Mail SG Finance Attn Michele Williams PO Box 11851 2023-2026

IRS Guidelines

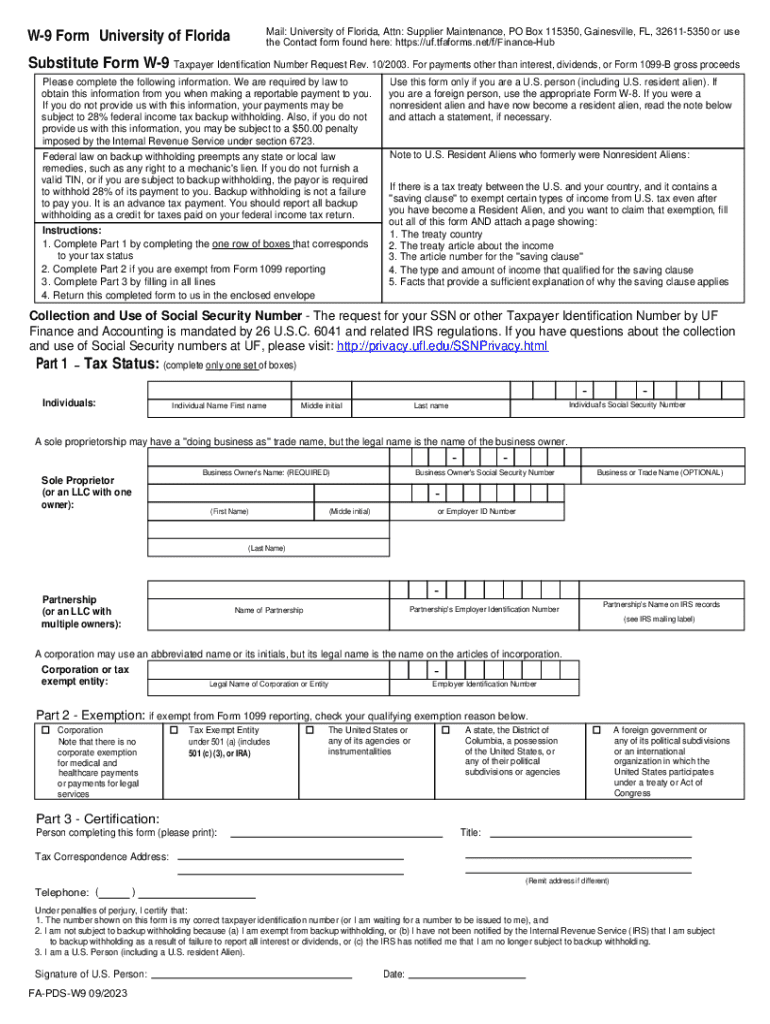

The W-9 form is a crucial document used by the Internal Revenue Service (IRS) to collect taxpayer information. It is primarily utilized by individuals and businesses to provide their Taxpayer Identification Number (TIN) to entities that will report income paid to them. The IRS requires that the information on the W-9 form be accurate to ensure proper tax reporting and compliance. It is important to understand that the W-9 does not itself serve as a tax return but is used to facilitate the reporting of income on forms such as the 1099.

Filing Deadlines / Important Dates

While the W-9 form itself does not have a specific filing deadline, it is essential to submit it promptly when requested by a business or individual that will be making payments to you. Typically, the W-9 should be completed and returned before any payments are made to ensure compliance with IRS regulations. For tax reporting purposes, the information provided on the W-9 will be used by the payer to complete their 1099 forms, which have their own filing deadlines, usually by January 31 of the following year.

Required Documents

To complete the W-9 form, you will need to provide specific information, including your name, business name (if applicable), address, and TIN. The TIN can be your Social Security Number (SSN) or Employer Identification Number (EIN). If you are a sole proprietor, you may use your SSN. In some cases, additional documentation may be required to verify your identity or business status, especially if you are submitting the form for a business entity.

Form Submission Methods (Online / Mail / In-Person)

The W-9 form can be submitted in various ways depending on the requestor's preferences. Common methods include:

- Online Submission: Some businesses may allow you to fill out and submit the W-9 electronically through their secure portals.

- Email: You can scan and email the completed W-9 form to the requesting party.

- Mail: Alternatively, you can print the form, complete it, and send it via postal mail to the requestor.

- In-Person: If necessary, you may also deliver the completed form in person.

Eligibility Criteria

Eligibility to fill out a W-9 form generally includes individuals who are U.S. citizens or resident aliens, as well as businesses operating within the United States. This form is typically required for freelancers, contractors, and other self-employed individuals who receive payments for services rendered. It is important to ensure that you meet the eligibility criteria before submitting the form to avoid any issues with tax reporting.

Taxpayer Scenarios (e.g., self-employed, retired, students)

The W-9 form is applicable in various taxpayer scenarios. Self-employed individuals often use the W-9 to provide their TIN to clients for whom they perform services. Retired individuals may also need to fill out a W-9 if they receive income from pensions or retirement accounts. Students who work part-time or freelance may be required to submit a W-9 to their employers or clients to report their earnings accurately. Understanding your specific situation can help ensure compliance with IRS regulations.

Quick guide on how to complete mail sg finance attn michele williams po box 11851

Effortlessly Prepare Mail SG Finance Attn Michele Williams PO Box 11851 on Any Device

Digital document management has become increasingly favored by both organizations and individuals. It serves as a perfect environmentally-friendly alternative to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without hesitation. Manage Mail SG Finance Attn Michele Williams PO Box 11851 on any platform using airSlate SignNow applications for Android or iOS and enhance any document-centered workflow today.

How to Modify and eSign Mail SG Finance Attn Michele Williams PO Box 11851 with Ease

- Acquire Mail SG Finance Attn Michele Williams PO Box 11851 and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Mark essential sections of your documents or conceal sensitive details with the tools offered by airSlate SignNow specifically for this task.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Mail SG Finance Attn Michele Williams PO Box 11851, ensuring excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mail sg finance attn michele williams po box 11851

Create this form in 5 minutes!

How to create an eSignature for the mail sg finance attn michele williams po box 11851

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the fa pds w9 form and why is it important?

The fa pds w9 form is a tax document used by businesses to collect information from contractors and freelancers. It is essential for ensuring accurate tax reporting and compliance with IRS regulations. By using the fa pds w9 form, businesses can streamline their tax processes and avoid potential penalties.

-

How can airSlate SignNow help with the fa pds w9 form?

airSlate SignNow provides an efficient platform for sending and eSigning the fa pds w9 form. With its user-friendly interface, you can easily create, send, and manage your W9 forms electronically. This not only saves time but also enhances the security and organization of your documents.

-

Is there a cost associated with using airSlate SignNow for the fa pds w9 form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan includes features that facilitate the management of documents like the fa pds w9 form. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the fa pds w9 form?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning for the fa pds w9 form. These tools help streamline the document management process, making it easier to collect and store important tax information.

-

Can I integrate airSlate SignNow with other software for the fa pds w9 form?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage the fa pds w9 form alongside your existing tools. This enhances productivity and ensures that all your documents are easily accessible in one place.

-

What are the benefits of using airSlate SignNow for the fa pds w9 form?

Using airSlate SignNow for the fa pds w9 form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick eSigning and easy tracking of document status, ensuring that your tax forms are processed promptly.

-

How secure is the airSlate SignNow platform for handling the fa pds w9 form?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your documents, including the fa pds w9 form. You can trust that your sensitive information is safe while using our platform for eSigning and document management.

Get more for Mail SG Finance Attn Michele Williams PO Box 11851

Find out other Mail SG Finance Attn Michele Williams PO Box 11851

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation