Iowa Withholding Annual Vsp Report 2018

What is the Iowa Withholding Annual Vsp Report

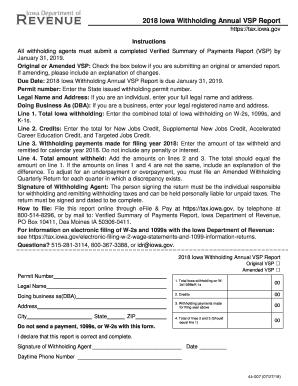

The Iowa Withholding Annual Vsp Report, known as form 44-007, is a crucial document for employers in Iowa. This report summarizes the total amount of state income tax withheld from employees' wages throughout the year. It is essential for ensuring compliance with state tax regulations and for accurate reporting to the Iowa Department of Revenue. The information provided in this form helps the state track tax revenues and ensures that employers fulfill their withholding obligations.

Steps to complete the Iowa Withholding Annual Vsp Report

Completing the Iowa Withholding Annual Vsp Report involves several key steps:

- Gather employee wage and withholding information for the entire year.

- Calculate the total state income tax withheld from each employee's wages.

- Fill out the form 44-007 with the total amounts and any required details.

- Review the completed form for accuracy to prevent errors that could lead to penalties.

- Submit the form by the designated filing deadline.

Legal use of the Iowa Withholding Annual Vsp Report

The Iowa Withholding Annual Vsp Report must be used in accordance with state tax laws. Employers are legally required to file this report annually to accurately reflect the state income tax withheld from their employees. Failure to submit the report on time or providing inaccurate information can lead to penalties, including fines and interest on unpaid taxes. It is important for employers to stay informed about any changes in tax laws that may affect their reporting obligations.

Filing Deadlines / Important Dates

Employers must be aware of specific deadlines for filing the Iowa Withholding Annual Vsp Report. Typically, the report is due by January 31 of the year following the tax year being reported. It is essential to mark this date on your calendar to avoid late submissions. Additionally, employers should keep track of any changes in deadlines announced by the Iowa Department of Revenue, especially during tax season.

Form Submission Methods (Online / Mail / In-Person)

The Iowa Withholding Annual Vsp Report can be submitted through various methods, providing flexibility for employers. The available submission methods include:

- Online: Employers can file the form electronically through the Iowa Department of Revenue's online portal.

- Mail: The completed form can be printed and mailed to the appropriate address for the Iowa Department of Revenue.

- In-Person: Employers may also choose to deliver the form in person at designated state offices.

Key elements of the Iowa Withholding Annual Vsp Report

When filling out the Iowa Withholding Annual Vsp Report, certain key elements must be included to ensure compliance. These elements typically consist of:

- Employer's name and address

- Employer's Iowa withholding account number

- Total wages paid to employees

- Total state income tax withheld

- Signature of the person responsible for the report

Quick guide on how to complete iowa withholding annual vsp report 44007

Your assistance manual on how to prepare your Iowa Withholding Annual Vsp Report

If you're interested in learning how to generate and submit your Iowa Withholding Annual Vsp Report, here are some brief guidelines to make tax reporting easier.

To begin, you simply need to set up your airSlate SignNow account to revolutionize your online document management. airSlate SignNow is an intuitive and powerful document solution that enables you to modify, create, and complete your tax forms with ease. Utilizing its editor, you can toggle between text, checkboxes, and eSignatures, and go back to adjust details as necessary. Streamline your tax handling with advanced PDF editing, eSigning, and straightforward sharing options.

Follow the instructions below to complete your Iowa Withholding Annual Vsp Report in just a few minutes:

- Create your account and start working on PDFs within moments.

- Utilize our directory to find any IRS tax form; browse through variations and schedules.

- Click Get form to open your Iowa Withholding Annual Vsp Report in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Use the Sign Tool to add your legally-recognized eSignature (if needed).

- Examine your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Be aware that paper filing can lead to increased return mistakes and delayed refunds. Of course, before e-filing your taxes, consult the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct iowa withholding annual vsp report 44007

FAQs

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

Create this form in 5 minutes!

How to create an eSignature for the iowa withholding annual vsp report 44007

How to create an electronic signature for the Iowa Withholding Annual Vsp Report 44007 online

How to generate an eSignature for the Iowa Withholding Annual Vsp Report 44007 in Google Chrome

How to generate an electronic signature for signing the Iowa Withholding Annual Vsp Report 44007 in Gmail

How to generate an eSignature for the Iowa Withholding Annual Vsp Report 44007 right from your mobile device

How to make an electronic signature for the Iowa Withholding Annual Vsp Report 44007 on iOS devices

How to generate an electronic signature for the Iowa Withholding Annual Vsp Report 44007 on Android devices

People also ask

-

What is the form44 007?

The form44 007 is a specific document format utilized for electronic signatures. It is designed to streamline the signing process, making it more efficient for businesses. With airSlate SignNow, users can easily send and eSign form44 007 documents securely and conveniently.

-

How does airSlate SignNow integrate with form44 007?

airSlate SignNow seamlessly supports form44 007, providing a user-friendly platform to manage these documents. Users can quickly upload, send, and track form44 007 signatures in real-time. The platform's integration capabilities ensure compatibility with other tools your business may already use.

-

What are the pricing options for using form44 007 with airSlate SignNow?

airSlate SignNow offers competitive pricing plans for businesses looking to utilize form44 007. These plans cater to various business sizes and needs, ensuring that you only pay for what you require. The transparent pricing model allows users to choose a package that best suits their budget and document signing needs.

-

What features does airSlate SignNow provide for managing form44 007?

AirSlate SignNow offers a range of features to enhance the management of form44 007. Users can take advantage of template creation, automated reminders, and real-time tracking of document status. These features help ensure efficient processes and timely completion of the signing tasks.

-

What benefits can businesses expect when using form44 007 with airSlate SignNow?

By utilizing form44 007 with airSlate SignNow, businesses can experience increased efficiency in document handling. The ability to eSign documents remotely streamlines workflows and saves time. Additionally, it reduces the risk of errors and enhances security in document transactions.

-

Is it easy to switch to airSlate SignNow for form44 007 processing?

Switching to airSlate SignNow for form44 007 processing is straightforward, with dedicated support to assist you through the transition. The platform's user-friendly interface ensures a smooth onboarding experience. Businesses can quickly adapt and start benefiting from the advanced features available for form44 007.

-

Can airSlate SignNow help with compliance when using form44 007?

Yes, airSlate SignNow provides features that help ensure compliance when working with form44 007. The platform adheres to legal standards for electronic signatures, ensuring that all eSigned documents are legally binding. This helps businesses maintain compliance and mitigates legal risks.

Get more for Iowa Withholding Annual Vsp Report

- Worksheet for sieve analysis of fine and coarse aggregate aashto t 11 and aashto t 27 flh fhwa dot form

- Sample aztech recognition agreement form

- Hospital inventory list form

- Nysdoh form 5072 parent of legal guardian consent for body

- Sign in sign out sheet dhmh 568doc dhmh maryland form

- Example of goodwill checklist form

- Automatic payments via eft authorization form

- Bfa form 800 application for assistancenew hampshire

Find out other Iowa Withholding Annual Vsp Report

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online