MICHIGAN Schedule 1 Additions and Subtractions Issued under Authority of Public Act 281 of 1967 Form

Understanding the MICHIGAN Schedule 1 Additions and Subtractions

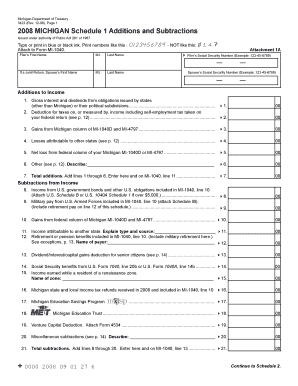

The MICHIGAN Schedule 1 Additions and Subtractions Issued Under Authority Of Public Act 281 Of 1967 is a crucial form used by taxpayers in Michigan to report specific additions and subtractions to their income. This form allows individuals to adjust their taxable income by accounting for various deductions and credits that may apply to their financial situation. Understanding how to accurately complete this form is essential for ensuring compliance with state tax regulations and optimizing tax obligations.

Steps to Complete the MICHIGAN Schedule 1 Additions and Subtractions

Completing the MICHIGAN Schedule 1 requires careful attention to detail. Here are the key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any relevant receipts.

- Identify the specific additions and subtractions applicable to your situation, such as retirement contributions or other deductions.

- Fill out the form accurately, ensuring that all figures are correct and match your financial records.

- Review the completed form for any errors or omissions before submission.

How to Obtain the MICHIGAN Schedule 1 Additions and Subtractions

The MICHIGAN Schedule 1 can be obtained from the Michigan Department of Treasury's official website or through various tax preparation software. It is available in both digital and paper formats, allowing taxpayers to choose the method that best suits their needs. For those preferring a physical copy, it can also be requested directly from local tax offices or through mail.

Key Elements of the MICHIGAN Schedule 1 Additions and Subtractions

This form includes several key elements that taxpayers must understand:

- Additions: These are items that increase your taxable income, such as certain types of interest income.

- Subtractions: These reduce your taxable income and may include deductions for retirement plan contributions or certain business expenses.

- Instructions: The form provides detailed instructions on how to report each addition and subtraction accurately.

Legal Use of the MICHIGAN Schedule 1 Additions and Subtractions

The MICHIGAN Schedule 1 is legally mandated for reporting specific financial adjustments on state tax returns. Failure to accurately complete and submit this form can result in penalties or audits by the Michigan Department of Treasury. It is essential for taxpayers to understand the legal implications of the information they provide on this form, ensuring that all reported figures are truthful and substantiated by appropriate documentation.

Filing Deadlines and Important Dates

Timely submission of the MICHIGAN Schedule 1 is critical. The typical deadline aligns with the state income tax return filing date, usually on April 15. However, taxpayers should verify specific deadlines each year, as they may vary due to holidays or other factors. Late submissions can incur penalties, so it is advisable to complete and file the form as early as possible.

Quick guide on how to complete michigan schedule 1 additions and subtractions issued under authority of public act 281 of 1967

Complete [SKS] effortlessly on any device

Digital document management has become prevalent among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools you need to create, edit, and electronically sign your documents quickly and without hindrances. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to edit and eSign [SKS] with ease

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to MICHIGAN Schedule 1 Additions And Subtractions Issued Under Authority Of Public Act 281 Of 1967

Create this form in 5 minutes!

How to create an eSignature for the michigan schedule 1 additions and subtractions issued under authority of public act 281 of 1967

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MICHIGAN Schedule 1 Additions And Subtractions Issued Under Authority Of Public Act 281 Of 1967?

The MICHIGAN Schedule 1 Additions And Subtractions Issued Under Authority Of Public Act 281 Of 1967 is a tax form used by Michigan residents to report specific additions and subtractions to their taxable income. This form helps ensure accurate tax calculations and compliance with state tax laws.

-

How can airSlate SignNow assist with the MICHIGAN Schedule 1 Additions And Subtractions Issued Under Authority Of Public Act 281 Of 1967?

airSlate SignNow provides a streamlined platform for electronically signing and sending the MICHIGAN Schedule 1 Additions And Subtractions Issued Under Authority Of Public Act 281 Of 1967. Our solution simplifies document management, making it easier for users to complete and submit their tax forms efficiently.

-

What are the pricing options for using airSlate SignNow for MICHIGAN Schedule 1 Additions And Subtractions?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses and individuals handling the MICHIGAN Schedule 1 Additions And Subtractions Issued Under Authority Of Public Act 281 Of 1967. Our cost-effective solutions ensure you only pay for what you need, with options for monthly or annual subscriptions.

-

What features does airSlate SignNow offer for managing tax documents like the MICHIGAN Schedule 1?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, specifically designed for managing tax documents like the MICHIGAN Schedule 1 Additions And Subtractions Issued Under Authority Of Public Act 281 Of 1967. These features enhance efficiency and ensure compliance with tax regulations.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Yes, airSlate SignNow seamlessly integrates with various tax preparation software, allowing you to manage the MICHIGAN Schedule 1 Additions And Subtractions Issued Under Authority Of Public Act 281 Of 1967 alongside your existing tools. This integration streamlines your workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents like the MICHIGAN Schedule 1 Additions And Subtractions Issued Under Authority Of Public Act 281 Of 1967 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled securely and are easily accessible.

-

Is airSlate SignNow user-friendly for those unfamiliar with eSigning?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to eSign documents, including the MICHIGAN Schedule 1 Additions And Subtractions Issued Under Authority Of Public Act 281 Of 1967. Our intuitive interface guides users through the signing process, ensuring a smooth experience.

Get more for MICHIGAN Schedule 1 Additions And Subtractions Issued Under Authority Of Public Act 281 Of 1967

- Guidelines for mentoring nbcot nbcot form

- 2007 merlin order bformb front merlin industries inc

- Nd probate code form 2 page 1 ndcourts

- Dr 475s parenting plan short version 7 15 fill in domestic relations forms

- The fairy stories in the city of god ciberteologia paulinas ciberteologia paulinas org form

- Application for membership perch base ussvi form

- Wegmans school of nursing clinical year application spring sjfc form

- Sr 13 form georgia pdf sr 13 form georgia pdf 1592031547

Find out other MICHIGAN Schedule 1 Additions And Subtractions Issued Under Authority Of Public Act 281 Of 1967

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter