Individual Income Tax Forms and Instructions, Office of State

What is the Individual Income Tax Forms And Instructions, Office Of State

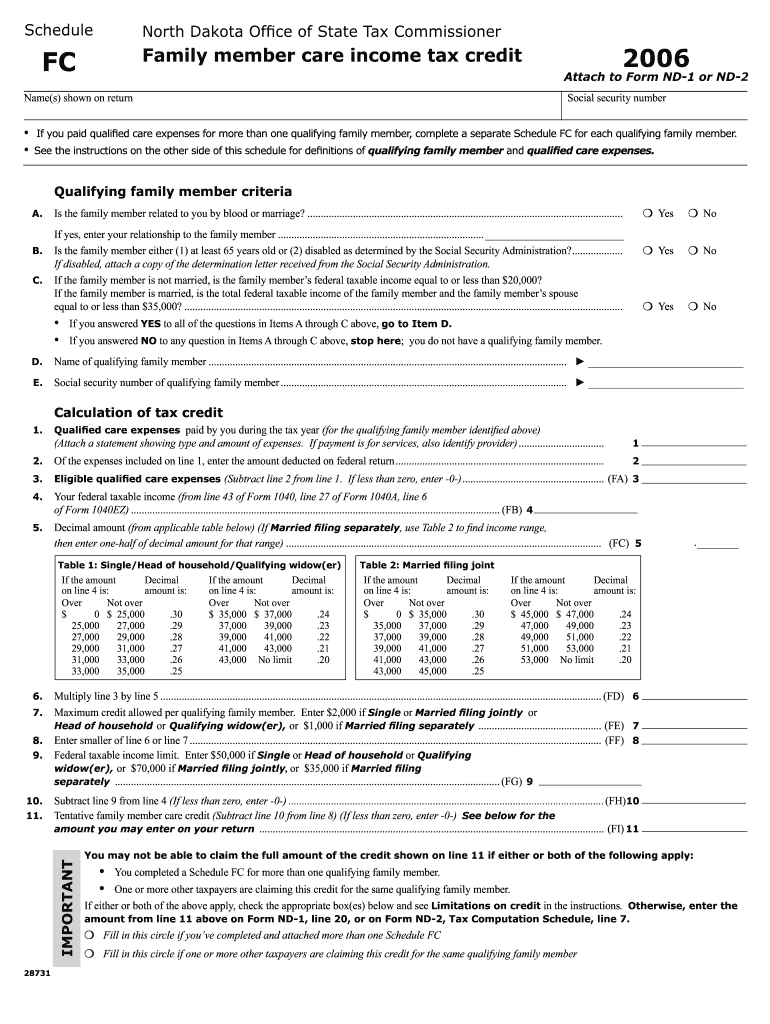

The Individual Income Tax Forms and Instructions provided by the Office of State are essential documents for residents to report their annual income to the state government. These forms facilitate the calculation of state tax obligations based on individual earnings, deductions, and credits. Each state may have its unique set of forms and instructions tailored to its tax laws, ensuring compliance with local regulations.

How to use the Individual Income Tax Forms And Instructions, Office Of State

Using the Individual Income Tax Forms and Instructions involves several steps. First, taxpayers should carefully read the instructions accompanying the forms to understand the requirements specific to their situation. It is important to gather all necessary documentation, such as W-2s, 1099s, and receipts for deductions. Once the forms are filled out, individuals can submit them through the designated method, whether online, by mail, or in person, as outlined in the instructions.

Steps to complete the Individual Income Tax Forms And Instructions, Office Of State

Completing the Individual Income Tax Forms requires a systematic approach:

- Collect all relevant income documents, including W-2s and 1099s.

- Review the instructions to identify applicable deductions and credits.

- Fill out the forms accurately, ensuring all information is complete.

- Double-check calculations to avoid errors.

- Submit the forms by the specified deadline using the preferred submission method.

Filing Deadlines / Important Dates

Filing deadlines for the Individual Income Tax Forms vary by state, but typically, they align with the federal tax deadline. Most states require forms to be submitted by April 15 each year. It is crucial to check specific state regulations for any variations or extensions that may apply, especially in unique circumstances such as natural disasters or public health emergencies.

Required Documents

To complete the Individual Income Tax Forms accurately, several documents are typically required:

- W-2 forms from employers.

- 1099 forms for additional income sources.

- Records of deductible expenses, such as medical bills and charitable contributions.

- Proof of residency, if applicable.

Form Submission Methods (Online / Mail / In-Person)

Individuals can submit their Individual Income Tax Forms through various methods, depending on state guidelines. Common submission options include:

- Online submission via the state’s tax website.

- Mailing completed forms to the designated tax office.

- In-person submission at local tax offices or designated locations.

Quick guide on how to complete individual income tax forms and instructions office of state

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click on Get Form to commence.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose your delivery method for the form: via email, SMS, or invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign [SKS] while ensuring effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Individual Income Tax Forms And Instructions, Office Of State

Create this form in 5 minutes!

How to create an eSignature for the individual income tax forms and instructions office of state

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Individual Income Tax Forms And Instructions, Office Of State?

Individual Income Tax Forms And Instructions, Office Of State, are essential documents required for filing state income taxes. These forms provide taxpayers with the necessary guidelines and information to accurately report their income and calculate their tax obligations. Understanding these forms is crucial for compliance and to avoid potential penalties.

-

How can airSlate SignNow help with Individual Income Tax Forms And Instructions, Office Of State?

airSlate SignNow simplifies the process of managing Individual Income Tax Forms And Instructions, Office Of State by allowing users to easily send, sign, and store these documents electronically. This streamlines the workflow, reduces paperwork, and ensures that all forms are securely handled. With our platform, you can focus on your tax preparation without the hassle of traditional methods.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as eSignature capabilities, document templates, and secure cloud storage specifically designed for managing Individual Income Tax Forms And Instructions, Office Of State. These features enhance efficiency and ensure that your documents are always accessible and compliant with state regulations. Additionally, our user-friendly interface makes it easy for anyone to navigate.

-

Is there a cost associated with using airSlate SignNow for tax forms?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs when managing Individual Income Tax Forms And Instructions, Office Of State. Our plans are designed to be cost-effective, providing excellent value for businesses and individuals alike. You can choose a plan that fits your budget while still benefiting from our comprehensive features.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow can be integrated with various tax preparation software, enhancing your ability to manage Individual Income Tax Forms And Instructions, Office Of State seamlessly. This integration allows for a more streamlined workflow, ensuring that all your documents are in one place and easily accessible. Check our integration options to find the best fit for your needs.

-

What are the benefits of using airSlate SignNow for tax document signing?

Using airSlate SignNow for signing Individual Income Tax Forms And Instructions, Office Of State offers numerous benefits, including faster turnaround times and enhanced security. Our eSignature technology ensures that your documents are signed quickly and securely, reducing the time spent on manual processes. Additionally, you can track the status of your documents in real-time.

-

How secure is airSlate SignNow for handling tax documents?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents like Individual Income Tax Forms And Instructions, Office Of State. We utilize advanced encryption and secure cloud storage to protect your data. Our platform complies with industry standards to ensure that your information remains confidential and secure.

Get more for Individual Income Tax Forms And Instructions, Office Of State

Find out other Individual Income Tax Forms And Instructions, Office Of State

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament