Illinois Department of Revenue Schedule 1299 C Income Tax Subtractions and Credits for Individuals IL Attachment No Form

Understanding the Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No

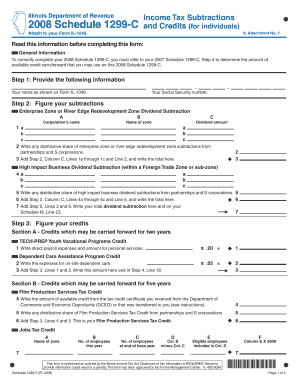

The Illinois Department Of Revenue Schedule 1299 C is a crucial form for individuals seeking to claim various income tax subtractions and credits. This form allows taxpayers to report specific deductions that can reduce their taxable income, ultimately lowering their tax liability. It is important for individuals to understand the different types of subtractions and credits available, as these can significantly impact their overall tax situation. The Schedule 1299 C is specifically designed for individual taxpayers, making it essential for anyone filing taxes in Illinois to familiarize themselves with its purpose and requirements.

Steps to Complete the Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No

Completing the Schedule 1299 C involves several key steps to ensure accurate reporting of income tax subtractions and credits. First, gather all necessary documentation, including income statements and records of any eligible expenses. Next, carefully fill out the form, starting with personal information and then moving on to specific subtractions and credits applicable to your situation. It is crucial to read the instructions provided with the form to understand eligibility criteria for each subtraction and credit. After completing the form, review it for accuracy before submitting it along with your main tax return.

How to Obtain the Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No

The Schedule 1299 C can be obtained directly from the Illinois Department of Revenue's official website. Taxpayers can download the form in PDF format, which can be printed and filled out manually. Alternatively, individuals may also visit local tax offices or libraries to access physical copies of the form. It is advisable to ensure you have the most current version of the form, as tax laws and requirements can change annually.

Key Elements of the Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No

Key elements of the Schedule 1299 C include sections dedicated to various subtractions and credits, such as those for retirement contributions, education expenses, and property taxes. Each section specifies the eligibility criteria and required documentation to support claims. Additionally, the form includes instructions for calculating the total subtractions and credits, which ultimately contribute to determining the taxpayer's final tax liability. Understanding these key elements is essential for maximizing potential tax benefits.

Eligibility Criteria for the Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No

Eligibility for claiming subtractions and credits on the Schedule 1299 C varies based on specific criteria outlined by the Illinois Department of Revenue. Generally, individuals must meet certain income thresholds and have incurred qualifying expenses during the tax year. For instance, some credits may be available only to taxpayers who contribute to retirement accounts or incur educational costs. It is important to review the eligibility requirements carefully to ensure compliance and maximize potential benefits.

Filing Deadlines for the Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No

Filing deadlines for the Schedule 1299 C align with the standard tax return deadlines set by the IRS. Typically, individual taxpayers must submit their state tax returns, including the Schedule 1299 C, by April fifteenth of each year. However, if April fifteenth falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial for taxpayers to be aware of these deadlines to avoid penalties and ensure timely processing of their tax returns.

Quick guide on how to complete illinois department of revenue schedule 1299 c income tax subtractions and credits for individuals il attachment no

Complete [SKS] effortlessly on any device

Managing documents online has become widespread among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to edit and eSign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and eSign [SKS] and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue schedule 1299 c income tax subtractions and credits for individuals il attachment no

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No.?

The Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No. is a form used by individuals to claim various tax subtractions and credits on their income tax returns. This schedule helps taxpayers reduce their taxable income and potentially increase their refund. Understanding this form is essential for maximizing your tax benefits.

-

How can airSlate SignNow assist with the Illinois Department Of Revenue Schedule 1299 C?

airSlate SignNow provides a streamlined solution for electronically signing and sending the Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No. This ensures that your documents are securely signed and submitted on time, reducing the hassle of traditional paper methods. Our platform simplifies the entire process, making tax season less stressful.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including a free trial for new users. Each plan provides access to features that facilitate the signing and management of documents, including the Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No. Choose a plan that best fits your requirements and budget.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage. These tools enhance your ability to manage documents like the Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No. efficiently. With our platform, you can ensure that all your documents are organized and easily accessible.

-

Is airSlate SignNow compliant with legal standards?

Yes, airSlate SignNow is compliant with various legal standards, including e-signature laws such as the ESIGN Act and UETA. This compliance ensures that documents like the Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No. are legally binding and secure. You can trust our platform to handle your sensitive information with the utmost care.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers integrations with popular software applications, enhancing your workflow. Whether you need to connect with accounting software or CRM systems, our platform can seamlessly integrate to help you manage documents like the Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No. more effectively.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents, including the Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No., provides numerous benefits. It saves time, reduces errors, and enhances security compared to traditional methods. Our platform allows for quick document turnaround, ensuring you meet all deadlines with ease.

Get more for Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No

Find out other Illinois Department Of Revenue Schedule 1299 C Income Tax Subtractions And Credits for Individuals IL Attachment No

- Sign Minnesota Employee Appraisal Form Online

- How To Sign Alabama Employee Satisfaction Survey

- Sign Colorado Employee Satisfaction Survey Easy

- Sign North Carolina Employee Compliance Survey Safe

- Can I Sign Oklahoma Employee Satisfaction Survey

- How Do I Sign Florida Self-Evaluation

- How Do I Sign Idaho Disclosure Notice

- Sign Illinois Drug Testing Consent Agreement Online

- Sign Louisiana Applicant Appraisal Form Evaluation Free

- Sign Maine Applicant Appraisal Form Questions Secure

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval