Schedule 38 UT Calculation of Interest on Underpayment or Late Payment of Estimated Income Tax for Estates and Trusts Schedule 3 Form

Understanding Schedule 38 UT for Estates and Trusts

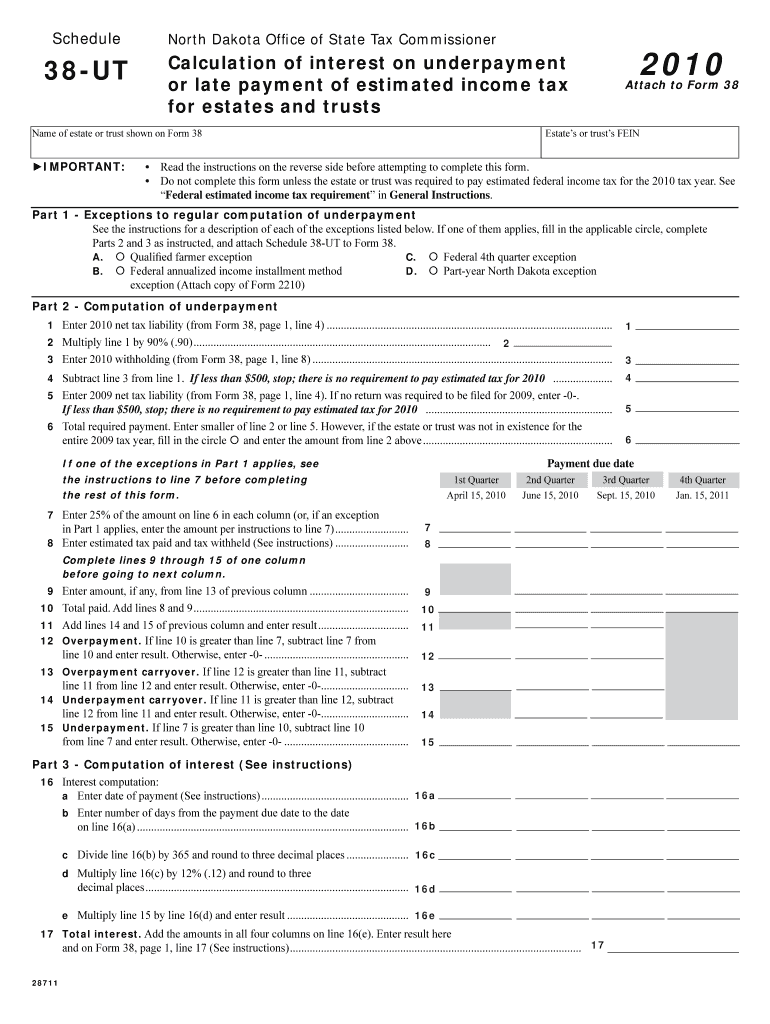

The Schedule 38 UT is a specific form used to calculate interest on underpayment or late payment of estimated income tax for estates and trusts. This form is essential for fiduciaries who manage estates or trusts and need to report any interest owed due to underpayment of taxes. The calculations involve determining the amount of estimated tax that was not paid on time and applying the appropriate interest rates as outlined by the IRS. Understanding this form is crucial for compliance and accurate tax reporting.

How to Complete Schedule 38 UT

Completing the Schedule 38 UT involves several steps. First, gather all necessary financial documents related to the estate or trust, including prior tax returns and estimated tax payments made. Next, calculate the total estimated tax liability for the year. If any payments were missed or underpaid, you will need to determine the amount owed. Finally, fill out the form with the calculated interest based on the IRS guidelines, ensuring all figures are accurate before submission.

Key Components of Schedule 38 UT

Several key elements must be included when completing Schedule 38 UT. These include:

- Taxpayer Information: Include the name and identification number of the estate or trust.

- Estimated Tax Payments: Report all estimated tax payments made during the year.

- Interest Calculation: Use the IRS interest rates to calculate any amounts owed due to late payments.

- Signature: Ensure the form is signed by the fiduciary or authorized representative.

Filing Deadlines for Schedule 38 UT

It is important to be aware of the filing deadlines associated with Schedule 38 UT. Typically, the form must be filed by the due date of the estate or trust's income tax return. This is usually the fifteenth day of the fourth month following the end of the tax year. Missing this deadline can result in penalties and interest accruing on the unpaid tax amount.

Examples of Schedule 38 UT Applications

To illustrate the application of Schedule 38 UT, consider a trust that underestimated its tax liability and failed to make sufficient estimated payments throughout the year. When completing the form, the fiduciary would calculate the interest owed based on the unpaid amounts and the time they were overdue. Another example could involve an estate that experienced delays in asset liquidation, leading to late estimated tax payments. In both cases, the Schedule 38 UT assists in accurately reporting and rectifying the tax obligations.

IRS Guidelines for Schedule 38 UT

The IRS provides specific guidelines for completing and submitting Schedule 38 UT. It is essential to refer to the latest IRS publications and instructions for the most accurate information. These guidelines include details on interest rates applicable for underpayment, how to calculate the owed amounts, and any updates to filing procedures. Adhering to these guidelines helps ensure compliance and minimizes the risk of penalties.

Quick guide on how to complete schedule 38 ut calculation of interest on underpayment or late payment of estimated income tax for estates and trusts schedule

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can access the necessary forms and safely store them online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents promptly without any holdups. Manage [SKS] on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

The Easiest Method to Edit and eSign [SKS] with Ease

- Locate [SKS] and then click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive details using tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, the hassle of searching for forms, or errors that require new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Edit and eSign [SKS] and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule 38 UT Calculation Of Interest On Underpayment Or Late Payment Of Estimated Income Tax For Estates And Trusts Schedule 3

Create this form in 5 minutes!

How to create an eSignature for the schedule 38 ut calculation of interest on underpayment or late payment of estimated income tax for estates and trusts schedule

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule 38 UT Calculation Of Interest On Underpayment Or Late Payment Of Estimated Income Tax For Estates And Trusts?

The Schedule 38 UT Calculation Of Interest On Underpayment Or Late Payment Of Estimated Income Tax For Estates And Trusts is a tax form used to determine the interest owed on underpayments or late payments of estimated income tax for estates and trusts. This calculation is crucial for ensuring compliance with tax regulations and avoiding penalties.

-

How can airSlate SignNow assist with the Schedule 38 UT Calculation?

airSlate SignNow provides an easy-to-use platform that simplifies the process of completing the Schedule 38 UT Calculation Of Interest On Underpayment Or Late Payment Of Estimated Income Tax For Estates And Trusts. With our solution, users can efficiently manage their documents and ensure accurate calculations, saving time and reducing errors.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as eSigning, document templates, and secure storage, all of which are beneficial for managing tax documents like the Schedule 38 UT Calculation Of Interest On Underpayment Or Late Payment Of Estimated Income Tax For Estates And Trusts. These features enhance productivity and streamline the tax filing process.

-

Is there a cost associated with using airSlate SignNow for tax calculations?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to essential features for managing documents, including those related to the Schedule 38 UT Calculation Of Interest On Underpayment Or Late Payment Of Estimated Income Tax For Estates And Trusts, ensuring you get the best value for your investment.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow supports integrations with various accounting and tax software, making it easier to manage the Schedule 38 UT Calculation Of Interest On Underpayment Or Late Payment Of Estimated Income Tax For Estates And Trusts alongside your existing tools. This integration helps streamline workflows and enhances overall efficiency.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the Schedule 38 UT Calculation Of Interest On Underpayment Or Late Payment Of Estimated Income Tax For Estates And Trusts, offers numerous benefits. These include improved accuracy, faster processing times, and enhanced security for sensitive information, all contributing to a smoother tax filing experience.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your tax documents by employing advanced encryption and secure cloud storage. This ensures that your Schedule 38 UT Calculation Of Interest On Underpayment Or Late Payment Of Estimated Income Tax For Estates And Trusts and other sensitive information are protected from unauthorized access.

Get more for Schedule 38 UT Calculation Of Interest On Underpayment Or Late Payment Of Estimated Income Tax For Estates And Trusts Schedule 3

- New zealand visitor visa form 1018 2018 2019

- How to fill new zealand passenger arrival card 2018 2019 form

- Inz 1105 2015 2019 form

- Ac2103 residential application for a project information memorandum and or building consent

- Mlp 01213 form

- Send your full paper and coversheet to iasp2011papersiasp form

- Markus nomil iversen refer ncias na internet cyclopaedia net form

- 1 secretaria do estado da educa o programa de desenvolvimento form

Find out other Schedule 38 UT Calculation Of Interest On Underpayment Or Late Payment Of Estimated Income Tax For Estates And Trusts Schedule 3

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe