Tax Subtractions and Credits Form

What is the Tax Subtractions And Credits

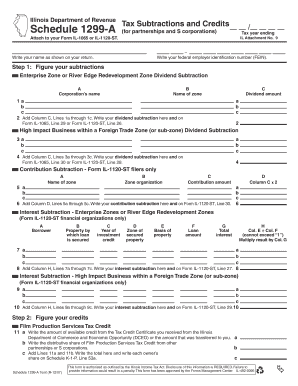

Tax subtractions and credits refer to specific deductions and credits that taxpayers can claim to reduce their overall tax liability. Subtractions lower the amount of taxable income, while credits directly reduce the amount of tax owed. Understanding these elements is essential for maximizing tax savings and ensuring compliance with IRS regulations.

How to use the Tax Subtractions And Credits

To effectively use tax subtractions and credits, taxpayers should first identify which deductions and credits they qualify for based on their financial situation. Common subtractions include standard deductions and itemized deductions, while credits may include the Earned Income Tax Credit or education credits. Taxpayers should gather necessary documentation, such as W-2 forms and receipts, to support their claims. Utilizing tax preparation software can simplify this process, making it easier to calculate and apply these benefits.

Key elements of the Tax Subtractions And Credits

Key elements of tax subtractions and credits include eligibility criteria, the types of deductions available, and the specific credits that can be claimed. Taxpayers must be aware of income limits and filing status, which can affect their ability to claim certain benefits. Additionally, understanding the difference between refundable and non-refundable credits is crucial, as refundable credits can result in a refund even if no tax is owed.

Examples of using the Tax Subtractions And Credits

Examples of tax subtractions and credits in action include a taxpayer who claims the standard deduction of twelve thousand dollars for a single filer, effectively reducing their taxable income. Another example is a family that qualifies for the Child Tax Credit, which directly reduces their tax liability by two thousand dollars per qualifying child. These examples illustrate how strategic use of subtractions and credits can lead to significant tax savings.

Eligibility Criteria

Eligibility criteria for tax subtractions and credits vary widely. For instance, the standard deduction is available to all taxpayers, while other credits may require specific conditions, such as income thresholds or dependent status. It is important for taxpayers to review IRS guidelines to determine their eligibility for various benefits, ensuring they do not miss out on potential savings.

Filing Deadlines / Important Dates

Filing deadlines for tax returns and the associated subtractions and credits are typically set by the IRS. Generally, the deadline for individual tax returns is April fifteenth. However, taxpayers should be aware of any extensions or changes in deadlines, especially in response to emergencies or legislative updates. Keeping track of these dates is essential for timely filing and avoiding penalties.

Required Documents

To claim tax subtractions and credits, taxpayers need to gather specific documents. Commonly required documents include W-2 forms, 1099 forms, receipts for deductible expenses, and records of any tax credits claimed in previous years. Having these documents organized and accessible can streamline the filing process and help ensure accuracy in claims.

Quick guide on how to complete tax subtractions and credits

Prepare [SKS] seamlessly on any device

Online document management has become widespread among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle [SKS] on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant parts of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the issues of lost or mislaid documents, arduous form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure excellent communication at any step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Tax Subtractions And Credits

Create this form in 5 minutes!

How to create an eSignature for the tax subtractions and credits

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Tax Subtractions And Credits?

Tax Subtractions And Credits are financial benefits that reduce your taxable income or tax liability. Understanding these can help you maximize your savings during tax season. Utilizing airSlate SignNow can streamline the documentation process for claiming these benefits.

-

How can airSlate SignNow help with Tax Subtractions And Credits?

airSlate SignNow simplifies the process of sending and eSigning documents related to Tax Subtractions And Credits. By providing a user-friendly platform, it ensures that you can quickly manage and submit necessary paperwork, making tax filing more efficient.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features like customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents. These features help ensure that all forms related to Tax Subtractions And Credits are completed accurately and submitted on time.

-

Is airSlate SignNow cost-effective for small businesses looking to maximize Tax Subtractions And Credits?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses. By reducing the time and resources spent on document management, businesses can focus on maximizing their Tax Subtractions And Credits, ultimately improving their bottom line.

-

Can I integrate airSlate SignNow with my accounting software for tax purposes?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, allowing you to manage your Tax Subtractions And Credits more effectively. This integration ensures that all your financial documents are in one place, simplifying the tax preparation process.

-

What benefits does eSigning provide for tax-related documents?

eSigning offers numerous benefits for tax-related documents, including speed, security, and convenience. With airSlate SignNow, you can quickly eSign forms related to Tax Subtractions And Credits, ensuring that your submissions are timely and compliant with regulations.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your documents with advanced encryption and secure storage. This ensures that all information related to Tax Subtractions And Credits is protected, giving you peace of mind while managing sensitive financial data.

Get more for Tax Subtractions And Credits

- Compensation guideline definitions sierra pacific synod spselca form

- Plagiarism declaration stellenbosch computer science cs sun ac form

- Meridianrx electronic funds transfer eft enrollment form

- California consent minor form

- 05 163 texas 2015 form

- Sonyatv music publishing synchronization request bb form

- Tc 57a form

- Dc 442 form

Find out other Tax Subtractions And Credits

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online