INT 2 1 Bank Franchise Tax Schedule BF Form

Understanding the INT 2 1 Bank Franchise Tax Schedule BF

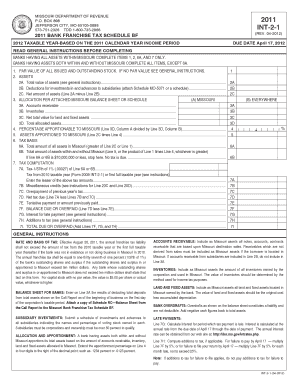

The INT 2 1 Bank Franchise Tax Schedule BF is a specific form used by banks and financial institutions to report their franchise tax obligations to the state. This schedule is crucial for ensuring compliance with state tax regulations. It captures essential financial information that determines the tax liability of a bank based on its business operations within the state. The form is typically required to be filed annually, and it is important for institutions to understand its requirements to avoid penalties.

Steps to Complete the INT 2 1 Bank Franchise Tax Schedule BF

Completing the INT 2 1 Bank Franchise Tax Schedule BF involves several key steps:

- Gather financial statements and relevant documentation, including balance sheets and income statements.

- Fill in the required sections with accurate financial data, ensuring all figures are current and reflect the institution's operations.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate state tax authority by the specified deadline.

How to Obtain the INT 2 1 Bank Franchise Tax Schedule BF

The INT 2 1 Bank Franchise Tax Schedule BF can typically be obtained through the state tax authority’s website or office. Many states provide downloadable versions of the form in PDF format, which can be printed and filled out manually. Additionally, some states may offer online filing options, allowing banks to complete and submit the form electronically.

Key Elements of the INT 2 1 Bank Franchise Tax Schedule BF

Several key elements are essential to the INT 2 1 Bank Franchise Tax Schedule BF:

- Identification information for the bank, including name, address, and tax identification number.

- Financial data such as total revenue, assets, and liabilities.

- Calculations related to the franchise tax owed, based on the financial data provided.

- Signature of an authorized representative, confirming the accuracy of the information submitted.

Filing Deadlines for the INT 2 1 Bank Franchise Tax Schedule BF

Filing deadlines for the INT 2 1 Bank Franchise Tax Schedule BF vary by state. Typically, banks must submit this form by the end of their fiscal year or a specific date set by the state tax authority. It is crucial for banks to be aware of these deadlines to avoid late fees or penalties. Checking the state tax authority’s website for the most current deadlines is advisable.

Legal Use of the INT 2 1 Bank Franchise Tax Schedule BF

The INT 2 1 Bank Franchise Tax Schedule BF is legally required for banks operating in states that impose a franchise tax. Proper completion and timely submission of this form ensure that banks comply with state tax laws and avoid potential legal issues. Understanding the legal implications of this form is vital for maintaining good standing with state authorities.

Quick guide on how to complete int 2 1 bank franchise tax schedule bf 11099698

Facilitate [SKS] effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, enabling you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources you require to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The easiest way to modify and eSign [SKS] effortlessly

- Find [SKS] and click on Obtain Form to begin.

- Employ the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Finished button to save your modifications.

- Choose how you would like to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and eSign [SKS] and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the int 2 1 bank franchise tax schedule bf 11099698

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the INT 2 1 Bank Franchise Tax Schedule BF?

The INT 2 1 Bank Franchise Tax Schedule BF is a specific form used by banks to report their franchise tax obligations. It provides a detailed breakdown of taxable income and deductions, ensuring compliance with state tax regulations. Understanding this schedule is crucial for accurate tax reporting.

-

How can airSlate SignNow help with the INT 2 1 Bank Franchise Tax Schedule BF?

airSlate SignNow streamlines the process of completing and submitting the INT 2 1 Bank Franchise Tax Schedule BF by allowing users to eSign documents securely. Our platform simplifies document management, making it easier to gather necessary signatures and ensure timely submissions. This efficiency can save your business valuable time and resources.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans include features that support the completion of forms like the INT 2 1 Bank Franchise Tax Schedule BF, ensuring you get the best value for your investment. You can choose from monthly or annual subscriptions based on your usage requirements.

-

What features does airSlate SignNow provide for document management?

airSlate SignNow includes a variety of features designed to enhance document management, such as customizable templates, automated workflows, and secure cloud storage. These features are particularly beneficial when handling forms like the INT 2 1 Bank Franchise Tax Schedule BF, as they streamline the process and reduce the risk of errors. Additionally, our platform supports real-time collaboration among team members.

-

Is airSlate SignNow compliant with legal standards for eSigning?

Yes, airSlate SignNow is fully compliant with legal standards for electronic signatures, including the ESIGN Act and UETA. This compliance ensures that documents like the INT 2 1 Bank Franchise Tax Schedule BF are legally binding and secure. Our platform provides an audit trail for all signed documents, adding an extra layer of security and accountability.

-

Can I integrate airSlate SignNow with other software tools?

Absolutely! airSlate SignNow offers seamless integrations with various software tools, including CRM systems and accounting software. This capability allows for efficient data transfer and management, particularly when dealing with the INT 2 1 Bank Franchise Tax Schedule BF. Integrating our platform with your existing tools can enhance productivity and streamline your workflows.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, such as the INT 2 1 Bank Franchise Tax Schedule BF, offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows for quick eSigning and document sharing, which can signNowly speed up the tax filing process. Additionally, the user-friendly interface makes it accessible for all team members.

Get more for INT 2 1 Bank Franchise Tax Schedule BF

- Call report pro cover page 041 citigroup form

- Snapshot august 91407 citigroup form

- New beginnings 2007 citigroup form

- Brazil window opens for international managers form

- Also do not rely on draft instructions and publications for filing irs form

- Limited partnerships california tax asc law com form

- 08 41941 cdr this document indicates the immunization history information for an individual it is required to be completed and

- Section a property information for insurance company use a1

Find out other INT 2 1 Bank Franchise Tax Schedule BF

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe