Illinois Department of Revenue Schedule 1299 a for Partnerships and S Corporations Tax Subtractions and Credits Tax Year Ending Form

Understanding the Illinois Department of Revenue Schedule 1299 A

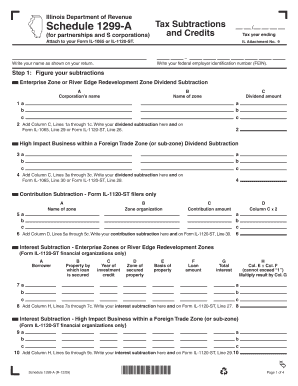

The Illinois Department of Revenue Schedule 1299 A is a crucial form for partnerships and S corporations, designed to report tax subtractions and credits for the tax year ending. This form is essential for businesses operating in Illinois, as it allows them to claim specific deductions and credits that can reduce their overall tax liability. By accurately completing this schedule, entities can ensure compliance with state tax regulations while maximizing potential savings.

How to Use Schedule 1299 A

To effectively use the Schedule 1299 A, partnerships and S corporations must first gather all necessary financial documentation, including income statements and previous tax returns. The form requires detailed information about the entity's income, expenses, and any applicable tax credits. Once the required data is collected, businesses can fill out the form, ensuring that all entries are accurate and complete. This schedule must be attached to the IL-1065 or IL-1120 ST forms when submitting the annual tax return.

Steps to Complete Schedule 1299 A

Completing the Schedule 1299 A involves several key steps:

- Gather all relevant financial documents, including income and expense reports.

- Identify the specific tax subtractions and credits applicable to your entity.

- Fill out the form carefully, ensuring all information is accurate.

- Review the completed form for any errors or omissions.

- Attach the Schedule 1299 A to your IL-1065 or IL-1120 ST form before submission.

Legal Use of Schedule 1299 A

The Schedule 1299 A is legally required for partnerships and S corporations that wish to claim tax subtractions and credits in Illinois. Proper use of this form ensures compliance with state tax laws and helps avoid potential penalties. It is important for businesses to understand the legal implications of submitting this form, as inaccuracies or omissions can lead to audits or fines.

Key Elements of Schedule 1299 A

Several key elements must be included when completing the Schedule 1299 A:

- Entity information, including name and identification number.

- Details of income earned and expenses incurred during the tax year.

- Specific tax credits being claimed, along with supporting calculations.

- Signatures of authorized representatives, confirming the accuracy of the information provided.

Filing Deadlines for Schedule 1299 A

Partnerships and S corporations must adhere to specific filing deadlines for the Schedule 1299 A. Typically, the form is due on the same date as the IL-1065 or IL-1120 ST forms, which is generally the 15th day of the third month following the end of the tax year. It is essential to stay informed about any changes in deadlines to avoid late filing penalties.

Quick guide on how to complete illinois department of revenue schedule 1299 a for partnerships and s corporations tax subtractions and credits tax year ending

Prepare [SKS] seamlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, enabling you to locate the right form and securely save it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign [SKS] effortlessly

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight relevant sections of the documents or obscure sensitive information with features that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue Schedule 1299 A for Partnerships And S Corporations Tax Subtractions And Credits Tax Year Ending

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue schedule 1299 a for partnerships and s corporations tax subtractions and credits tax year ending

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Schedule 1299 A for Partnerships And S Corporations Tax Subtractions And Credits?

The Illinois Department Of Revenue Schedule 1299 A for Partnerships And S Corporations Tax Subtractions And Credits is a form used to report tax subtractions and credits for partnerships and S corporations. This form is essential for accurately calculating tax liabilities and ensuring compliance with state tax regulations.

-

How do I attach the Illinois Department Of Revenue Schedule 1299 A to my Form IL 1065 or IL 1120 ST?

To attach the Illinois Department Of Revenue Schedule 1299 A to your Form IL 1065 or IL 1120 ST, simply include it as a supporting document when filing your tax return. Ensure that all relevant information is filled out correctly to avoid delays in processing.

-

What are the benefits of using airSlate SignNow for submitting the Illinois Department Of Revenue Schedule 1299 A?

Using airSlate SignNow streamlines the process of submitting the Illinois Department Of Revenue Schedule 1299 A for Partnerships And S Corporations Tax Subtractions And Credits. Our platform allows you to eSign documents quickly and securely, ensuring that your tax forms are submitted on time and with minimal hassle.

-

Is there a cost associated with using airSlate SignNow for tax document submissions?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our cost-effective solutions provide access to features that simplify the submission of the Illinois Department Of Revenue Schedule 1299 A for Partnerships And S Corporations Tax Subtractions And Credits, making it a worthwhile investment.

-

Can I integrate airSlate SignNow with my existing accounting software for tax submissions?

Absolutely! airSlate SignNow integrates seamlessly with many popular accounting software solutions. This integration allows you to easily manage and submit the Illinois Department Of Revenue Schedule 1299 A for Partnerships And S Corporations Tax Subtractions And Credits directly from your accounting platform.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers a range of features designed to simplify tax document management, including eSigning, document templates, and secure cloud storage. These features are particularly useful for handling the Illinois Department Of Revenue Schedule 1299 A for Partnerships And S Corporations Tax Subtractions And Credits efficiently.

-

How can airSlate SignNow help ensure compliance with Illinois tax regulations?

airSlate SignNow helps ensure compliance with Illinois tax regulations by providing tools that facilitate accurate document preparation and submission. By using our platform for the Illinois Department Of Revenue Schedule 1299 A for Partnerships And S Corporations Tax Subtractions And Credits, you can minimize errors and stay up-to-date with the latest tax requirements.

Get more for Illinois Department Of Revenue Schedule 1299 A for Partnerships And S Corporations Tax Subtractions And Credits Tax Year Ending

Find out other Illinois Department Of Revenue Schedule 1299 A for Partnerships And S Corporations Tax Subtractions And Credits Tax Year Ending

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy