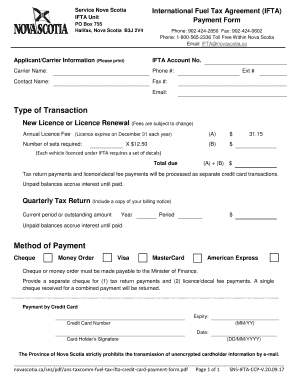

Ifta Nova Scotia Form

What is the IFTA Nova Scotia

The International Fuel Tax Agreement (IFTA) is a cooperative agreement among U.S. states and Canadian provinces, including Nova Scotia, designed to simplify the reporting of fuel use by motor carriers that operate in multiple jurisdictions. This agreement allows carriers to file a single quarterly fuel tax report, rather than separate reports for each jurisdiction. The IFTA Nova Scotia specifically pertains to fuel tax obligations for vehicles operating within and outside the province, ensuring compliance with both provincial and federal regulations.

Steps to Complete the IFTA Nova Scotia

Completing the IFTA payment form for Nova Scotia involves several key steps:

- Gather necessary information, including vehicle details, fuel purchases, and mileage records.

- Calculate the total fuel consumed in each jurisdiction where the vehicle operated.

- Determine the amount of tax owed or refundable based on the fuel usage and jurisdiction rates.

- Complete the IFTA payment form accurately, ensuring all calculations are correct.

- Submit the form electronically or via mail, along with any payment due.

Required Documents

When filling out the IFTA payment form for Nova Scotia, certain documents are essential to ensure accurate reporting and compliance:

- Fuel purchase receipts, detailing the type and quantity of fuel bought.

- Mileage logs that record the distance traveled in each jurisdiction.

- Previous IFTA returns for reference, if applicable.

Filing Deadlines / Important Dates

It is crucial for carriers to be aware of the filing deadlines for the IFTA payment form in Nova Scotia. Generally, the forms are due on the last day of the month following the end of each quarter. This means:

- First quarter: due April 30

- Second quarter: due July 31

- Third quarter: due October 31

- Fourth quarter: due January 31

Penalties for Non-Compliance

Failure to comply with IFTA regulations in Nova Scotia can result in significant penalties. These may include:

- Fines for late submissions or underreporting fuel usage.

- Interest on unpaid taxes, which can accumulate over time.

- Potential audits or increased scrutiny from tax authorities.

Digital vs. Paper Version

Choosing between the digital and paper versions of the IFTA payment form can impact convenience and efficiency. The digital version allows for easier calculations, automatic updates, and faster submission. In contrast, the paper version may require more manual effort and time for processing. However, both formats must meet the same legal requirements for compliance.

Quick guide on how to complete ifta nova scotia

Complete Ifta Nova Scotia effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents swiftly without delays. Handle Ifta Nova Scotia on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to alter and eSign Ifta Nova Scotia with ease

- Find Ifta Nova Scotia and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Decide how you want to submit your form, either by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign Ifta Nova Scotia and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an IFTA payment form and why do I need it?

The IFTA payment form is a crucial document used for reporting and paying fuel taxes for interstate travel. It helps streamline compliance with Interstate Fuel Tax Agreement regulations. Understanding how to properly complete the IFTA payment form ensures that your business avoids penalties and maintains good standing.

-

How can I complete the IFTA payment form using airSlate SignNow?

With airSlate SignNow, you can easily complete the IFTA payment form by uploading your document, filling it out digitally, and adding your electronic signature. The platform simplifies document management, allowing you to track and keep all forms organized in one secure location.

-

Are there any costs involved in using the IFTA payment form service with airSlate SignNow?

Yes, airSlate SignNow offers a range of pricing plans that include features for managing documents, such as the IFTA payment form. We provide cost-effective solutions tailored to businesses of all sizes, ensuring you get the best value for your document management needs.

-

Can I automate the submission process for the IFTA payment form?

Absolutely! airSlate SignNow allows users to automate the submission of the IFTA payment form, saving time and reducing the risk of errors. This feature enables you to set up workflows that automatically send completed forms directly to the appropriate authorities.

-

Does airSlate SignNow integrate with other accounting software for handling IFTA payment forms?

Yes, airSlate SignNow offers integrations with various accounting software, making it easier to manage your IFTA payment form alongside your financial records. This interoperability enhances your workflow efficiency and ensures accurate data handling across platforms.

-

What security measures does airSlate SignNow implement for the IFTA payment form?

airSlate SignNow prioritizes your data security with advanced encryption and compliance with industry standards. This ensures that your IFTA payment form and any sensitive information are securely protected during transmission and storage.

-

How quickly can I get assistance if I have questions about the IFTA payment form?

airSlate SignNow provides comprehensive customer support that is readily available to assist you with any questions regarding the IFTA payment form. You can signNow our support team via chat, email, or phone, ensuring you receive timely assistance.

Get more for Ifta Nova Scotia

- Revolving credit mortgage forms for florida

- Amuexamcontroler form

- Automobile loss notice south carolina insurance reserve fund irf sc form

- Sc dss employment verification form

- Esap application form fill online printable fillable blank

- Arizona department of child safety dcs records request form

- Live scan background screening submission form dcf state fl

- Transportation permission child care centers dcf f cfs0056 division of early care and education form

Find out other Ifta Nova Scotia

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document