Illinois Department of Revenue Illinois Net Loss Deduction Schedule NLD Carry Year Ending for Illinois Net Losses Arising in Tax Form

Understanding the Illinois Net Loss Deduction Schedule NLD

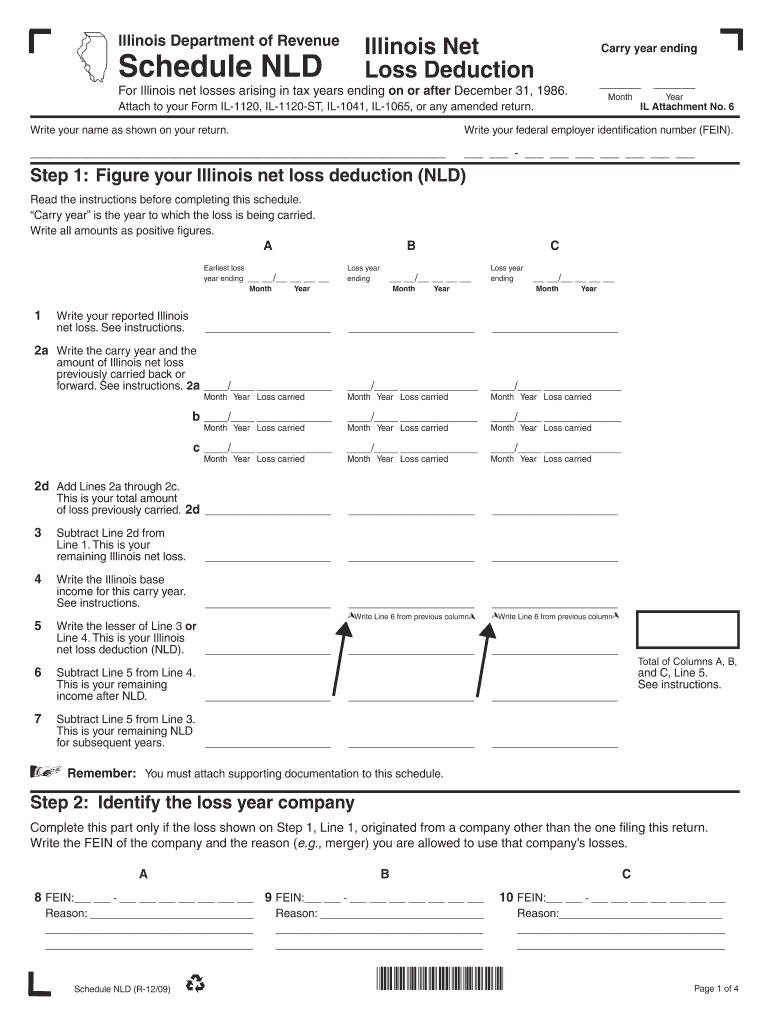

The Illinois Department of Revenue Illinois Net Loss Deduction Schedule NLD is a crucial form for taxpayers who have incurred net losses in tax years ending on or after December 31, 1986. This schedule allows individuals and businesses to carry forward their net losses to offset future taxable income. By utilizing this deduction, taxpayers can reduce their overall tax liability in subsequent years, making it an essential tool for effective tax planning.

Steps to Complete the Illinois Net Loss Deduction Schedule NLD

Completing the Illinois Net Loss Deduction Schedule NLD involves several key steps:

- Gather financial records, including income statements and previous tax returns.

- Calculate your total net loss for the applicable tax year, ensuring all relevant deductions are included.

- Fill out the NLD form, detailing the calculated net loss and the year it was incurred.

- Determine the amount of net loss to carry forward to future tax years, adhering to the limits set by Illinois tax regulations.

- Submit the completed schedule along with your Illinois tax return for the current tax year.

Eligibility Criteria for the Illinois Net Loss Deduction

To qualify for the Illinois Net Loss Deduction, taxpayers must meet specific eligibility criteria:

- The net loss must arise from a trade or business activity conducted in Illinois.

- The loss must be reported on an Illinois income tax return for the year in which it occurred.

- Taxpayers must adhere to the carryforward provisions outlined by the Illinois Department of Revenue.

Required Documents for the Illinois Net Loss Deduction Schedule NLD

When preparing to file the Illinois Net Loss Deduction Schedule NLD, it is essential to have the following documents ready:

- Previous tax returns, including any schedules that detail income and losses.

- Financial statements that substantiate the reported net loss.

- Any supporting documentation related to deductions taken in the loss year.

Filing Methods for the Illinois Net Loss Deduction Schedule NLD

Taxpayers can submit the Illinois Net Loss Deduction Schedule NLD through various methods:

- Online submission via the Illinois Department of Revenue's e-filing system.

- Mailing a paper copy of the completed form along with the tax return.

- In-person submission at designated Illinois Department of Revenue offices.

Common Scenarios for Using the Illinois Net Loss Deduction

Different taxpayer scenarios may influence how the Illinois Net Loss Deduction is utilized:

- Self-employed individuals may use the deduction to offset income from their business operations.

- Corporations can apply the deduction against future profits to minimize tax liabilities.

- Partnerships may distribute net loss deductions among partners based on their ownership percentages.

Quick guide on how to complete illinois department of revenue illinois net loss deduction schedule nld carry year ending for illinois net losses arising in

Prepare [SKS] effortlessly on any device

The management of online documents has become increasingly prevalent among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed materials, as you can obtain the necessary form and safely save it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Handle [SKS] on any platform with airSlate SignNow Android or iOS applications and simplify any document-based task today.

The easiest way to modify and electronically sign [SKS] without hassle

- Locate [SKS] and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click the Done button to save your changes.

- Select your preferred method for delivering your form, by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new copies of documents. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Edit and electronically sign [SKS] and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue Illinois Net Loss Deduction Schedule NLD Carry Year Ending For Illinois Net Losses Arising In Tax

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue illinois net loss deduction schedule nld carry year ending for illinois net losses arising in

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Illinois Net Loss Deduction Schedule NLD Carry Year Ending For Illinois Net Losses Arising In Tax Years Ending On Or After December 31, 1986?

The Illinois Department Of Revenue Illinois Net Loss Deduction Schedule NLD Carry Year Ending For Illinois Net Losses Arising In Tax Years Ending On Or After December 31, 1986, allows taxpayers to carry forward net losses to offset future taxable income. This schedule is essential for businesses looking to maximize their tax benefits and manage their financial health effectively.

-

How can airSlate SignNow assist with the Illinois Net Loss Deduction Schedule?

airSlate SignNow provides a streamlined platform for businesses to prepare and eSign documents related to the Illinois Net Loss Deduction Schedule. By using our solution, you can ensure that all necessary forms are completed accurately and submitted on time, helping you take full advantage of the deductions available.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to different business needs, ensuring that you can find a solution that fits your budget. Our plans include features that support the Illinois Department Of Revenue Illinois Net Loss Deduction Schedule NLD Carry Year Ending For Illinois Net Losses Arising In Tax Years Ending On Or After December 31, 1986, making it a cost-effective choice for managing your tax documentation.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for managing the Illinois Department Of Revenue Illinois Net Loss Deduction Schedule NLD Carry Year Ending For Illinois Net Losses Arising In Tax Years Ending On Or After December 31, 1986. These tools help streamline the process and ensure compliance with state regulations.

-

Can airSlate SignNow integrate with other software for tax preparation?

Yes, airSlate SignNow can integrate with various accounting and tax preparation software, enhancing your workflow when dealing with the Illinois Department Of Revenue Illinois Net Loss Deduction Schedule NLD Carry Year Ending For Illinois Net Losses Arising In Tax Years Ending On Or After December 31, 1986. This integration allows for seamless data transfer and improved efficiency in managing your tax documents.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the Illinois Department Of Revenue Illinois Net Loss Deduction Schedule NLD Carry Year Ending For Illinois Net Losses Arising In Tax Years Ending On Or After December 31, 1986, offers numerous benefits. These include increased efficiency, reduced errors, and enhanced security, ensuring that your sensitive information is protected throughout the process.

-

Is airSlate SignNow user-friendly for those unfamiliar with eSigning?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate, even those unfamiliar with eSigning. This user-friendly interface is particularly beneficial for completing the Illinois Department Of Revenue Illinois Net Loss Deduction Schedule NLD Carry Year Ending For Illinois Net Losses Arising In Tax Years Ending On Or After December 31, 1986, without any hassle.

Get more for Illinois Department Of Revenue Illinois Net Loss Deduction Schedule NLD Carry Year Ending For Illinois Net Losses Arising In Tax

- Assignment of lease and rent from borrower to lender vermont form

- Assignment of lease from lessor with notice of assignment vermont form

- Vermont tenant form

- Guaranty or guarantee of payment of rent vermont form

- Letter from landlord to tenant as notice of default on commercial lease vermont form

- Residential or rental lease extension agreement vermont form

- Commercial rental lease application questionnaire vermont form

- Rental application vermont form

Find out other Illinois Department Of Revenue Illinois Net Loss Deduction Schedule NLD Carry Year Ending For Illinois Net Losses Arising In Tax

- Can I Sign New Jersey Life-Insurance Quote Form

- Can I Sign Pennsylvania Church Donation Giving Form

- Sign Oklahoma Life-Insurance Quote Form Later

- Can I Sign Texas Life-Insurance Quote Form

- Sign Texas Life-Insurance Quote Form Fast

- How To Sign Washington Life-Insurance Quote Form

- Can I Sign Wisconsin Life-Insurance Quote Form

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title