Employer Notice of Tax Appeal FillableBLANK Form

What is the Employer Notice Of Tax Appeal FillableBLANK

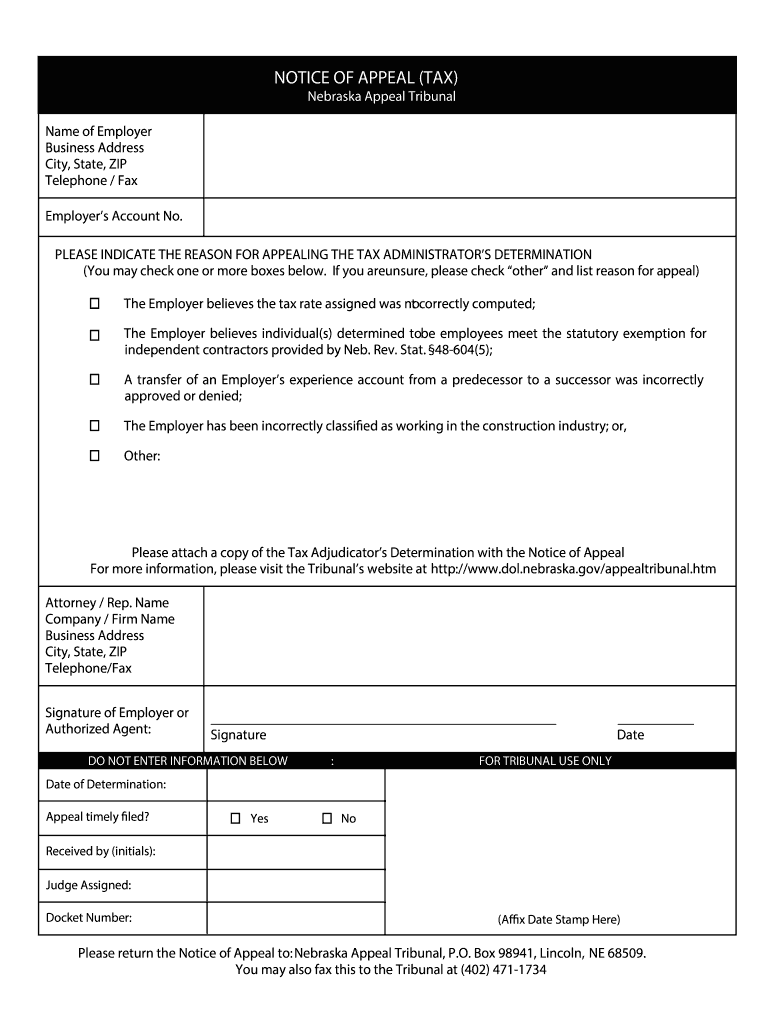

The Employer Notice Of Tax Appeal FillableBLANK is a formal document used by employers to contest a tax assessment made by a state or local tax authority. This form is essential for initiating an appeal process regarding tax liabilities that an employer believes are incorrect. The form typically requires detailed information about the employer, the tax assessment in question, and the grounds for the appeal. Understanding this form is crucial for employers who wish to ensure their tax obligations are accurately assessed.

How to use the Employer Notice Of Tax Appeal FillableBLANK

Using the Employer Notice Of Tax Appeal FillableBLANK involves several steps to ensure that all necessary information is accurately provided. First, download the fillable form from a reliable source. Next, complete the form by entering relevant details such as the employer's name, address, and the specific tax assessment being contested. It is important to clearly state the reasons for the appeal and attach any supporting documentation. Once completed, the form should be submitted according to the instructions provided, typically to the relevant tax authority.

Steps to complete the Employer Notice Of Tax Appeal FillableBLANK

Completing the Employer Notice Of Tax Appeal FillableBLANK requires careful attention to detail. Follow these steps:

- Download the fillable form from an official source.

- Fill in the employer's information, including name and address.

- Provide details of the tax assessment being appealed, including dates and amounts.

- Clearly articulate the reasons for the appeal, ensuring they are well-supported.

- Attach any necessary documentation that substantiates the appeal.

- Review the completed form for accuracy before submission.

- Submit the form to the appropriate tax authority by the specified deadline.

Key elements of the Employer Notice Of Tax Appeal FillableBLANK

The Employer Notice Of Tax Appeal FillableBLANK contains several key elements that must be addressed for a successful appeal. These include:

- Employer Information: Name, address, and contact details of the employer.

- Tax Assessment Details: Specifics about the assessment being contested, including dates and amounts.

- Reasons for Appeal: A detailed explanation of why the employer believes the assessment is incorrect.

- Supporting Documentation: Any relevant documents that provide evidence for the appeal.

- Signature: The form must be signed by an authorized representative of the employer.

Legal use of the Employer Notice Of Tax Appeal FillableBLANK

The legal use of the Employer Notice Of Tax Appeal FillableBLANK is governed by state and local tax laws. Employers must ensure that they are adhering to the specific regulations that apply to their jurisdiction when filing an appeal. This form serves as a formal request to review and potentially overturn a tax assessment, and it must be completed accurately to avoid delays or rejections. Legal counsel may be consulted to navigate complex tax issues and ensure compliance with all legal requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Employer Notice Of Tax Appeal FillableBLANK can vary by state and local jurisdiction. It is crucial for employers to be aware of these deadlines to ensure their appeal is considered. Typically, appeals must be filed within a certain timeframe following the receipt of the tax assessment notice. Missing these deadlines can result in the forfeiture of the right to contest the assessment. Employers should check their local tax authority's guidelines for specific dates and requirements.

Quick guide on how to complete employer notice of tax appeal fillableblank

Complete [SKS] seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any hold-ups. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign [SKS] effortlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your PC.

Eliminate concerns about lost or misplaced files, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the employer notice of tax appeal fillableblank

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Employer Notice Of Tax Appeal FillableBLANK?

The Employer Notice Of Tax Appeal FillableBLANK is a customizable document designed to help businesses formally appeal tax assessments. This fillable form simplifies the process of submitting tax appeals, ensuring that all necessary information is included for a successful submission.

-

How can I access the Employer Notice Of Tax Appeal FillableBLANK?

You can easily access the Employer Notice Of Tax Appeal FillableBLANK through the airSlate SignNow platform. Simply sign up for an account, navigate to the templates section, and search for the Employer Notice Of Tax Appeal FillableBLANK to start using it immediately.

-

Is the Employer Notice Of Tax Appeal FillableBLANK customizable?

Yes, the Employer Notice Of Tax Appeal FillableBLANK is fully customizable. You can add your company’s information, adjust the content as needed, and ensure that it meets your specific requirements before sending it out for signatures.

-

What are the benefits of using the Employer Notice Of Tax Appeal FillableBLANK?

Using the Employer Notice Of Tax Appeal FillableBLANK streamlines the tax appeal process, saving you time and reducing errors. It also allows for easy electronic signatures, making it more efficient to gather necessary approvals from stakeholders.

-

What features does airSlate SignNow offer for the Employer Notice Of Tax Appeal FillableBLANK?

airSlate SignNow offers features such as eSigning, document tracking, and collaboration tools for the Employer Notice Of Tax Appeal FillableBLANK. These features enhance the overall efficiency of managing your tax appeal documents and ensure that you stay organized throughout the process.

-

Are there any integrations available for the Employer Notice Of Tax Appeal FillableBLANK?

Yes, airSlate SignNow integrates with various applications, allowing you to streamline your workflow when using the Employer Notice Of Tax Appeal FillableBLANK. You can connect it with tools like Google Drive, Dropbox, and CRM systems to enhance document management.

-

What is the pricing structure for using the Employer Notice Of Tax Appeal FillableBLANK?

airSlate SignNow offers flexible pricing plans that cater to different business needs. You can choose from monthly or annual subscriptions, which provide access to the Employer Notice Of Tax Appeal FillableBLANK along with other essential features.

Get more for Employer Notice Of Tax Appeal FillableBLANK

Find out other Employer Notice Of Tax Appeal FillableBLANK

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free