IL 1023 C Tax Illinois Form

What is the IL 1023 C Tax Illinois

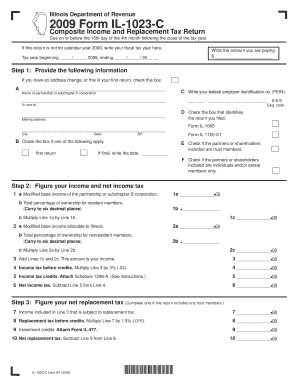

The IL 1023 C Tax Illinois is a specific tax form used by businesses in Illinois to claim an exemption from certain state taxes. This form is primarily designed for organizations that qualify as charitable, religious, or educational entities under Illinois law. By submitting the IL 1023 C, these organizations can demonstrate their eligibility for tax-exempt status, allowing them to operate without incurring specific state tax liabilities.

Steps to complete the IL 1023 C Tax Illinois

Completing the IL 1023 C requires careful attention to detail. Here are the essential steps:

- Gather necessary information about your organization, including its legal name, address, and federal tax identification number.

- Provide a detailed description of your organization’s activities, ensuring clarity on how they align with tax-exempt purposes.

- Complete all sections of the form, including financial data and any required supporting documents.

- Review the form for accuracy and completeness before submission.

- Sign and date the form as required, certifying the information provided is true and correct.

Required Documents

When submitting the IL 1023 C, certain documents must accompany the form to support your claim for tax exemption. These typically include:

- A copy of the organization’s articles of incorporation or bylaws.

- Financial statements for the past three years, if applicable.

- Documentation of the organization’s mission and activities.

- Any additional materials that demonstrate compliance with Illinois tax exemption requirements.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the IL 1023 C to ensure timely submission and avoid penalties. Generally, the form should be filed:

- Within the first three months of your organization’s fiscal year.

- As soon as possible after your organization is formed, if applicable.

Check the Illinois Department of Revenue website for any updates on specific deadlines that may apply to your situation.

Legal use of the IL 1023 C Tax Illinois

The IL 1023 C must be used in accordance with state laws governing tax exemptions. Organizations must ensure they meet the eligibility criteria established by the Illinois Department of Revenue. Misuse of the form or failure to comply with legal requirements can result in penalties, including the loss of tax-exempt status.

Who Issues the Form

The IL 1023 C Tax Illinois is issued by the Illinois Department of Revenue. This state agency is responsible for overseeing tax compliance and ensuring that organizations claiming tax-exempt status adhere to the relevant laws and regulations.

Quick guide on how to complete il 1023 c tax illinois

Complete [SKS] effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can locate the appropriate template and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents promptly without holdups. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to edit and electronically sign [SKS] with ease

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to finalize your changes.

- Choose how you would like to send your form: via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets your needs in document management with a few clicks from any device you choose. Edit and electronically sign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the il 1023 c tax illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IL 1023 C Tax Illinois form?

The IL 1023 C Tax Illinois form is a crucial document for organizations seeking tax-exempt status in Illinois. It allows nonprofits to apply for exemption from state income tax, ensuring they can operate without the burden of certain taxes. Understanding this form is essential for any organization looking to benefit from tax exemptions.

-

How can airSlate SignNow help with the IL 1023 C Tax Illinois process?

airSlate SignNow streamlines the process of completing and submitting the IL 1023 C Tax Illinois form. With its user-friendly interface, you can easily fill out the necessary fields, eSign the document, and send it securely. This efficiency helps organizations save time and reduce errors in their applications.

-

What are the pricing options for using airSlate SignNow for IL 1023 C Tax Illinois?

airSlate SignNow offers flexible pricing plans that cater to various business needs, making it cost-effective for organizations handling the IL 1023 C Tax Illinois form. You can choose from monthly or annual subscriptions, ensuring you only pay for what you need. This affordability allows nonprofits to allocate more resources to their missions.

-

Are there any features specifically beneficial for IL 1023 C Tax Illinois users?

Yes, airSlate SignNow includes features that are particularly beneficial for users dealing with the IL 1023 C Tax Illinois form. These features include customizable templates, secure eSigning, and document tracking, which enhance the overall efficiency of the application process. This ensures that your organization can focus on its core activities while managing tax documentation effectively.

-

Can I integrate airSlate SignNow with other tools for IL 1023 C Tax Illinois?

Absolutely! airSlate SignNow offers integrations with various tools and platforms that can assist in managing the IL 1023 C Tax Illinois process. Whether you use CRM systems, cloud storage, or accounting software, these integrations help streamline your workflow and keep all your documents organized in one place.

-

What are the benefits of using airSlate SignNow for IL 1023 C Tax Illinois submissions?

Using airSlate SignNow for IL 1023 C Tax Illinois submissions provides numerous benefits, including enhanced security, ease of use, and faster processing times. The platform ensures that your documents are securely stored and easily accessible, which is vital for compliance. Additionally, the ability to eSign documents expedites the submission process, allowing you to focus on your organization's mission.

-

Is airSlate SignNow compliant with Illinois tax regulations for IL 1023 C?

Yes, airSlate SignNow is designed to comply with Illinois tax regulations, including those related to the IL 1023 C Tax Illinois form. The platform adheres to industry standards for security and data protection, ensuring that your sensitive information is handled appropriately. This compliance gives users peace of mind when managing their tax-exempt applications.

Get more for IL 1023 C Tax Illinois

Find out other IL 1023 C Tax Illinois

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF