AGENDA FLORIDA DEPARTMENT of REVENUE RULE Form

Understanding the AGENDA FLORIDA DEPARTMENT OF REVENUE RULE

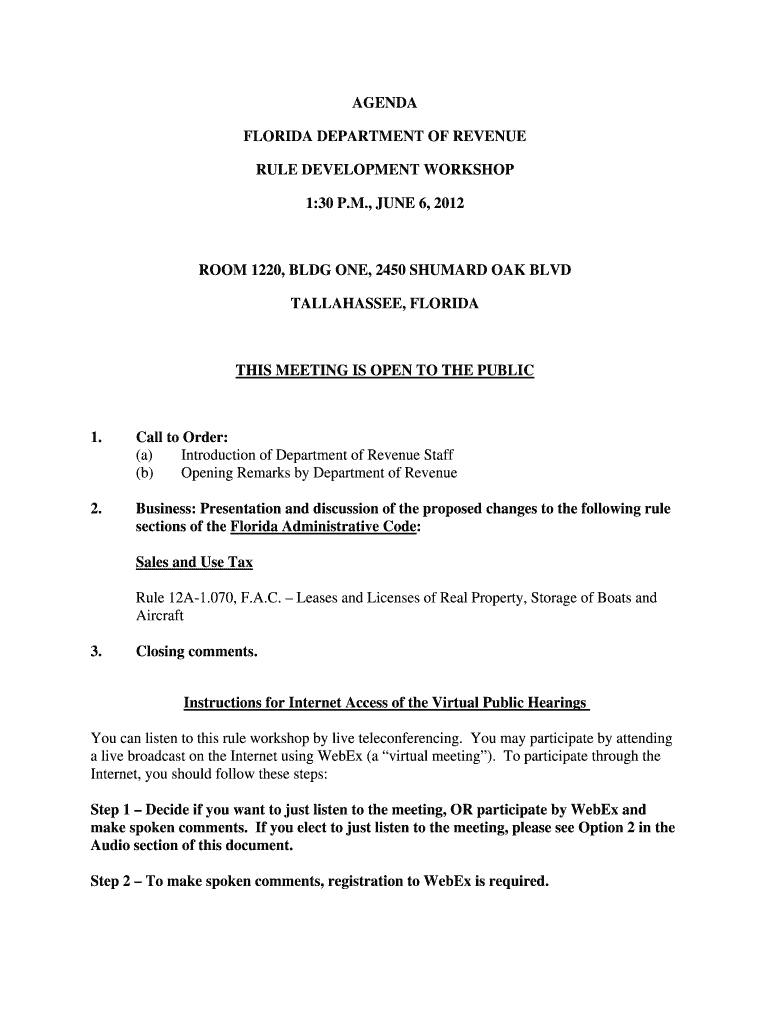

The AGENDA FLORIDA DEPARTMENT OF REVENUE RULE outlines specific regulations and guidelines set by the Florida Department of Revenue. This rule is essential for ensuring compliance with state tax laws and is applicable to various stakeholders, including businesses and individuals. It provides a framework for understanding tax obligations, filing requirements, and procedural standards that must be adhered to by taxpayers in Florida.

Steps to Complete the AGENDA FLORIDA DEPARTMENT OF REVENUE RULE

Completing the AGENDA FLORIDA DEPARTMENT OF REVENUE RULE involves several key steps. First, familiarize yourself with the specific requirements outlined in the rule. Next, gather all necessary documentation, including financial records and identification information. After that, fill out the required forms accurately, ensuring that all information is complete and correct. Finally, submit the completed forms through the designated channels, whether online, by mail, or in person, as specified by the Florida Department of Revenue.

Legal Use of the AGENDA FLORIDA DEPARTMENT OF REVENUE RULE

The legal use of the AGENDA FLORIDA DEPARTMENT OF REVENUE RULE is crucial for maintaining compliance with state regulations. Taxpayers must adhere to the guidelines set forth in the rule to avoid potential penalties or legal repercussions. Understanding the legal implications of the rule ensures that individuals and businesses can navigate their tax obligations effectively while safeguarding their rights and interests.

Key Elements of the AGENDA FLORIDA DEPARTMENT OF REVENUE RULE

Several key elements define the AGENDA FLORIDA DEPARTMENT OF REVENUE RULE. These include the specific tax categories it covers, the obligations imposed on taxpayers, and the procedures for filing and compliance. Additionally, the rule outlines the penalties for non-compliance, ensuring that taxpayers are aware of the consequences of failing to meet their obligations. Understanding these elements is vital for effective tax planning and compliance.

Required Documents for the AGENDA FLORIDA DEPARTMENT OF REVENUE RULE

To comply with the AGENDA FLORIDA DEPARTMENT OF REVENUE RULE, taxpayers must prepare several required documents. These typically include identification forms, tax returns, financial statements, and any additional documentation that supports the information provided in the filings. Ensuring that all required documents are complete and accurate is essential for a smooth submission process and to avoid delays or complications.

Filing Deadlines and Important Dates

Filing deadlines and important dates associated with the AGENDA FLORIDA DEPARTMENT OF REVENUE RULE are critical for compliance. Taxpayers should be aware of the specific dates for filing returns, making payments, and submitting any required documentation. Keeping track of these deadlines helps prevent late fees and ensures that taxpayers remain in good standing with the Florida Department of Revenue.

Examples of Using the AGENDA FLORIDA DEPARTMENT OF REVENUE RULE

Examples of using the AGENDA FLORIDA DEPARTMENT OF REVENUE RULE can provide clarity on its application. For instance, a small business may utilize the rule to determine its sales tax obligations when selling goods in Florida. Similarly, an individual may refer to the rule when filing state income taxes to ensure compliance with all necessary requirements. These examples illustrate the practical implications of the rule in various scenarios.

Quick guide on how to complete agenda florida department of revenue rule

Complete [SKS] effortlessly on any device

Digital document management has gained popularity among companies and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed materials, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign [SKS] without hassle

- Find [SKS] and click on Get Form to begin.

- Use the tools available to complete your form.

- Emphasize relevant portions of your documents or hide sensitive data with the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and electronically sign [SKS] to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to AGENDA FLORIDA DEPARTMENT OF REVENUE RULE

Create this form in 5 minutes!

How to create an eSignature for the agenda florida department of revenue rule

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the AGENDA FLORIDA DEPARTMENT OF REVENUE RULE?

The AGENDA FLORIDA DEPARTMENT OF REVENUE RULE outlines the regulations and procedures that businesses must follow when interacting with the Florida Department of Revenue. Understanding this rule is crucial for compliance and efficient tax management. airSlate SignNow can help streamline document processes related to these regulations.

-

How can airSlate SignNow assist with the AGENDA FLORIDA DEPARTMENT OF REVENUE RULE?

airSlate SignNow provides a user-friendly platform for businesses to create, send, and eSign documents that comply with the AGENDA FLORIDA DEPARTMENT OF REVENUE RULE. This ensures that all necessary documentation is handled efficiently and securely, reducing the risk of errors and delays.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various businesses. Each plan includes features that support compliance with the AGENDA FLORIDA DEPARTMENT OF REVENUE RULE, ensuring you get the best value for your investment. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for compliance with the AGENDA FLORIDA DEPARTMENT OF REVENUE RULE?

Key features of airSlate SignNow include customizable templates, secure eSigning, and automated workflows that help ensure compliance with the AGENDA FLORIDA DEPARTMENT OF REVENUE RULE. These tools simplify the document management process, making it easier for businesses to stay compliant.

-

Are there integrations available with airSlate SignNow for the AGENDA FLORIDA DEPARTMENT OF REVENUE RULE?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms that businesses commonly use. This allows for efficient document handling and ensures that all processes related to the AGENDA FLORIDA DEPARTMENT OF REVENUE RULE are streamlined and effective.

-

What are the benefits of using airSlate SignNow for the AGENDA FLORIDA DEPARTMENT OF REVENUE RULE?

Using airSlate SignNow for the AGENDA FLORIDA DEPARTMENT OF REVENUE RULE offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. The platform's intuitive design makes it easy for users to manage documents, ensuring that all necessary steps are followed.

-

Is airSlate SignNow secure for handling documents related to the AGENDA FLORIDA DEPARTMENT OF REVENUE RULE?

Absolutely! airSlate SignNow prioritizes security and compliance, employing advanced encryption and security measures to protect your documents. This is especially important when dealing with sensitive information related to the AGENDA FLORIDA DEPARTMENT OF REVENUE RULE.

Get more for AGENDA FLORIDA DEPARTMENT OF REVENUE RULE

Find out other AGENDA FLORIDA DEPARTMENT OF REVENUE RULE

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple