N101a 2003

What is the N101a

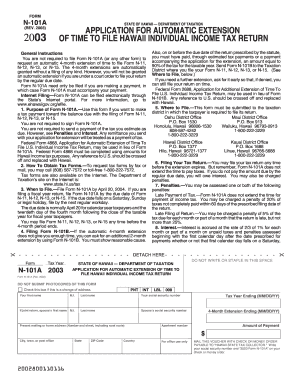

The N101a is a specific tax form used in Hawaii, primarily for requesting an extension of time to file an individual income tax return. This form allows taxpayers to extend their filing deadline, providing additional time to gather necessary documentation and complete their tax return accurately. Understanding the purpose and function of the N101a is crucial for residents who may need extra time to fulfill their tax obligations.

How to use the N101a

Using the N101a involves several steps to ensure that the form is completed correctly. Taxpayers must first download the form from the official state website or obtain a physical copy. After filling out the required information, including personal details and the reason for the extension, the form must be submitted to the appropriate tax authority. It is essential to keep a copy of the submitted form for personal records and to confirm that the extension request has been processed.

Steps to complete the N101a

Completing the N101a involves a series of clear steps:

- Download the N101a form from the Hawaii Department of Taxation website.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the type of extension you are requesting and the reason for the extension.

- Review the form for accuracy and completeness.

- Submit the completed form either online, by mail, or in person to the relevant tax office.

Legal use of the N101a

The N101a is legally binding when submitted correctly and in accordance with Hawaii tax laws. It is important to ensure that all information provided is accurate and truthful, as any discrepancies may lead to penalties or legal issues. Compliance with the state's tax regulations is essential for the validity of the extension request.

Filing Deadlines / Important Dates

Filing deadlines for the N101a are crucial for taxpayers to adhere to. Generally, the form must be submitted by the original due date of the tax return. For most individuals, this date falls on April fifteenth. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. Staying informed about these dates helps taxpayers avoid late penalties.

Required Documents

When completing the N101a, certain documents may be required to support the extension request. Taxpayers should have their previous year’s tax return, any relevant income statements, and documentation justifying the need for an extension. Having these documents on hand can facilitate the completion of the form and ensure a smooth submission process.

Quick guide on how to complete n101a

Complete N101a effortlessly on any gadget

Online document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed paperwork, as you can obtain the correct format and securely store it online. airSlate SignNow furnishes you with all the tools necessary to create, alter, and eSign your documents quickly without delays. Manage N101a on any gadget with airSlate SignNow Android or iOS applications and simplify any document-based procedure today.

The easiest way to modify and eSign N101a without any hassle

- Locate N101a and then click Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that task.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the details and then click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign N101a and ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct n101a

Create this form in 5 minutes!

How to create an eSignature for the n101a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form n101a?

The form n101a is utilized in the UK for certain legal proceedings. It serves as a notice of appeal and helps individuals communicate their intent to appeal a decision. Understanding the nuances of the form n101a is essential for effective legal representation.

-

How can airSlate SignNow help with the form n101a?

airSlate SignNow simplifies the process of completing and signing the form n101a online. Our platform enables users to easily fill out the necessary fields, ensuring accuracy and compliance with legal standards. With airSlate SignNow, you can manage the entire signing process seamlessly.

-

Is there a cost associated with using airSlate SignNow for the form n101a?

Yes, using airSlate SignNow for the form n101a comes with a competitive pricing structure tailored for various business needs. We offer different subscription plans that provide excellent value for businesses looking to streamline document management. Sign up today to see how affordable our solutions really are!

-

What features does airSlate SignNow offer for form n101a users?

airSlate SignNow includes several powerful features for form n101a users, including easy document editing, secure eSignature capabilities, and automated workflows. These tools enhance the efficiency of completing legal documents like the form n101a. Experience the convenience of managing your documents from any device.

-

Can I integrate airSlate SignNow with other software for the form n101a?

Absolutely! airSlate SignNow provides integration capabilities with various software solutions, allowing for smooth data transfer related to the form n101a. Whether you’re using CRM systems or other document management tools, our integrations enhance productivity and workflow efficiency.

-

What are the benefits of using airSlate SignNow for the form n101a?

Using airSlate SignNow for the form n101a offers numerous benefits, including enhanced security for sensitive data, faster turnaround times for document processing, and improved collaboration among stakeholders. Our user-friendly platform ensures that even those unfamiliar with digital documents can easily navigate the process.

-

Is airSlate SignNow compliant with legal regulations for form n101a?

Yes, airSlate SignNow is fully compliant with legal standards for electronic signatures, ensuring that your form n101a meets all necessary regulations. We prioritize the security and legality of digital transactions, so you can trust that your documents are handled appropriately. Protect your legal interests with our reliable platform.

Get more for N101a

Find out other N101a

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT