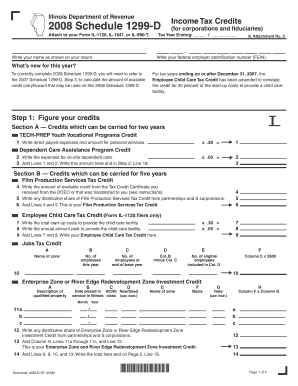

Illinois Department of Revenue Income Tax Credits Schedule 1299 D Attach to Your Form IL 1120, IL 1041, or IL 990 T

What is the Illinois Department Of Revenue Income Tax Credits Schedule 1299 D?

The Illinois Department Of Revenue Income Tax Credits Schedule 1299 D is a crucial form used by businesses and individuals to claim various income tax credits. This schedule must be attached to specific tax forms, including Form IL 1120 for corporations, Form IL 1041 for trusts and estates, and Form IL 990 T for exempt organizations. The purpose of Schedule 1299 D is to provide detailed information about the credits being claimed, ensuring compliance with state tax regulations.

How to use the Illinois Department Of Revenue Income Tax Credits Schedule 1299 D

Using Schedule 1299 D involves several steps to ensure accurate completion and submission. First, gather all necessary documentation related to the tax credits you intend to claim. Next, fill out the schedule by providing details about each credit, including the credit amount and any required supporting information. Once completed, attach Schedule 1299 D to your appropriate tax return, whether it be Form IL 1120, IL 1041, or IL 990 T. This ensures that your claimed credits are processed correctly by the Illinois Department of Revenue.

Steps to complete the Illinois Department Of Revenue Income Tax Credits Schedule 1299 D

Completing Schedule 1299 D requires careful attention to detail. Follow these steps:

- Identify the specific tax credits you are eligible to claim.

- Gather any required documentation that supports your claim for these credits.

- Fill out the schedule, ensuring you include all necessary information, such as the credit type and amount.

- Review the completed schedule for accuracy before attaching it to your tax return.

- Submit your tax return along with Schedule 1299 D by the designated filing deadline.

Eligibility Criteria for the Illinois Department Of Revenue Income Tax Credits Schedule 1299 D

To qualify for the credits listed on Schedule 1299 D, taxpayers must meet specific eligibility criteria established by the Illinois Department of Revenue. These criteria vary depending on the type of credit being claimed. Generally, eligibility may depend on factors such as the taxpayer's income level, the nature of the business, and compliance with state regulations. It is important to review the requirements for each credit carefully to ensure that you qualify before submitting the schedule.

Required Documents for the Illinois Department Of Revenue Income Tax Credits Schedule 1299 D

When completing Schedule 1299 D, certain documents may be required to substantiate your claims. Commonly required documents include:

- Proof of eligibility for each tax credit claimed.

- Financial statements or tax returns from previous years.

- Documentation of any expenditures or investments related to the credits.

- Any additional forms or schedules that provide further detail on your tax situation.

Form Submission Methods for the Illinois Department Of Revenue Income Tax Credits Schedule 1299 D

Schedule 1299 D can be submitted through various methods, depending on the taxpayer's preference and the requirements of the Illinois Department of Revenue. The available submission methods include:

- Online submission through the Illinois Department of Revenue's e-filing system.

- Mailing the completed forms to the appropriate address provided by the department.

- In-person submission at designated tax offices, if applicable.

Quick guide on how to complete illinois department of revenue income tax credits schedule 1299 d attach to your form il 1120 il 1041 or il 990 t

Prepare [SKS] seamlessly on any device

Digital document management has gained signNow traction among companies and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Manage [SKS] across any device with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to modify and electronically sign [SKS] with ease

- Find [SKS] and then click Get Form to initiate the process.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent parts of your documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method for sending your form: via email, text message (SMS), or an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes requiring you to print additional copies of documents. airSlate SignNow addresses your document management needs with just a few clicks from any device you choose. Modify and electronically sign [SKS] to ensure excellent communication at every stage of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue Income Tax Credits Schedule 1299 D Attach To Your Form IL 1120, IL 1041, Or IL 990 T

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue income tax credits schedule 1299 d attach to your form il 1120 il 1041 or il 990 t

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Income Tax Credits Schedule 1299 D?

The Illinois Department Of Revenue Income Tax Credits Schedule 1299 D is a form used to claim various tax credits available to businesses in Illinois. It must be attached to your Form IL 1120, IL 1041, or IL 990 T when filing your taxes. Understanding this schedule is crucial for maximizing your tax benefits.

-

How do I complete the Schedule 1299 D for my business?

To complete the Schedule 1299 D, you need to gather information about the tax credits you are eligible for and fill out the required sections accurately. It's important to follow the instructions provided by the Illinois Department of Revenue to ensure compliance. Consider using airSlate SignNow to streamline the document preparation process.

-

What are the benefits of using airSlate SignNow for tax document management?

airSlate SignNow offers an easy-to-use platform for sending and eSigning documents, including tax forms like the Illinois Department Of Revenue Income Tax Credits Schedule 1299 D. Its cost-effective solution helps businesses save time and reduce errors in document handling, ensuring a smoother tax filing experience.

-

Is there a cost associated with using airSlate SignNow for tax forms?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. The cost is competitive and reflects the value of features like document eSigning and secure storage. Investing in this solution can help you efficiently manage your Illinois Department Of Revenue Income Tax Credits Schedule 1299 D and other important documents.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software. This integration allows you to easily manage your Illinois Department Of Revenue Income Tax Credits Schedule 1299 D alongside your other financial documents, enhancing your overall workflow.

-

What features does airSlate SignNow offer for document security?

airSlate SignNow prioritizes document security with features like encryption, secure access, and audit trails. These measures ensure that your sensitive information, including the Illinois Department Of Revenue Income Tax Credits Schedule 1299 D, is protected throughout the signing process. You can trust that your documents are safe with us.

-

How can airSlate SignNow help me track my tax documents?

With airSlate SignNow, you can easily track the status of your tax documents, including the Illinois Department Of Revenue Income Tax Credits Schedule 1299 D. The platform provides real-time updates and notifications, allowing you to stay informed about when documents are sent, viewed, and signed, ensuring a smooth filing process.

Get more for Illinois Department Of Revenue Income Tax Credits Schedule 1299 D Attach To Your Form IL 1120, IL 1041, Or IL 990 T

Find out other Illinois Department Of Revenue Income Tax Credits Schedule 1299 D Attach To Your Form IL 1120, IL 1041, Or IL 990 T

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF