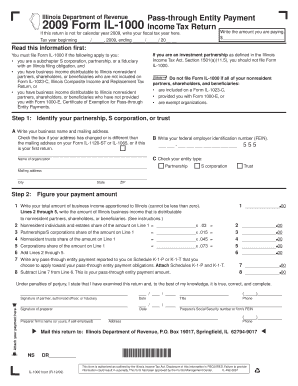

Lllinois Department of Revenue Form IL 1000 Read This Information First You Must File Form IL 1000 If the Following Apply to You

What is the Illinois Department of Revenue Form IL-1000?

The Illinois Department of Revenue Form IL-1000 is a tax form specifically designed for Subchapter S corporations, partnerships, and fiduciaries that have an obligation to file in the state of Illinois. This form is essential for reporting income, deductions, and credits associated with these business entities. It ensures compliance with Illinois tax laws and facilitates the accurate calculation of state tax liabilities.

How to Use the Illinois Department of Revenue Form IL-1000

Using Form IL-1000 involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents related to your business operations. This includes income statements, expense reports, and any relevant tax documents. Once you have the required information, fill out the form with precise details regarding your entity's income, deductions, and credits. After completing the form, review it carefully for any errors before submission.

Steps to Complete the Illinois Department of Revenue Form IL-1000

Completing Form IL-1000 requires attention to detail. Follow these steps:

- Begin by entering your entity's name, address, and tax identification number at the top of the form.

- Report your total income for the tax year, ensuring that all sources of income are included.

- Detail any deductions your entity is eligible for, such as business expenses or credits.

- Calculate your total tax liability based on the reported income and deductions.

- Sign and date the form, certifying that the information provided is accurate and complete.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for Form IL-1000 to avoid penalties. Generally, the form must be filed by the 15th day of the third month following the end of your entity's tax year. For entities operating on a calendar year, this typically means a deadline of March 15. Ensure that you submit the form on time to maintain compliance with Illinois tax regulations.

Penalties for Non-Compliance

Failure to file Form IL-1000 by the deadline can result in significant penalties. The Illinois Department of Revenue may impose fines based on the amount of tax owed or the duration of the delay. Additionally, non-compliance may lead to interest charges on unpaid taxes. It is essential to file accurately and on time to avoid these financial repercussions.

Eligibility Criteria for Filing Form IL-1000

To be eligible to file Form IL-1000, your entity must be classified as a Subchapter S corporation, partnership, or fiduciary. These entities must have an Illinois filing obligation, meaning they generate income or conduct business activities within the state. Ensure that your entity meets these criteria before attempting to file the form to avoid complications.

Quick guide on how to complete lllinois department of revenue form il 1000 read this information first you must file form il 1000 if the following apply to

Handle [SKS] effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, adjust, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest method to alter and eSign [SKS] with ease

- Obtain [SKS] and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] while ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Lllinois Department Of Revenue Form IL 1000 Read This Information First You Must File Form IL 1000 If The Following Apply To You

Create this form in 5 minutes!

How to create an eSignature for the lllinois department of revenue form il 1000 read this information first you must file form il 1000 if the following apply to

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Form IL 1000?

The Illinois Department Of Revenue Form IL 1000 is a tax form that must be filed by Subchapter S Corporations, Partnerships, or Fiduciaries with an Illinois filing obligation. It is essential to understand the requirements and ensure compliance to avoid penalties. If you fall under these categories, you must file Form IL 1000.

-

Who needs to file the Illinois Department Of Revenue Form IL 1000?

You must file the Illinois Department Of Revenue Form IL 1000 if you are a Subchapter S Corporation, Partnership, or a Fiduciary with an Illinois filing obligation. This form is crucial for reporting income and ensuring that your business meets state tax requirements. Failing to file can lead to signNow penalties.

-

What are the benefits of using airSlate SignNow for filing Form IL 1000?

Using airSlate SignNow for filing Form IL 1000 streamlines the document signing process, making it easy and efficient. Our platform allows you to eSign documents securely and ensures that your filings are submitted on time. This can save you time and reduce the stress associated with tax compliance.

-

How much does airSlate SignNow cost for filing Form IL 1000?

airSlate SignNow offers a cost-effective solution for businesses looking to file Form IL 1000. Pricing varies based on the features you choose, but we provide flexible plans to accommodate different business needs. You can start with a free trial to explore our services before committing.

-

Can I integrate airSlate SignNow with other software for filing Form IL 1000?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow for filing Form IL 1000. This integration allows you to manage documents and signatures efficiently, ensuring that all necessary information is readily available. Check our integration options to find the best fit for your business.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features for document management, including eSigning, templates, and secure storage. These features are designed to simplify the process of preparing and filing Form IL 1000. With our user-friendly interface, you can easily manage all your documents in one place.

-

Is airSlate SignNow secure for filing sensitive documents like Form IL 1000?

Absolutely! airSlate SignNow prioritizes security, ensuring that your sensitive documents, including Form IL 1000, are protected. We use advanced encryption and security protocols to safeguard your data, giving you peace of mind while you manage your tax filings.

Get more for Lllinois Department Of Revenue Form IL 1000 Read This Information First You Must File Form IL 1000 If The Following Apply To You

Find out other Lllinois Department Of Revenue Form IL 1000 Read This Information First You Must File Form IL 1000 If The Following Apply To You

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo