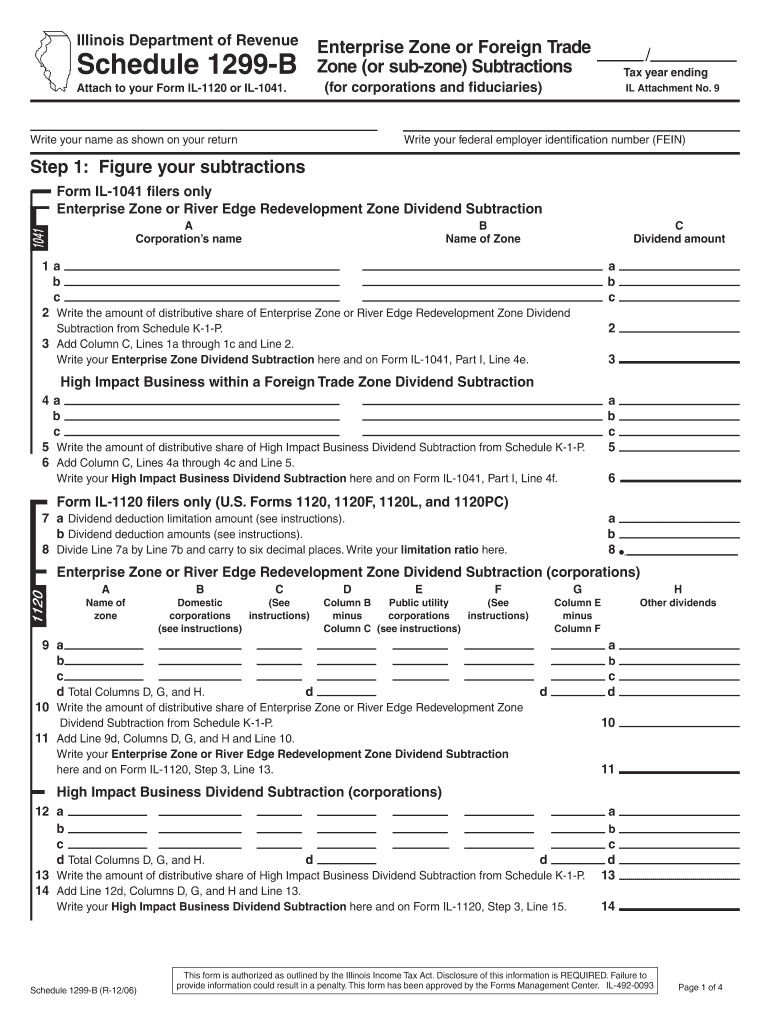

Schedule 1299 B Income Tax Corporate Form

What is the Schedule 1299 B Income Tax Corporate

The Schedule 1299 B Income Tax Corporate is a specific tax form used by corporations in the United States to report income, deductions, and credits. This form is essential for corporations that need to provide detailed information about their financial activities for the tax year. It is typically filed alongside the corporate income tax return, allowing the Internal Revenue Service (IRS) to assess the corporation's tax liability accurately. Understanding the purpose of this form is crucial for compliance with federal tax regulations.

How to use the Schedule 1299 B Income Tax Corporate

Using the Schedule 1299 B requires careful attention to detail. Corporations must fill out the form by entering their financial information accurately. This includes reporting gross income, allowable deductions, and any applicable tax credits. The form typically includes sections for various types of income, such as ordinary business income and capital gains. It is important to follow the instructions provided with the form to ensure all necessary information is included, which helps in avoiding delays or issues with the IRS.

Steps to complete the Schedule 1299 B Income Tax Corporate

Completing the Schedule 1299 B involves several key steps:

- Gather financial records, including income statements and expense reports.

- Fill in the corporation's identifying information at the top of the form.

- Report total income, including sales revenue and other income sources.

- List all deductions, ensuring they are valid and supported by documentation.

- Calculate any tax credits that the corporation may be eligible for.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the Schedule 1299 B. Generally, the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this typically means the deadline is April 15. It is important to be aware of any extensions that may apply, as well as any changes to deadlines due to special circumstances, such as federal holidays or natural disasters.

Legal use of the Schedule 1299 B Income Tax Corporate

The Schedule 1299 B must be used legally and in compliance with IRS regulations. Corporations are required to file this form accurately to avoid penalties. Misreporting income or failing to include necessary information can lead to audits or fines. It is advisable for corporations to consult with tax professionals to ensure that they are using the form correctly and adhering to all legal requirements.

Required Documents

To complete the Schedule 1299 B, corporations need to gather several key documents:

- Financial statements, including balance sheets and income statements.

- Records of all income sources, including sales and investments.

- Documentation for all deductions claimed, such as receipts and invoices.

- Previous tax returns, if applicable, for reference and consistency.

Quick guide on how to complete schedule 1299 b income tax corporate

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a fantastic eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the needed form and securely store it online. airSlate SignNow equips you with all the essential tools to create, edit, and eSign your documents swiftly without any delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

How to Edit and eSign [SKS] with Ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule 1299 b income tax corporate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule 1299 B Income Tax Corporate?

Schedule 1299 B Income Tax Corporate is a tax form used by corporations to report their income and calculate their tax liabilities. It is essential for businesses to accurately complete this form to ensure compliance with tax regulations and avoid penalties.

-

How can airSlate SignNow help with Schedule 1299 B Income Tax Corporate?

airSlate SignNow provides a streamlined solution for businesses to prepare and eSign their Schedule 1299 B Income Tax Corporate documents. With its user-friendly interface, companies can easily manage their tax documentation, ensuring accuracy and efficiency.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are crucial for managing Schedule 1299 B Income Tax Corporate forms. These features help businesses save time and reduce errors in their tax filing process.

-

Is airSlate SignNow cost-effective for small businesses handling Schedule 1299 B Income Tax Corporate?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses. By simplifying the process of preparing Schedule 1299 B Income Tax Corporate documents, it helps businesses save on both time and resources, making it an affordable choice.

-

Can I integrate airSlate SignNow with other accounting software for Schedule 1299 B Income Tax Corporate?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, allowing businesses to streamline their workflow when preparing Schedule 1299 B Income Tax Corporate. This integration ensures that all financial data is accurately reflected in the tax documents.

-

What are the benefits of using airSlate SignNow for Schedule 1299 B Income Tax Corporate?

Using airSlate SignNow for Schedule 1299 B Income Tax Corporate offers numerous benefits, including enhanced security, faster processing times, and improved collaboration among team members. These advantages help ensure that your tax documents are completed accurately and on time.

-

How secure is airSlate SignNow for handling Schedule 1299 B Income Tax Corporate documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your Schedule 1299 B Income Tax Corporate documents. This ensures that sensitive information remains confidential and secure throughout the signing process.

Get more for Schedule 1299 B Income Tax Corporate

- Hurst review pdf form

- Critical lift plan mobile cranesdoc form

- Markel marine tradesman insurance bapplicationb form

- Qualified association bapplicationb pa gov form

- Wb 1 residential listing contract exclusive right to form

- Lien waiver hillsboro title company form

- Texas contract form

- Sunland park employment application pdf hitchhiker hitchhiker nmstatelibrary form

Find out other Schedule 1299 B Income Tax Corporate

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy