Illinois Department of Revenue Schedule M Other Additions and Subtractions for Individuals Attach to Your Form IL 1040 for Form

Understanding the Illinois Department Of Revenue Schedule M

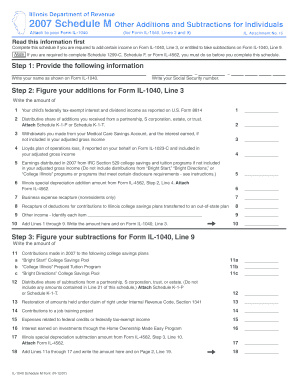

The Illinois Department Of Revenue Schedule M is a critical form for individuals filing their state income tax returns. This schedule is specifically designed to report other additions and subtractions that affect the taxable income reported on Form IL-1040. It is essential for accurately calculating your Illinois tax liability. The Schedule M is attached to your Form IL-1040 and is referenced on Lines 3 and 9, where taxpayers must report specific adjustments to their income.

Steps to Complete the Illinois Department Of Revenue Schedule M

Completing the Schedule M involves several key steps. First, gather all relevant financial documents, including W-2s, 1099s, and any records of additional income or deductions. Next, identify the specific additions and subtractions applicable to your situation, such as income from state and local bonds or contributions to retirement accounts. Carefully fill out the schedule, ensuring that all amounts are accurately reported. Finally, attach the completed Schedule M to your Form IL-1040 before submitting your tax return.

Key Elements of the Illinois Department Of Revenue Schedule M

The Schedule M encompasses various components that taxpayers must understand to ensure compliance. Key elements include specific lines for reporting additions, such as income from other states or certain retirement distributions, as well as subtractions, like qualifying deductions for state taxes paid. Each line item is accompanied by instructions that clarify what information is required, making it easier for individuals to complete the form correctly.

Legal Use of the Illinois Department Of Revenue Schedule M

The Schedule M must be used in accordance with Illinois tax laws. It is legally required for individuals who need to report specific income adjustments on their state tax returns. Failure to accurately complete and submit this schedule can result in penalties or delays in processing your tax return. It is crucial to follow the guidelines provided by the Illinois Department of Revenue to ensure that all reported information is compliant with state regulations.

Obtaining the Illinois Department Of Revenue Schedule M

The Schedule M can be obtained from the Illinois Department of Revenue's official website or through various tax preparation software platforms. It is available in a printable format, allowing individuals to fill it out manually if preferred. Additionally, many tax professionals can provide assistance in obtaining and completing the form, ensuring that all necessary information is included for accurate filing.

Examples of Using the Illinois Department Of Revenue Schedule M

Examples of when to use Schedule M include situations where a taxpayer has received income from a state or local bond, which may be exempt from federal tax but taxable at the state level. Another example is when a taxpayer has made contributions to a retirement account that qualify for subtraction from their taxable income. These scenarios illustrate the importance of accurately reporting additions and subtractions to ensure compliance and optimize tax liability.

Quick guide on how to complete illinois department of revenue schedule m other additions and subtractions for individuals attach to your form il 1040 for form

Handle [SKS] seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally-friendly substitute to traditional printed and signed documents, allowing you to access the right forms and securely store them online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Accent crucial sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or mislaid documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Adjust and eSign [SKS] and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue Schedule M Other Additions And Subtractions For Individuals Attach To Your Form IL 1040 for Form

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue schedule m other additions and subtractions for individuals attach to your form il 1040 for form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Schedule M Other Additions And Subtractions For Individuals?

The Illinois Department Of Revenue Schedule M Other Additions And Subtractions For Individuals is a form that allows taxpayers to report specific additions and subtractions to their income when filing Form IL 1040. This form is essential for accurately calculating your taxable income and ensuring compliance with state tax regulations.

-

How do I attach the Schedule M to my Form IL 1040?

To attach the Illinois Department Of Revenue Schedule M Other Additions And Subtractions For Individuals to your Form IL 1040, simply include it as a supplementary document when submitting your tax return. Ensure that all relevant lines, particularly Lines 3 and 9, are filled out correctly to avoid any processing delays.

-

What are the benefits of using airSlate SignNow for submitting my Schedule M?

Using airSlate SignNow for submitting your Illinois Department Of Revenue Schedule M Other Additions And Subtractions For Individuals offers a streamlined, efficient process. Our platform allows you to eSign documents securely and ensures that your forms are submitted accurately and on time, reducing the risk of errors.

-

Is there a cost associated with using airSlate SignNow for tax forms?

Yes, airSlate SignNow offers various pricing plans to cater to different needs, including options for individuals and businesses. The cost is competitive and provides access to features that simplify the process of managing and submitting your Illinois Department Of Revenue Schedule M Other Additions And Subtractions For Individuals.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various tax preparation software, allowing you to manage your Illinois Department Of Revenue Schedule M Other Additions And Subtractions For Individuals alongside other tax documents. This integration enhances your workflow and ensures that all your forms are organized and accessible.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features for document management, including eSigning, document templates, and secure storage. These features are particularly beneficial when handling the Illinois Department Of Revenue Schedule M Other Additions And Subtractions For Individuals, as they help ensure that your documents are completed accurately and securely.

-

How can I ensure my Schedule M is filled out correctly?

To ensure your Illinois Department Of Revenue Schedule M Other Additions And Subtractions For Individuals is filled out correctly, carefully review the instructions provided by the Illinois Department of Revenue. Additionally, using airSlate SignNow can help you track changes and maintain an organized workflow, reducing the likelihood of errors.

Get more for Illinois Department Of Revenue Schedule M Other Additions And Subtractions For Individuals Attach To Your Form IL 1040 for Form

Find out other Illinois Department Of Revenue Schedule M Other Additions And Subtractions For Individuals Attach To Your Form IL 1040 for Form

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy