Oregon Oregon Adjustments for Form 40N and Form 40P 2023

Understanding the Oregon Adjustments for Form 40N and Form 40P

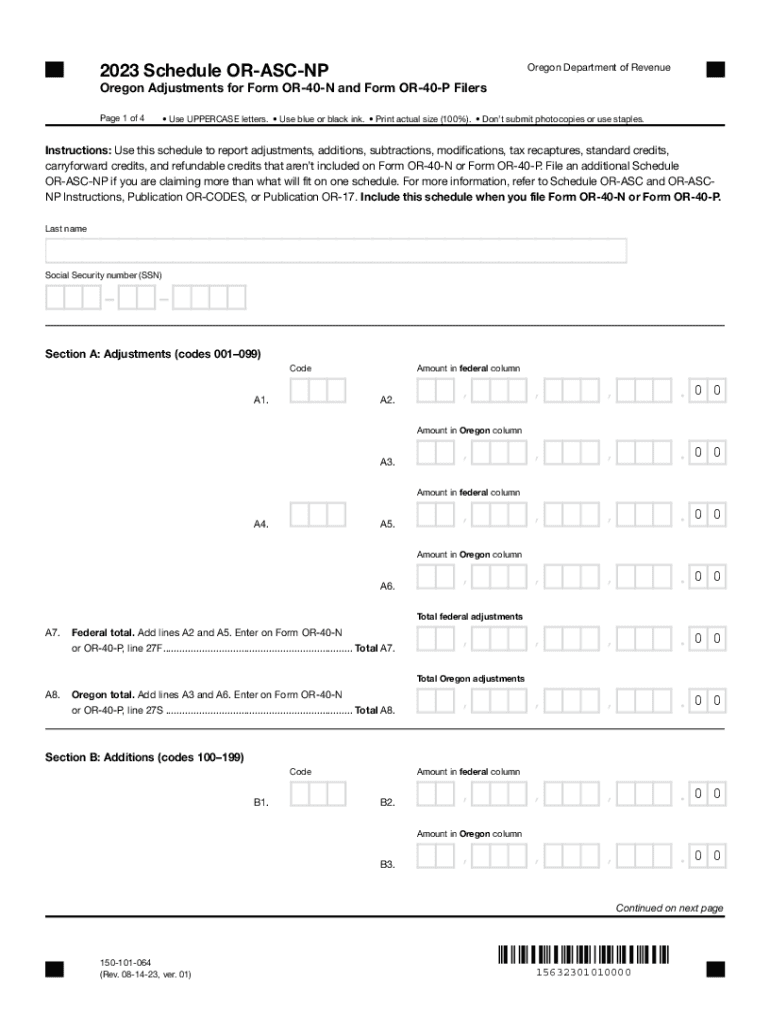

The Oregon Adjustments for Form 40N and Form 40P are essential components for individuals filing their state income taxes in Oregon. Form 40N is used by non-residents, while Form 40P is designated for part-year residents. These adjustments allow taxpayers to accurately report their income and claim any applicable deductions or credits. Understanding these forms is crucial for compliance with state tax regulations and for ensuring that taxpayers do not overpay or underpay their taxes.

Steps to Complete the Oregon Adjustments for Form 40N and Form 40P

Completing the Oregon Adjustments for Form 40N and Form 40P involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your residency status to select the correct form.

- Calculate your total income and any adjustments specific to Oregon.

- Fill out the appropriate sections of Form 40N or Form 40P, ensuring all income and deductions are accurately reported.

- Review the form for any errors before submission.

Key Elements of the Oregon Adjustments for Form 40N and Form 40P

When filling out the Oregon Adjustments, it is important to focus on several key elements:

- Income Reporting: Accurately report all sources of income, including wages, interest, and dividends.

- Deductions: Identify any deductions you may qualify for, such as business expenses or education credits.

- Tax Credits: Explore available tax credits that can reduce your overall tax liability.

- Residency Status: Ensure that you are using the correct form based on your residency status during the tax year.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines for the Oregon Adjustments for Form 40N and Form 40P. Typically, the deadline for filing state income tax returns is April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply and plan accordingly.

Required Documents for Oregon Adjustments

To successfully complete the Oregon Adjustments for Form 40N and Form 40P, taxpayers need to gather several key documents:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of other income sources, such as rental income or investment earnings.

- Documentation for any deductions or credits claimed, such as receipts for business expenses or education costs.

Eligibility Criteria for Oregon Adjustments

Eligibility for the Oregon Adjustments on Form 40N and Form 40P primarily depends on residency status and income level. Non-residents who earn income in Oregon must file Form 40N, while part-year residents who lived in Oregon for part of the year should use Form 40P. Additionally, taxpayers must meet specific income thresholds to qualify for certain deductions and credits.

Quick guide on how to complete oregon oregon adjustments for form 40n and form 40p

Complete Oregon Oregon Adjustments For Form 40N And Form 40P effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Oregon Oregon Adjustments For Form 40N And Form 40P on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to alter and electronically sign Oregon Oregon Adjustments For Form 40N And Form 40P with ease

- Obtain Oregon Oregon Adjustments For Form 40N And Form 40P and then click Get Form to begin.

- Utilize the available tools to finalize your document.

- Emphasize pertinent sections of your documents or redact confidential information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your alterations.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), or invite link, or download it to your PC.

Eliminate the worry of lost or misfiled documents, lengthy form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you select. Modify and electronically sign Oregon Oregon Adjustments For Form 40N And Form 40P to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct oregon oregon adjustments for form 40n and form 40p

Create this form in 5 minutes!

How to create an eSignature for the oregon oregon adjustments for form 40n and form 40p

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Oregon Oregon Adjustments For Form 40N And Form 40P?

Oregon Oregon Adjustments For Form 40N And Form 40P refer to specific modifications that taxpayers in Oregon can make when filing their state income tax returns. These adjustments help ensure that taxpayers accurately report their income and deductions, maximizing their potential refunds or minimizing their tax liabilities. Understanding these adjustments is crucial for compliance and financial planning.

-

How can airSlate SignNow assist with Oregon Oregon Adjustments For Form 40N And Form 40P?

airSlate SignNow provides a streamlined platform for businesses to manage and eSign documents related to Oregon Oregon Adjustments For Form 40N And Form 40P. With our user-friendly interface, you can easily prepare, send, and sign tax documents, ensuring that all necessary adjustments are accurately reflected. This efficiency saves time and reduces the risk of errors.

-

What features does airSlate SignNow offer for handling tax documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, all of which are essential for managing Oregon Oregon Adjustments For Form 40N And Form 40P. These features enhance the document workflow, making it easier for users to complete their tax filings accurately and on time. Additionally, our platform ensures compliance with state regulations.

-

Is there a cost associated with using airSlate SignNow for tax adjustments?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs, including those related to Oregon Oregon Adjustments For Form 40N And Form 40P. Our plans are designed to be cost-effective, providing excellent value for the features and support offered. You can choose a plan that fits your budget while ensuring you have the tools necessary for efficient document management.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software, making it easier to manage Oregon Oregon Adjustments For Form 40N And Form 40P. This integration allows for a smooth workflow, enabling users to import and export documents without hassle. By connecting your tools, you can enhance productivity and accuracy in your tax processes.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for managing Oregon Oregon Adjustments For Form 40N And Form 40P offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are stored securely and can be accessed anytime, anywhere. Additionally, the eSigning feature speeds up the approval process, allowing you to focus on other important tasks.

-

How secure is airSlate SignNow for handling sensitive tax information?

airSlate SignNow prioritizes the security of your sensitive tax information, especially when dealing with Oregon Oregon Adjustments For Form 40N And Form 40P. We implement advanced encryption protocols and comply with industry standards to protect your data. You can trust that your documents are safe and secure while using our platform.

Get more for Oregon Oregon Adjustments For Form 40N And Form 40P

Find out other Oregon Oregon Adjustments For Form 40N And Form 40P

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple