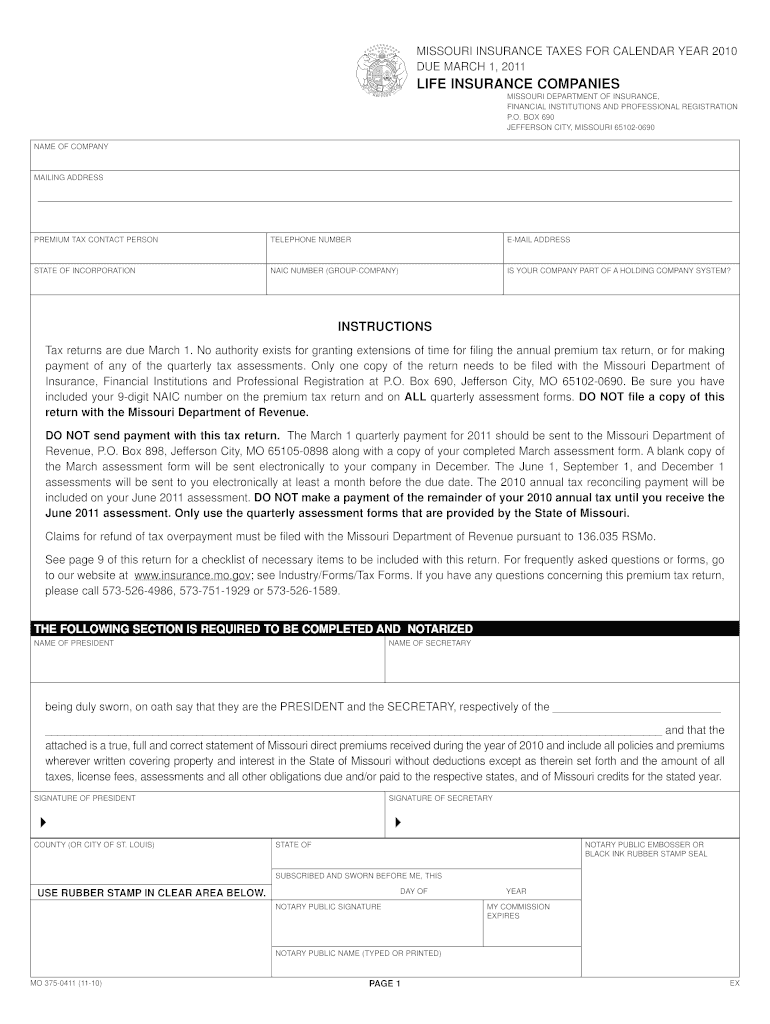

Life Insurance Companies Form

Understanding Life Insurance Companies

Life insurance companies provide financial protection to policyholders by offering various types of life insurance products. These products can include term life insurance, whole life insurance, and universal life insurance. Each type serves different needs, from providing a death benefit to beneficiaries to accumulating cash value over time. Life insurance companies assess risk through underwriting processes, which determine premiums based on factors like age, health, and lifestyle.

How to Obtain Life Insurance

To obtain life insurance, individuals typically start by researching different life insurance companies and their offerings. It is advisable to compare quotes and coverage options to find a policy that meets personal needs. After selecting a company, applicants fill out an application form, which includes personal information and health history. Following submission, the company will conduct an underwriting process, which may involve a medical exam. Once approved, the policyholder will receive their policy documents outlining coverage details.

Key Elements of Life Insurance Policies

Life insurance policies contain several key elements that define their terms and benefits. These include:

- Premiums: The amount paid periodically for the policy.

- Death Benefit: The sum paid to beneficiaries upon the policyholder's death.

- Cash Value: Available in whole and universal life policies, this is the savings component that can grow over time.

- Beneficiaries: Individuals or entities designated to receive the death benefit.

State-Specific Regulations for Life Insurance

Life insurance is regulated at the state level, meaning rules can vary significantly across the United States. Each state has its own insurance department that oversees the licensing of life insurance companies and agents. Additionally, states may have specific requirements for policy disclosures, consumer protections, and the handling of claims. It is important for policyholders to understand the regulations in their state to ensure compliance and protection.

Application Process and Approval Time

The application process for life insurance typically involves several steps. After selecting a policy, applicants submit their personal and health information. The approval time can vary based on the complexity of the application and the underwriting process. Generally, applicants can expect to wait anywhere from a few days to several weeks for approval. Factors that may influence this timeline include the need for medical exams or additional documentation.

Legal Use of Life Insurance

Life insurance serves various legal purposes, including estate planning and providing financial security for dependents. Policies can be structured to meet specific legal requirements, such as irrevocable trusts, which can help in estate tax planning. Additionally, life insurance proceeds are generally not subject to income tax, making them a valuable financial tool in legal and financial planning.

Quick guide on how to complete life insurance companies

Complete [SKS] effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents promptly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to edit and electronically sign [SKS] with ease

- Find [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from your preferred device. Edit and electronically sign [SKS] and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Life Insurance Companies

Create this form in 5 minutes!

How to create an eSignature for the life insurance companies

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the top features to look for in Life Insurance Companies?

When evaluating Life Insurance Companies, consider features such as policy flexibility, premium payment options, and customer service quality. Additionally, look for companies that offer online account management and easy claims processing. These features can signNowly enhance your experience and ensure you receive the best value.

-

How do Life Insurance Companies determine premium rates?

Life Insurance Companies typically determine premium rates based on several factors, including age, health status, lifestyle choices, and the type of coverage selected. They assess risk through underwriting processes, which can vary between companies. Understanding these factors can help you choose the right policy at a competitive rate.

-

What benefits do Life Insurance Companies offer beyond basic coverage?

Many Life Insurance Companies provide additional benefits such as accelerated death benefits, riders for critical illness, and cash value accumulation. These options can enhance your policy and provide financial security in various situations. It's essential to review these benefits when selecting a policy.

-

Are there any discounts available with Life Insurance Companies?

Yes, many Life Insurance Companies offer discounts for various reasons, such as bundling policies, maintaining a healthy lifestyle, or being a member of certain organizations. It's advisable to inquire about available discounts when obtaining quotes to maximize your savings. Always compare offers from different companies to find the best deal.

-

How can I compare different Life Insurance Companies?

To compare Life Insurance Companies effectively, start by reviewing their financial ratings, customer reviews, and policy options. Utilize online comparison tools and consult with insurance agents to gather insights. This comprehensive approach will help you make an informed decision based on your specific needs.

-

What is the claims process like with Life Insurance Companies?

The claims process with Life Insurance Companies generally involves submitting a claim form along with necessary documentation, such as the death certificate. Most companies aim to process claims quickly, often within a few weeks. It's crucial to understand each company's specific claims procedures to ensure a smooth experience.

-

Can I customize my policy with Life Insurance Companies?

Yes, many Life Insurance Companies allow you to customize your policy by adding riders or selecting coverage amounts that suit your needs. Customization options can include adding coverage for accidental death or critical illness. Discuss your preferences with an agent to tailor a policy that fits your unique situation.

Get more for Life Insurance Companies

- Firearms dealers licence application form rf1637 south australia

- Form 4317 2016

- Sworn affidavit b1sa b bbee website bee b1sa co form

- Lic 9182 1115 criminal background clearance transfer cdss cdss ca form

- Da form 2166 8 fillable pdf da form 2166 8 fillable pdf miki 441

- Occupational drivers license order free texas legal forms texaslawhelp

- Dd form 2983 recruittrainee prohibited activities acknowledgment january 2015

- 2 english in clause form ssdi ssdi di fct unl

Find out other Life Insurance Companies

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement