Form N 101A, Rev , Application for Automatic Extension of Time to File Hawaii Individual Income Tax Return Forms Fillable 2016-2026

Understanding Form N-101A

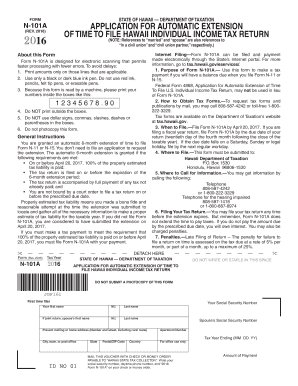

The Form N-101A, also known as the Application for Automatic Extension of Time to File Hawaii Individual Income Tax Return, is a crucial document for taxpayers in Hawaii. This form allows individuals to request an extension for filing their state income tax returns. By submitting this form, taxpayers can gain additional time to prepare their returns without incurring late filing penalties. It is important to note that while the form extends the filing deadline, it does not extend the time to pay any taxes owed.

How to Complete Form N-101A

Filling out Form N-101A requires careful attention to detail. Taxpayers must provide their name, address, and Social Security number. Additionally, they must indicate the tax year for which they are requesting the extension. The form also requires an estimate of the tax liability, which helps determine if any payment is necessary at the time of filing. Completing the form accurately ensures that the extension is granted without issues.

Obtaining Form N-101A

Taxpayers can easily obtain Form N-101A from the Hawaii Department of Taxation's website. The form is available in a fillable PDF format, allowing users to complete it electronically. Alternatively, physical copies can be requested through the department’s offices or accessed at various tax preparation locations throughout Hawaii. Ensuring you have the most current version of the form is essential for compliance.

Key Elements of Form N-101A

Form N-101A includes several key elements that are important for taxpayers to understand. These include the taxpayer's identification information, the specific tax year, and the estimated tax liability. The form also contains instructions on how to submit the application, either online or via mail. Understanding these elements helps taxpayers navigate the filing process effectively and avoid common pitfalls.

Filing Deadlines for Form N-101A

The deadline for submitting Form N-101A typically aligns with the original due date for the Hawaii individual income tax return. Taxpayers should be aware of these deadlines to ensure they file the extension on time. It is advisable to check the Hawaii Department of Taxation's website for any updates or changes to filing dates, especially in light of potential changes in tax regulations.

Eligibility Criteria for Form N-101A

To be eligible to file Form N-101A, taxpayers must be individuals who are required to file a Hawaii individual income tax return. This includes residents and non-residents who earn income in Hawaii. It is important to ensure that all eligibility criteria are met before submitting the form to avoid delays or rejections in the extension process.

Submission Methods for Form N-101A

Taxpayers have multiple options for submitting Form N-101A. The form can be filed electronically through the Hawaii Department of Taxation's online portal, which is a convenient option for many. Alternatively, taxpayers may choose to print the completed form and mail it to the appropriate address. In-person submissions are also accepted at designated tax offices. Each method has its own processing times, so taxpayers should consider this when choosing how to submit their form.

Quick guide on how to complete form n 101a rev application for automatic extension of time to file hawaii individual income tax return forms fillable

Complete Form N 101A, Rev , Application For Automatic Extension Of Time To File Hawaii Individual Income Tax Return Forms Fillable effortlessly on any device

Managing documents online has gained popularity among companies and individuals. It offers an excellent eco-friendly option to traditional printed and signed papers, as you can obtain the proper format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without holdups. Handle Form N 101A, Rev , Application For Automatic Extension Of Time To File Hawaii Individual Income Tax Return Forms Fillable on any device with airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to modify and eSign Form N 101A, Rev , Application For Automatic Extension Of Time To File Hawaii Individual Income Tax Return Forms Fillable with ease

- Obtain Form N 101A, Rev , Application For Automatic Extension Of Time To File Hawaii Individual Income Tax Return Forms Fillable and click on Get Form to commence.

- Make use of the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Craft your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you'd like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or mislaid files, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Modify and eSign Form N 101A, Rev , Application For Automatic Extension Of Time To File Hawaii Individual Income Tax Return Forms Fillable and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form n 101a rev application for automatic extension of time to file hawaii individual income tax return forms fillable

Create this form in 5 minutes!

How to create an eSignature for the form n 101a rev application for automatic extension of time to file hawaii individual income tax return forms fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form n101a and how is it used?

The form n101a is a legal document used in various administrative processes. It is essential for individuals looking to initiate specific legal actions or requests. Understanding how to properly fill out and submit the form n101a can streamline your legal procedures.

-

How can airSlate SignNow help with the form n101a?

airSlate SignNow provides a user-friendly platform to electronically sign and send the form n101a. With our solution, you can easily manage your documents, ensuring they are securely signed and submitted on time. This simplifies the process and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for the form n101a?

airSlate SignNow offers flexible pricing plans that cater to different business needs. Whether you are a small business or a large enterprise, you can find a plan that fits your budget while allowing you to manage the form n101a efficiently. Check our website for detailed pricing information.

-

Are there any features specifically designed for the form n101a?

Yes, airSlate SignNow includes features that enhance the handling of the form n101a, such as customizable templates and automated workflows. These features help ensure that your document is completed accurately and efficiently. Additionally, you can track the status of your form n101a in real-time.

-

What are the benefits of using airSlate SignNow for the form n101a?

Using airSlate SignNow for the form n101a offers numerous benefits, including increased efficiency and reduced turnaround times. Our platform allows for quick electronic signatures, which can expedite the entire process. Furthermore, you can access your documents from anywhere, making it convenient for busy professionals.

-

Can I integrate airSlate SignNow with other applications for the form n101a?

Absolutely! airSlate SignNow supports integrations with various applications, allowing you to streamline your workflow when dealing with the form n101a. Whether you use CRM systems or document management tools, our platform can connect seamlessly to enhance your productivity.

-

Is it secure to use airSlate SignNow for the form n101a?

Yes, security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your data when handling the form n101a. You can trust that your documents are safe and compliant with industry standards.

Get more for Form N 101A, Rev , Application For Automatic Extension Of Time To File Hawaii Individual Income Tax Return Forms Fillable

Find out other Form N 101A, Rev , Application For Automatic Extension Of Time To File Hawaii Individual Income Tax Return Forms Fillable

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation