Printable Iowa 2018

What is the 2018 Iowa 1040?

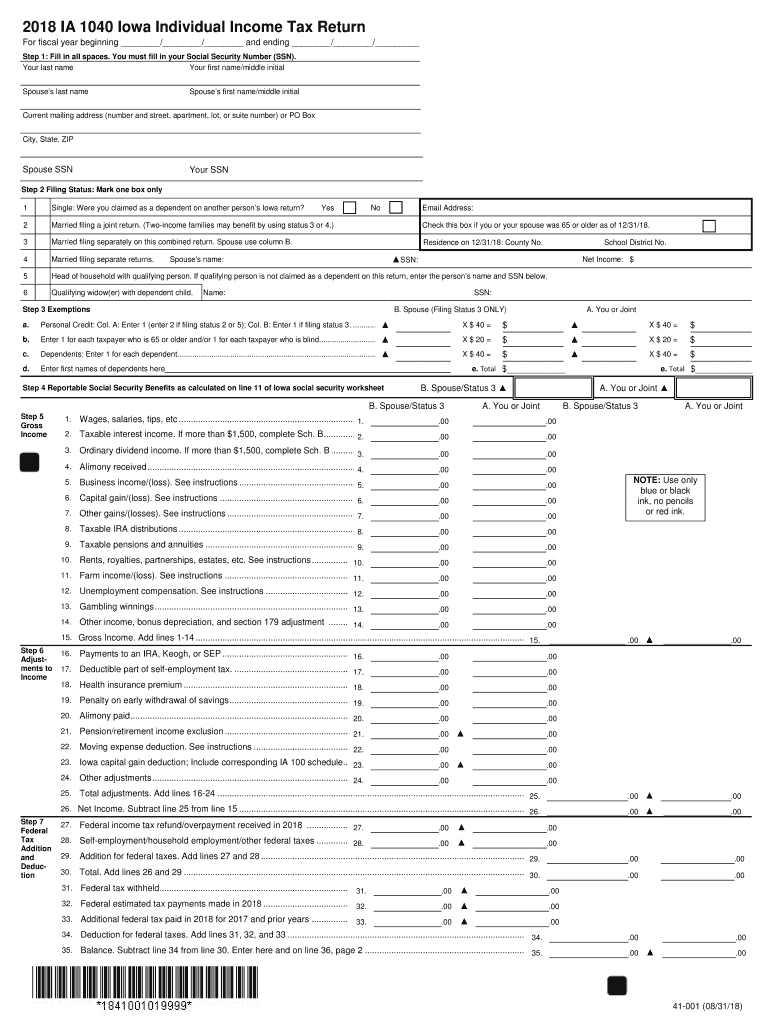

The 2018 Iowa 1040 is the state income tax return form used by residents of Iowa to report their income, calculate their tax liability, and claim any applicable credits or deductions. This form is essential for individuals and families who earn income in Iowa and need to comply with state tax laws. The 2018 Iowa 1040 includes various sections for reporting income, such as wages, interest, and dividends, as well as adjustments to income and tax credits. Understanding this form is crucial for accurate tax filing and compliance.

Steps to Complete the 2018 Iowa 1040

Completing the 2018 Iowa 1040 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including W-2s, 1099s, and other income statements. Next, fill out the personal information section, providing details such as your name, address, and Social Security number. Then, report your total income in the appropriate sections, making sure to include all sources of income. After calculating your taxable income, apply any deductions or credits you may qualify for. Finally, review your completed form for accuracy before submitting it.

Filing Deadlines / Important Dates

For the 2018 Iowa 1040, the filing deadline typically aligns with the federal tax deadline, which is usually April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential to file your return on time to avoid penalties and interest on any unpaid taxes. If you need additional time, you may file for an extension, but be aware that this does not extend the time to pay any taxes owed.

Legal Use of the 2018 Iowa 1040

The 2018 Iowa 1040 is a legally recognized document for reporting income and tax liability in the state of Iowa. It must be completed accurately and submitted to the Iowa Department of Revenue to fulfill legal tax obligations. Failing to file or providing false information can result in penalties, including fines and interest on unpaid taxes. It is important to ensure that all information reported on the form is truthful and complete to avoid legal repercussions.

Key Elements of the 2018 Iowa 1040

Several key elements are essential to the 2018 Iowa 1040. These include:

- Personal Information: Name, address, and Social Security number.

- Income Reporting: Total income from various sources, including wages and investments.

- Deductions and Credits: Applicable deductions and tax credits that reduce overall tax liability.

- Signature: A signature is required to validate the form, confirming the accuracy of the information provided.

Form Submission Methods

The 2018 Iowa 1040 can be submitted through various methods, including:

- Online Submission: Many taxpayers choose to file electronically using tax software, which can streamline the process and reduce errors.

- Mail: Taxpayers can print the completed form and mail it to the Iowa Department of Revenue.

- In-Person: Some individuals may opt to deliver their forms in person at designated state tax offices.

Quick guide on how to complete iowa income tax forms fillable 2018 2019

Your assistance manual on how to prepare your Printable Iowa

If you’re wondering how to create and submit your Printable Iowa, here are a few brief instructions on how to simplify tax processing.

To begin, you just need to register your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a user-friendly and robust document solution that enables you to edit, produce, and complete your income tax forms with ease. With its editor, you can alternate between text, check boxes, and eSignatures and return to modify information where necessary. Optimize your tax administration with enhanced PDF editing, eSigning, and intuitive sharing.

Adhere to the instructions below to complete your Printable Iowa in moments:

- Create your account and start working on PDFs within moments.

- Utilize our directory to obtain any IRS tax form; browse through versions and schedules.

- Click Obtain form to open your Printable Iowa in our editor.

- Complete the mandatory fillable fields with your details (text, numbers, checkmarks).

- Employ the Signature Tool to insert your legally-binding eSignature (if needed).

- Review your document and rectify any discrepancies.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Be aware that submitting on paper can increase return errors and delay reimbursements. Of course, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct iowa income tax forms fillable 2018 2019

FAQs

-

I'm trying to fill out a free fillable tax form. It won't let me click "done with this form" or "efile" which?

From https://www.irs.gov/pub/irs-utl/... (emphasis mine):DONE WITH THIS FORM — Select this button to save and close the form you are currently viewing and return to your 1040 form. This button is disabled when you are in your 1040 formSo, it appears, and without them mentioning it while you're working on it, that button is for all forms except 1040. Thank you to the other response to this question. I would never have thought of just clicking the Step 2 tab.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How can I fill out the income tax return of the year 2016-17 in 2018?

There is no option to file online return but you can prepare an offline return and went to the officer of your jurisdiction income tax commissioner and after his permission you can file the return with his office.

-

Which ITR form should an NRI fill out for AY 2018–2019 if there are two rental incomes in India other than that from interests?

Choosing Correct Income Tax form is the important aspect of filling Income tax return.Lets us discuss it one by one.ITR -1 —— Mainly used for salary income , other source income, one house property income ( upto Rs. 50 Lakhs ) for Individual Resident Assessees only.ITR-2 —- For Salary Income , Other source income ( exceeding Rs. 50 lakhs) house property income from more than one house and Capital Gains / Loss Income for Individual Resident or Non- Resident Assessees and HUF Assessees only.ITR 3— Income from Business or profession Together with any other income such as Salary Income, Other sources, Capital Gains , House property ( Business/ Profession income is must for filling this form) . For individual and HUF Assessees OnlySo in case NRI Assessees having rental income from two house property , then ITR need to be filed in Form ITR 2.For Detail understanding please refer to my video link.

Create this form in 5 minutes!

How to create an eSignature for the iowa income tax forms fillable 2018 2019

How to make an eSignature for your Iowa Income Tax Forms Fillable 2018 2019 online

How to generate an electronic signature for the Iowa Income Tax Forms Fillable 2018 2019 in Chrome

How to make an electronic signature for putting it on the Iowa Income Tax Forms Fillable 2018 2019 in Gmail

How to create an eSignature for the Iowa Income Tax Forms Fillable 2018 2019 from your smart phone

How to create an eSignature for the Iowa Income Tax Forms Fillable 2018 2019 on iOS devices

How to generate an electronic signature for the Iowa Income Tax Forms Fillable 2018 2019 on Android devices

People also ask

-

What is the 2018 Iowa 1040 form used for?

The 2018 Iowa 1040 form is used by Iowa residents to report their income and calculate state taxes. It includes details on income, deductions, and tax credits specific to Iowa. Utilizing the 2018 Iowa 1040 is essential for accurate state tax filing and compliance.

-

How can I eSign my 2018 Iowa 1040 documents with airSlate SignNow?

With airSlate SignNow, eSigning your 2018 Iowa 1040 documents is straightforward. You can upload your tax forms, add signature fields, and invite others to eSign. This process ensures a fast and secure signing experience, making tax filing easier.

-

Are there costs associated with using airSlate SignNow for the 2018 Iowa 1040?

Yes, airSlate SignNow offers a range of pricing plans to accommodate different needs. While there may be a fee for using their advanced features, the solution remains cost-effective compared to traditional printing and mailing methods for your 2018 Iowa 1040.

-

What features does airSlate SignNow provide for preparing the 2018 Iowa 1040?

airSlate SignNow provides features such as document templates, eSignature capabilities, and secure storage to simplify preparing the 2018 Iowa 1040. These tools streamline the process, allowing for easy edits and sharing before submission.

-

Can airSlate SignNow integrate with tax software for the 2018 Iowa 1040?

Absolutely! airSlate SignNow seamlessly integrates with various tax software, making it easy to manage your 2018 Iowa 1040. This ensures that you can import necessary data directly, improving accuracy and efficiency in your tax preparations.

-

What are the benefits of using airSlate SignNow for my 2018 Iowa 1040 filing?

Using airSlate SignNow for your 2018 Iowa 1040 filing offers numerous benefits, including time savings and enhanced security. The platform allows quick eSigning and document sharing, reducing the time spent on administrative tasks while ensuring your sensitive information is protected.

-

Is it safe to submit my 2018 Iowa 1040 through airSlate SignNow?

Yes, submitting your 2018 Iowa 1040 through airSlate SignNow is safe. The platform employs industry-standard encryption and security protocols to protect your documents and personal information. You can confidently eSign and send your tax forms securely.

Get more for Printable Iowa

- Cancer mitosis gone wrong answer key form

- Amtgard waiver form

- North carolina rocky mount form

- Form 4a 206 request for hearing

- Application for the refund of payment for approved equipment 405665535 form

- Power of attorney california form

- Ordering information child care licensing inquiry packets dcf f cfs2022 child care licensing

- Authorization to administer medication child care centers dcf f cfs0059 form

Find out other Printable Iowa

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple