penalties and interest charges from the state. It is important for taxpayers to understand their legal obligations regarding the K-1, including the requirement to report all income received, even if it is not distributed. Compliance with these regulations ensures that taxpayers fulfill their responsibilities under Illinois tax law.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule K-1 P2 align with the overall tax filing deadlines for partnerships and S corporations in Illinois. Typically, these entities must file their returns by the fifteenth day of the third month following the end of their fiscal year. For individuals receiving K-1s, it is essential to file their personal tax returns by April fifteenth, unless an extension is filed. Taxpayers should be aware of these dates to avoid late fees and penalties.

Who Issues the Form

The Schedule K-1 P2 is issued by partnerships and S corporations to their partners or shareholders. Each entity is responsible for preparing and distributing the K-1 to its members, ensuring that the information is accurate and complete. Taxpayers should expect to receive their K-1s in a timely manner, allowing them sufficient time to incorporate the information into their tax filings.

Quick guide on how to complete schedule k 1 p2 income tax business tax illinois

Finish [SKS] effortlessly on any gadget

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents quickly without delays. Handle [SKS] on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The most efficient method to alter and eSign [SKS] with ease

- Obtain [SKS] and then click Access Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Complete button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, lengthy form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your preference. Alter and eSign [SKS] and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule K 1 P2 Income Tax Business Tax Illinois

Create this form in 5 minutes!

How to create an eSignature for the schedule k 1 p2 income tax business tax illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule K 1 P2 Income Tax Business Tax Illinois?

Schedule K 1 P2 Income Tax Business Tax Illinois is a tax form used to report income, deductions, and credits from partnerships and S corporations. It provides detailed information about each partner's share of the business's income, which is essential for accurate tax filing. Understanding this form is crucial for businesses operating in Illinois to ensure compliance with state tax regulations.

-

How can airSlate SignNow help with Schedule K 1 P2 Income Tax Business Tax Illinois?

airSlate SignNow simplifies the process of preparing and signing Schedule K 1 P2 Income Tax Business Tax Illinois forms. Our platform allows businesses to easily send, eSign, and manage documents securely, ensuring that all tax-related paperwork is handled efficiently. This streamlines the workflow and reduces the risk of errors in tax submissions.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans include features that support the management of Schedule K 1 P2 Income Tax Business Tax Illinois forms, ensuring you get the best value for your investment. You can choose from monthly or annual subscriptions, with discounts available for long-term commitments.

-

What features does airSlate SignNow provide for tax document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are essential for managing Schedule K 1 P2 Income Tax Business Tax Illinois forms. These tools help businesses streamline their tax documentation process, ensuring that all necessary forms are completed accurately and on time. Additionally, our platform integrates with various accounting software for seamless data transfer.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive tax documents like Schedule K 1 P2 Income Tax Business Tax Illinois. Our platform uses advanced encryption and secure storage solutions to protect your data. We also comply with industry standards to ensure that your information remains confidential and secure.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with popular accounting and tax preparation software, making it easier to manage Schedule K 1 P2 Income Tax Business Tax Illinois forms. This integration allows for seamless data transfer and reduces the time spent on manual entry, enhancing overall efficiency in your tax preparation process.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including Schedule K 1 P2 Income Tax Business Tax Illinois, provides numerous benefits. It enhances efficiency by automating document workflows, reduces the risk of errors through eSigning, and ensures compliance with tax regulations. Additionally, our user-friendly interface makes it easy for businesses to manage their tax documentation effectively.

Get more for Schedule K 1 P2 Income Tax Business Tax Illinois

Find out other Schedule K 1 P2 Income Tax Business Tax Illinois

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation