*047001110* Tax Illinois Form

What is the 047001110 Tax Illinois

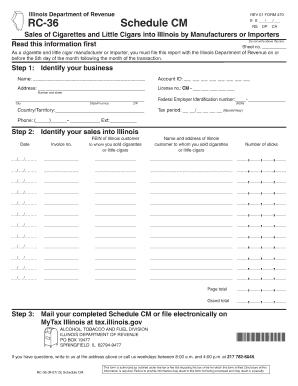

The 047001110 Tax Illinois form is a specific document used for state tax purposes in Illinois. This form is essential for individuals and businesses to report their income, calculate tax liabilities, and ensure compliance with state tax regulations. It encompasses various tax-related information, including income sources, deductions, and credits applicable under Illinois tax law.

How to use the 047001110 Tax Illinois

Using the 047001110 Tax Illinois form involves several key steps. First, gather all necessary financial documents, such as W-2s, 1099s, and any relevant receipts for deductions. Next, accurately fill out the form by entering your personal information, income details, and applicable deductions. It is crucial to double-check all entries for accuracy to avoid potential penalties. Once completed, the form can be submitted either electronically or via mail, depending on your preference and the options available for filing in Illinois.

Steps to complete the 047001110 Tax Illinois

Completing the 047001110 Tax Illinois form requires careful attention to detail. Follow these steps:

- Collect all necessary financial documents, including income statements and receipts.

- Fill in your personal information, such as your name, address, and Social Security number.

- Report your total income from all sources, including wages, dividends, and business income.

- Apply any eligible deductions, such as business expenses or education credits.

- Calculate your total tax liability based on the provided tax rates.

- Review the form for accuracy and completeness.

- Submit the form electronically or by mail, ensuring you meet any filing deadlines.

Required Documents

To successfully complete the 047001110 Tax Illinois form, certain documents are necessary. These include:

- W-2 forms from employers detailing annual wages and tax withholdings.

- 1099 forms for any freelance or contract work, reporting income earned.

- Receipts for deductible expenses, such as medical bills or educational costs.

- Previous year’s tax return for reference and consistency.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the 047001110 Tax Illinois form. Typically, the due date for filing individual income tax returns is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, extensions may be available, but it is crucial to file the necessary forms to avoid penalties.

Penalties for Non-Compliance

Failure to comply with the requirements of the 047001110 Tax Illinois form can result in significant penalties. These may include:

- Late filing penalties, which can accumulate daily until the form is submitted.

- Interest on unpaid taxes, which accrues from the due date until the tax is paid in full.

- Potential legal actions for severe non-compliance, including audits or additional fines.

Quick guide on how to complete 047001110 tax illinois

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute to traditional printed and signed papers, as you can acquire the necessary form and securely keep it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly without unnecessary delays. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to Modify and Electronically Sign [SKS] with Ease

- Find [SKS] and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you would like to send your form, whether via email, text message (SMS), invite link, or download it to your computer.

Eliminate issues with lost or misplaced paperwork, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and electronically sign [SKS] to ensure effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to *047001110* Tax Illinois

Create this form in 5 minutes!

How to create an eSignature for the 047001110 tax illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of *047001110* Tax Illinois?

*047001110* Tax Illinois refers to a specific tax code that businesses must comply with in Illinois. Understanding this code is crucial for ensuring accurate tax filings and avoiding penalties. airSlate SignNow can help streamline the document signing process related to tax compliance.

-

How does airSlate SignNow assist with *047001110* Tax Illinois documentation?

airSlate SignNow provides a user-friendly platform for creating, sending, and eSigning documents related to *047001110* Tax Illinois. This simplifies the process of gathering necessary signatures and ensures that all documents are legally binding. Our solution helps businesses stay organized and compliant.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those dealing with *047001110* Tax Illinois. Our plans are designed to be cost-effective, ensuring that you get the best value for your investment. You can choose from monthly or annual subscriptions based on your usage.

-

What features does airSlate SignNow offer for tax-related documents?

Our platform includes features such as customizable templates, automated workflows, and secure cloud storage, all of which are beneficial for managing *047001110* Tax Illinois documents. These features enhance efficiency and reduce the time spent on paperwork. Additionally, our solution ensures that your documents are safe and easily accessible.

-

Can airSlate SignNow integrate with other software for tax management?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax management software, making it easier to handle *047001110* Tax Illinois filings. This integration allows for a smoother workflow and ensures that all your documents are synchronized across platforms. You can connect with popular tools like QuickBooks and Xero.

-

What are the benefits of using airSlate SignNow for *047001110* Tax Illinois?

Using airSlate SignNow for *047001110* Tax Illinois offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. Our platform allows for quick document turnaround, which is essential during tax season. Additionally, eSigning eliminates the need for physical signatures, saving time and resources.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your *047001110* Tax Illinois documents. We ensure that all data is securely stored and transmitted, giving you peace of mind when handling sensitive information. Your privacy and security are our top priorities.

Get more for *047001110* Tax Illinois

Find out other *047001110* Tax Illinois

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding