IL 1120 Instructions Tax Illinois Form

What is the IL 1120 Instructions Tax Illinois

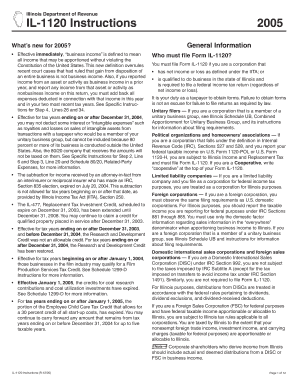

The IL 1120 Instructions provide essential guidance for corporations filing their income tax returns in the state of Illinois. This form is specifically designed for corporations, including C corporations, that are subject to the Illinois Income Tax Act. The instructions outline the necessary steps to accurately complete the IL 1120 form, ensuring compliance with state tax laws. Understanding these instructions is crucial for corporations to avoid penalties and ensure proper reporting of their income, deductions, and tax liabilities.

Steps to complete the IL 1120 Instructions Tax Illinois

Completing the IL 1120 requires a systematic approach. First, gather all relevant financial documents, including income statements, balance sheets, and prior tax returns. Next, follow these steps:

- Begin by filling out the identification section, including the corporation's name, address, and federal employer identification number (FEIN).

- Report total income by including all sources of revenue, such as sales and services.

- Deduct allowable expenses, including operating costs and other business-related deductions, to arrive at the taxable income.

- Calculate the Illinois income tax owed based on the applicable tax rate.

- Complete any additional schedules required for specific deductions or credits.

- Review the form for accuracy and ensure all necessary signatures are included before submission.

Filing Deadlines / Important Dates

Corporations must be aware of critical deadlines associated with the IL 1120 filing. Typically, the due date for filing the IL 1120 is the 15th day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is March 15. Extensions may be available, but they must be requested prior to the original due date. It is essential to keep track of these dates to avoid late filing penalties.

Required Documents

To complete the IL 1120 form accurately, corporations need to prepare several key documents:

- Financial statements, including income statements and balance sheets.

- Prior year tax returns for reference.

- Documentation of all business income and expenses.

- Any relevant schedules or forms that support deductions or credits claimed.

Having these documents ready will streamline the filing process and help ensure compliance with Illinois tax regulations.

Form Submission Methods

Corporations can submit the IL 1120 form through various methods. The options include:

- Online filing via the Illinois Department of Revenue's e-filing system, which is efficient and allows for quicker processing.

- Mailing a paper copy of the completed form to the appropriate address as specified in the instructions.

- In-person submission at designated tax offices, though this method may require an appointment.

Choosing the right submission method can impact the processing time and confirmation of receipt.

Penalties for Non-Compliance

Failure to comply with the IL 1120 filing requirements can result in significant penalties. Common penalties include:

- Late filing penalties, which can accumulate based on the number of days the return is overdue.

- Interest on any unpaid tax amount, which accrues from the due date until the tax is paid in full.

- Potential audits or additional scrutiny from the Illinois Department of Revenue.

Understanding these penalties emphasizes the importance of timely and accurate filing.

Quick guide on how to complete il 1120 instructions tax illinois

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by both companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents promptly without setbacks. Manage [SKS] on any device with airSlate SignNow’s applications for Android or iOS, and simplify any document-related task today.

How to Edit and eSign [SKS] with Ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with the tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only a few seconds and carries the same legal validity as a conventional wet signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you want to send your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any preferred device. Edit and eSign [SKS] to ensure seamless communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to IL 1120 Instructions Tax Illinois

Create this form in 5 minutes!

How to create an eSignature for the il 1120 instructions tax illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the IL 1120 Instructions Tax Illinois?

The IL 1120 Instructions Tax Illinois provide detailed guidelines for corporations filing their income tax returns in Illinois. These instructions cover eligibility, required forms, and deadlines to ensure compliance with state tax laws.

-

How can airSlate SignNow help with IL 1120 Instructions Tax Illinois?

airSlate SignNow simplifies the process of preparing and submitting your IL 1120 forms by allowing you to eSign documents securely. This ensures that your tax documents are completed accurately and submitted on time, reducing the risk of errors.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as document templates, eSignature capabilities, and secure cloud storage. These tools streamline the management of your IL 1120 Instructions Tax Illinois, making it easier to organize and access your tax documents.

-

Is airSlate SignNow cost-effective for small businesses handling IL 1120 Instructions Tax Illinois?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses. With flexible pricing plans, it provides essential features for managing IL 1120 Instructions Tax Illinois without breaking the bank.

-

Can I integrate airSlate SignNow with other accounting software for IL 1120 Instructions Tax Illinois?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, allowing you to streamline your workflow. This integration helps ensure that your IL 1120 Instructions Tax Illinois are processed efficiently alongside your financial records.

-

What are the benefits of using airSlate SignNow for IL 1120 Instructions Tax Illinois?

Using airSlate SignNow for IL 1120 Instructions Tax Illinois offers numerous benefits, including enhanced security, ease of use, and time savings. The platform allows you to focus on your business while ensuring your tax documents are handled professionally.

-

How secure is airSlate SignNow for handling IL 1120 Instructions Tax Illinois?

airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. This ensures that your IL 1120 Instructions Tax Illinois and other sensitive documents are protected from unauthorized access.

Get more for IL 1120 Instructions Tax Illinois

- Staar review packet jflaherty1kleinisdnet form

- Form 32a statement of intended evidence

- Certificate of completion consumers energy residential trade form

- Eng form 6042 1 medical information sheet jun 2012 eng form 6042 1 medical information sheet jun 2012 publications usace army

- Form hhs 697 foreign activities questionnaire hhs

- First b notice word form

- Post manufacture window tint medical exemption form

- Chess score sheet excel form

Find out other IL 1120 Instructions Tax Illinois

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe