Schedule NR Income Tax Individual Form

What is the Schedule NR Income Tax Individual

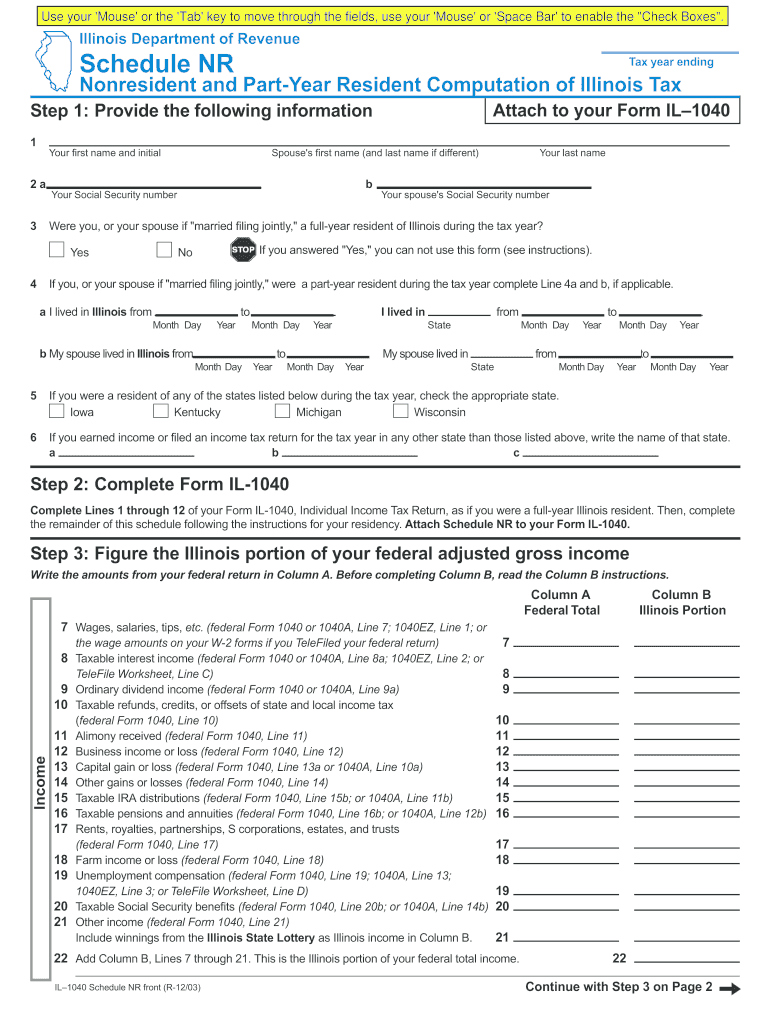

The Schedule NR Income Tax Individual is a specific tax form used by non-resident aliens in the United States to report their income and calculate their tax liability. This form is essential for individuals who are not U.S. citizens or residents but have earned income from U.S. sources. It allows these individuals to comply with U.S. tax laws and fulfill their reporting obligations.

How to use the Schedule NR Income Tax Individual

Using the Schedule NR Income Tax Individual involves several steps. First, gather all necessary documentation, including income statements and any relevant tax treaties that may affect your tax obligations. Next, complete the form by providing accurate information regarding your income, deductions, and credits. Finally, ensure that you review the completed form for accuracy before submitting it to the IRS.

Steps to complete the Schedule NR Income Tax Individual

Completing the Schedule NR Income Tax Individual requires attention to detail. Start by entering your personal information at the top of the form. Then, report your U.S. source income, which may include wages, interest, and dividends. After that, apply any deductions or credits you qualify for, based on your residency status and specific tax treaties. Lastly, calculate your total tax liability and sign the form before submission.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule NR Income Tax Individual typically align with the general tax filing deadlines. Non-resident aliens must file their forms by April fifteenth of the year following the tax year unless an extension is granted. It is crucial to be aware of these deadlines to avoid penalties and ensure timely compliance with tax regulations.

Required Documents

To complete the Schedule NR Income Tax Individual, you will need several documents. These include your Form W-2, which reports wages, and Form 1099 for other income types. Additionally, any documentation regarding tax treaty benefits, as well as proof of residency status, may be necessary. Having these documents ready will streamline the filing process.

Legal use of the Schedule NR Income Tax Individual

The Schedule NR Income Tax Individual is legally required for non-resident aliens earning income in the U.S. Failure to file this form can result in penalties, including fines and interest on unpaid taxes. It is essential to understand the legal implications of not using this form appropriately to maintain compliance with U.S. tax laws.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule NR Income Tax Individual. These guidelines outline eligibility criteria, required information, and instructions for reporting income. It is advisable to consult the IRS website or official publications for the most current information and to ensure compliance with all regulations related to non-resident taxation.

Quick guide on how to complete schedule nr income tax individual 10998340

Effortlessly Prepare [SKS] on Any Gadget

Digital document management has gained traction among both companies and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to acquire the necessary format and securely maintain it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your papers swiftly and without hindrances. Manage [SKS] on any gadget using the airSlate SignNow applications for Android or iOS and enhance any document-related workflow today.

How to Modify and eSign [SKS] with Ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the features we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to preserve your modifications.

- Select how you wish to share your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or errors that necessitate reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule NR Income Tax Individual

Create this form in 5 minutes!

How to create an eSignature for the schedule nr income tax individual 10998340

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule NR Income Tax Individual?

Schedule NR Income Tax Individual is a tax form used by non-resident individuals to report their income earned in the United States. It is essential for ensuring compliance with U.S. tax laws and helps non-residents accurately calculate their tax obligations.

-

How can airSlate SignNow help with Schedule NR Income Tax Individual?

airSlate SignNow simplifies the process of preparing and signing your Schedule NR Income Tax Individual. With our user-friendly platform, you can easily fill out, eSign, and send your tax documents securely, ensuring a hassle-free experience.

-

What are the pricing options for using airSlate SignNow for Schedule NR Income Tax Individual?

airSlate SignNow offers flexible pricing plans to accommodate various needs, including options for individuals and businesses. Our cost-effective solutions ensure that you can manage your Schedule NR Income Tax Individual without breaking the bank.

-

Are there any features specifically designed for Schedule NR Income Tax Individual?

Yes, airSlate SignNow includes features tailored for Schedule NR Income Tax Individual, such as customizable templates, secure eSigning, and document tracking. These features streamline the tax filing process and enhance your overall experience.

-

Can I integrate airSlate SignNow with other tax software for Schedule NR Income Tax Individual?

Absolutely! airSlate SignNow integrates seamlessly with various tax software solutions, allowing you to manage your Schedule NR Income Tax Individual efficiently. This integration helps you maintain a smooth workflow and ensures all your documents are in one place.

-

What are the benefits of using airSlate SignNow for Schedule NR Income Tax Individual?

Using airSlate SignNow for your Schedule NR Income Tax Individual offers numerous benefits, including time savings, enhanced security, and ease of use. Our platform ensures that your documents are handled securely while providing a straightforward process for eSigning.

-

Is airSlate SignNow compliant with tax regulations for Schedule NR Income Tax Individual?

Yes, airSlate SignNow is designed to comply with all relevant tax regulations, including those pertaining to Schedule NR Income Tax Individual. Our commitment to security and compliance ensures that your sensitive information is protected throughout the process.

Get more for Schedule NR Income Tax Individual

- Aba llc checklistv1 velocitylawcom form

- Verified application for restraining order form

- Arizona form 450 arizona department of revenue azdor

- Permit application city of bradenton form

- Wedding mc run sheet form

- Eviction instruction sheet yuba county sheriffs office sheriff co yuba ca form

- Original works of art statement for duty entry form

- Aircraft discrepancy log form

Find out other Schedule NR Income Tax Individual

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document