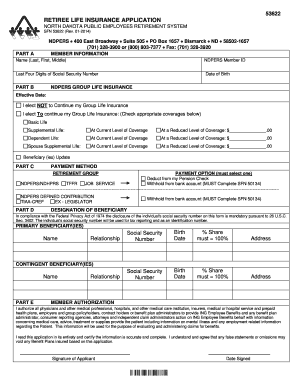

RETIREE LIFE INSURANCE APPLICATION Form

What is the RETIREE LIFE INSURANCE APPLICATION

The RETIREE LIFE INSURANCE APPLICATION is a formal document used by individuals who are retired and seeking to secure life insurance coverage. This application is designed to gather essential information about the applicant, including personal details, health history, and financial background, which insurers use to assess risk and determine eligibility for coverage. It is an important step in ensuring financial security for beneficiaries after the policyholder's passing.

Key elements of the RETIREE LIFE INSURANCE APPLICATION

When filling out the RETIREE LIFE INSURANCE APPLICATION, several key elements must be included:

- Personal Information: This includes the applicant's name, address, date of birth, and Social Security number.

- Health History: Applicants must disclose any pre-existing medical conditions, medications, and previous surgeries.

- Beneficiary Information: It is crucial to specify who will receive the benefits of the policy upon the applicant's death.

- Financial Information: This may include income details and any existing insurance policies.

- Coverage Amount: Applicants should indicate the desired amount of life insurance coverage.

Steps to complete the RETIREE LIFE INSURANCE APPLICATION

Completing the RETIREE LIFE INSURANCE APPLICATION involves several steps to ensure accuracy and completeness:

- Gather necessary documents, including identification, health records, and financial statements.

- Fill out the application form with accurate personal and health information.

- Review the completed application for any errors or omissions.

- Sign and date the application to validate it.

- Submit the application to the insurance provider through the preferred method (online, mail, or in-person).

Eligibility Criteria

Eligibility for the RETIREE LIFE INSURANCE APPLICATION typically depends on several factors:

- Age: Most insurers have specific age limits for retirees applying for life insurance.

- Health Status: Applicants may need to undergo a medical examination or provide health documentation.

- Residency: Applicants must be residents of the United States and comply with state regulations.

- Financial Stability: Insurers may assess the applicant's financial situation to determine the appropriate coverage.

Form Submission Methods

The RETIREE LIFE INSURANCE APPLICATION can be submitted through various methods, depending on the insurance provider:

- Online Submission: Many insurers offer secure online portals for submitting applications electronically.

- Mail: Applicants can print the completed form and send it via postal mail to the insurer's address.

- In-Person: Some applicants may prefer to deliver their application directly to an insurance agent or office.

Legal use of the RETIREE LIFE INSURANCE APPLICATION

The RETIREE LIFE INSURANCE APPLICATION serves a legal purpose in establishing a binding contract between the insurer and the applicant. Once the application is approved, it becomes part of the insurance policy documentation. It is essential to provide truthful and accurate information, as any discrepancies can lead to denial of claims or cancellation of the policy. Understanding the legal implications of the application process is crucial for retirees seeking life insurance coverage.

Quick guide on how to complete retiree life insurance application

Prepare [SKS] effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and eSign your documents swiftly without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Highlight important sections of your documents or redact sensitive information with the tools available through airSlate SignNow designed specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to RETIREE LIFE INSURANCE APPLICATION

Create this form in 5 minutes!

How to create an eSignature for the retiree life insurance application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a RETIREE LIFE INSURANCE APPLICATION?

A RETIREE LIFE INSURANCE APPLICATION is a document that individuals fill out to apply for life insurance coverage specifically designed for retirees. This application typically includes personal information, health history, and coverage preferences to help insurers assess eligibility and provide appropriate options.

-

How much does a RETIREE LIFE INSURANCE APPLICATION cost?

The cost associated with a RETIREE LIFE INSURANCE APPLICATION can vary based on factors such as the type of coverage, the insurer, and the applicant's health status. It's essential to compare different policies and providers to find a cost-effective solution that meets your needs.

-

What are the benefits of completing a RETIREE LIFE INSURANCE APPLICATION?

Completing a RETIREE LIFE INSURANCE APPLICATION can provide peace of mind by ensuring financial security for your loved ones after your passing. Additionally, it can help retirees access tailored coverage options that fit their unique circumstances and health considerations.

-

What features should I look for in a RETIREE LIFE INSURANCE APPLICATION?

When reviewing a RETIREE LIFE INSURANCE APPLICATION, look for features such as flexible coverage amounts, easy online submission, and quick approval processes. Additionally, consider options for riders that can enhance your policy, such as accidental death benefits or long-term care coverage.

-

Can I complete a RETIREE LIFE INSURANCE APPLICATION online?

Yes, many insurance providers offer the option to complete a RETIREE LIFE INSURANCE APPLICATION online, making the process convenient and efficient. This allows retirees to submit their applications from the comfort of their homes and often receive quicker responses.

-

How long does it take to process a RETIREE LIFE INSURANCE APPLICATION?

The processing time for a RETIREE LIFE INSURANCE APPLICATION can vary by insurer, but many applications are processed within a few days to a couple of weeks. Factors such as the complexity of the application and the need for additional information can influence the timeline.

-

Are there any age restrictions for a RETIREE LIFE INSURANCE APPLICATION?

Most insurers have specific age limits for a RETIREE LIFE INSURANCE APPLICATION, typically targeting individuals aged 50 and above. However, it's essential to check with individual providers, as some may offer policies with no upper age limit.

Get more for RETIREE LIFE INSURANCE APPLICATION

- Nc logger safety checklist booklet carolina loggers association form

- Tp103 2014 2019 form

- Ncaeop membership 2018 2019 form

- Nd f 66 2013 2019 form

- New hampshire fishing game permanent crossbow permit 2018 2019 form

- New jersey standard policy coverage selection form antique

- Water allocation permit application for renewals state of new nj form

- Week 1 personal responsibilities of citizenship flashcardsquizlet form

Find out other RETIREE LIFE INSURANCE APPLICATION

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors