Illinois Department of Revenue Schedule K 1 P2 Partner S and Shareholder S Instructions General Information What Does Column a R

Understanding the Illinois Department of Revenue Schedule K-1 P2

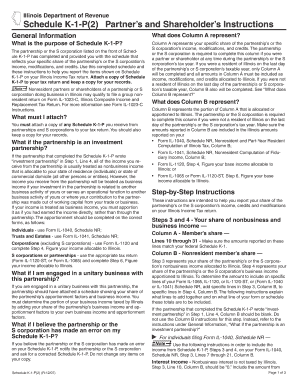

The Illinois Department of Revenue Schedule K-1 P2 is a crucial form for partners and shareholders in partnerships and S corporations. This form provides detailed information regarding the income, deductions, and credits that partners and shareholders must report on their individual tax returns. Understanding the specifics of this form is essential for accurate tax reporting and compliance with state regulations.

How to Use the Schedule K-1 P2

Using the Schedule K-1 P2 involves several steps. First, ensure that you receive this form from your partnership or S corporation, as it outlines your share of the entity's income, deductions, and credits. Next, review the information carefully, particularly Column A, which represents your share of the entity's income or loss. This data is vital for completing your individual tax return accurately. Finally, retain this form for your records, as it may be needed for future reference or audits.

Steps to Complete the Schedule K-1 P2

Completing the Schedule K-1 P2 requires attention to detail. Start by entering your name and identification information at the top of the form. Then, focus on Column A, which indicates your allocated share of the partnership's or S corporation's income, losses, and deductions. Ensure that you accurately report these figures on your Illinois tax return. Double-check all entries for accuracy, as errors can lead to complications with your tax filings.

Key Elements of the Schedule K-1 P2

Several key elements are essential to understand when working with the Schedule K-1 P2. Column A is particularly important, as it details your share of the entity's income or loss. Other columns may include information on distributions, credits, and other relevant tax data. Familiarizing yourself with these elements will help you navigate the form more effectively and ensure compliance with tax regulations.

State-Specific Rules for the Schedule K-1 P2

Illinois has specific rules regarding the use and reporting of the Schedule K-1 P2. It is important to understand how these rules apply to your situation, especially in relation to income allocation and tax credits. Ensure that you are aware of any state-specific requirements that may affect your tax filing, as these can differ from federal guidelines.

Examples of Using the Schedule K-1 P2

Examples of how to use the Schedule K-1 P2 can clarify its application. For instance, if you are a partner in a partnership that reported a net income of $100,000 and your share is 10%, you would report $10,000 on your individual tax return. This example illustrates the importance of accurately reflecting your share of the income or loss as indicated in Column A of the form.

Quick guide on how to complete illinois department of revenue schedule k 1 p2 partner s and shareholder s instructions general information what does column a

Prepare [SKS] effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to alter and eSign [SKS] effortlessly

- Find [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obfuscate sensitive details using tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes seconds and holds the exact legal validity as a traditional handwritten signature.

- Verify the details and then click on the Done button to save your changes.

- Choose how you wish to send your form—by email, SMS, or invite link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills your needs in document management in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue Schedule K 1 P2 Partner S And Shareholder S Instructions General Information What Does Column A R

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue schedule k 1 p2 partner s and shareholder s instructions general information what does column a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Schedule K 1 P2 Partner S And Shareholder S Instructions General Information?

The Illinois Department Of Revenue Schedule K 1 P2 Partner S And Shareholder S Instructions General Information provides essential guidelines for partners and shareholders on how to report income, deductions, and credits. This document is crucial for ensuring compliance with Illinois tax regulations and helps in accurately completing tax returns.

-

What does Column A represent in the Illinois Department Of Revenue Schedule K 1 P2?

Column A in the Illinois Department Of Revenue Schedule K 1 P2 represents the partner's or shareholder's share of income, deductions, and credits from the partnership or S corporation. Understanding this column is vital for accurately reporting tax obligations in Illinois.

-

How can airSlate SignNow assist with the Illinois Department Of Revenue Schedule K 1 P2?

airSlate SignNow simplifies the process of sending and eSigning the Illinois Department Of Revenue Schedule K 1 P2 documents. With its user-friendly interface, businesses can ensure that all necessary tax documents are completed and submitted efficiently, reducing the risk of errors.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. These plans provide access to features that streamline the signing and management of documents, including those related to the Illinois Department Of Revenue Schedule K 1 P2 Partner S And Shareholder S Instructions General Information.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage, making it easier to manage tax documents like the Illinois Department Of Revenue Schedule K 1 P2. These features enhance efficiency and ensure that all documents are organized and accessible.

-

Can airSlate SignNow integrate with other accounting software?

Yes, airSlate SignNow can integrate seamlessly with various accounting software, allowing for a streamlined workflow when handling tax documents, including the Illinois Department Of Revenue Schedule K 1 P2. This integration helps ensure that all financial data is synchronized and up-to-date.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, such as the Illinois Department Of Revenue Schedule K 1 P2, offers numerous benefits, including time savings, enhanced security, and improved accuracy. The platform's ease of use allows businesses to focus on their core operations while ensuring compliance with tax regulations.

Get more for Illinois Department Of Revenue Schedule K 1 P2 Partner S And Shareholder S Instructions General Information What Does Column A R

Find out other Illinois Department Of Revenue Schedule K 1 P2 Partner S And Shareholder S Instructions General Information What Does Column A R

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form

- Can I eSign Utah Lease agreement form

- Can I eSign Washington lease agreement

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now