Return on Average Bank of North Dakota Banknd Nd Form

Understanding the Return On Average Bank Of North Dakota Banknd Nd

The Return On Average for the Bank Of North Dakota, often referred to as Banknd Nd, is a financial metric that reflects the bank's profitability in relation to its average assets. This figure is crucial for stakeholders, including investors and regulators, as it provides insights into the bank's operational efficiency and financial health. A higher return indicates better performance, showcasing the bank's ability to generate profit from its assets.

How to Use the Return On Average Bank Of North Dakota Banknd Nd

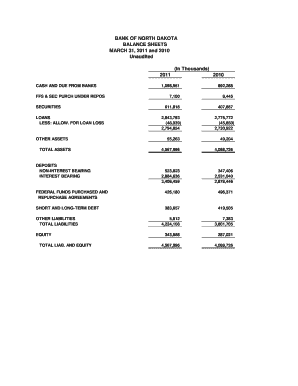

Utilizing the Return On Average involves analyzing the bank's financial statements, particularly the income statement and balance sheet. Stakeholders can assess trends over time by comparing the Return On Average across different periods. This analysis aids in making informed decisions regarding investments or regulatory compliance. Additionally, understanding this metric can help in evaluating the bank's performance against industry benchmarks.

Steps to Complete the Return On Average Bank Of North Dakota Banknd Nd

To calculate the Return On Average for the Bank Of North Dakota, follow these steps:

- Gather the bank's net income from the income statement.

- Determine the average total assets, which can be found on the balance sheet.

- Use the formula: Return On Average = (Net Income / Average Total Assets) x 100.

- Analyze the result to understand the bank's profitability relative to its asset base.

Legal Use of the Return On Average Bank Of North Dakota Banknd Nd

The Return On Average is not only a tool for internal assessment but also serves legal and regulatory purposes. Financial institutions are required to report this metric to regulatory bodies to ensure transparency and compliance with banking laws. Accurate reporting is essential, as discrepancies can lead to legal repercussions or penalties.

Key Elements of the Return On Average Bank Of North Dakota Banknd Nd

Key elements that influence the Return On Average include:

- Net income: This is the profit after all expenses have been deducted.

- Average total assets: This includes all assets owned by the bank, averaged over a specific period.

- Operational efficiency: This reflects how well the bank utilizes its assets to generate income.

- Market conditions: Economic factors can impact both net income and asset values, influencing the Return On Average.

Examples of Using the Return On Average Bank Of North Dakota Banknd Nd

For instance, if the Bank Of North Dakota reports a net income of two million dollars and average total assets of twenty million dollars, the Return On Average would be calculated as follows: (2,000,000 / 20,000,000) x 100, resulting in a ten percent Return On Average. This example illustrates how stakeholders can interpret the bank's profitability and make informed decisions based on this metric.

Quick guide on how to complete return on average bank of north dakota banknd nd

Complete [SKS] effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any platform using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes only a few seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or mistakes that require the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the return on average bank of north dakota banknd nd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Return On Average Bank Of North Dakota Banknd Nd?

The Return On Average Bank Of North Dakota Banknd Nd refers to the financial performance metrics that indicate how effectively the bank generates profit relative to its average assets. Understanding this metric can help customers assess the bank's efficiency and profitability, which is crucial for making informed financial decisions.

-

How does airSlate SignNow improve document management for Bank Of North Dakota customers?

airSlate SignNow enhances document management for Bank Of North Dakota customers by providing a seamless eSigning experience. With features like templates and automated workflows, users can efficiently manage their documents, ensuring that they meet the standards of the Return On Average Bank Of North Dakota Banknd Nd.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various businesses, including those associated with the Return On Average Bank Of North Dakota Banknd Nd. Customers can choose from different tiers based on their document volume and feature requirements, ensuring cost-effectiveness.

-

What features does airSlate SignNow provide to enhance eSigning?

airSlate SignNow provides a range of features such as customizable templates, real-time tracking, and secure cloud storage. These features not only streamline the eSigning process but also align with the Return On Average Bank Of North Dakota Banknd Nd by ensuring that transactions are efficient and secure.

-

Can airSlate SignNow integrate with other software used by Bank Of North Dakota?

Yes, airSlate SignNow can integrate with various software solutions commonly used by Bank Of North Dakota. This integration capability enhances the overall workflow and supports the Return On Average Bank Of North Dakota Banknd Nd by allowing users to manage documents within their existing systems.

-

What benefits does airSlate SignNow offer for businesses in North Dakota?

Businesses in North Dakota can benefit from airSlate SignNow through increased efficiency and reduced turnaround times for document signing. By leveraging the platform, companies can improve their operational metrics, which can positively impact the Return On Average Bank Of North Dakota Banknd Nd.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely, airSlate SignNow prioritizes security with features like encryption and secure access controls. This ensures that sensitive documents are protected, which is essential for maintaining trust and compliance, especially for institutions focused on the Return On Average Bank Of North Dakota Banknd Nd.

Get more for Return On Average Bank Of North Dakota Banknd Nd

- Florida form answer 2012

- 12 902 d 2018 2019 form

- Nj order cause 2012 2019 form

- Case information statement cis lp case information statement cis lp

- Case information statement cis lp new jersey courts judiciary state nj

- Child support guideline worksheet form

- Stipulated judgement form oregon 2017 2019

- Et 4926 2017 2019 form

Find out other Return On Average Bank Of North Dakota Banknd Nd

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form