Sc Pt 300 2020

What is the SC PT 300?

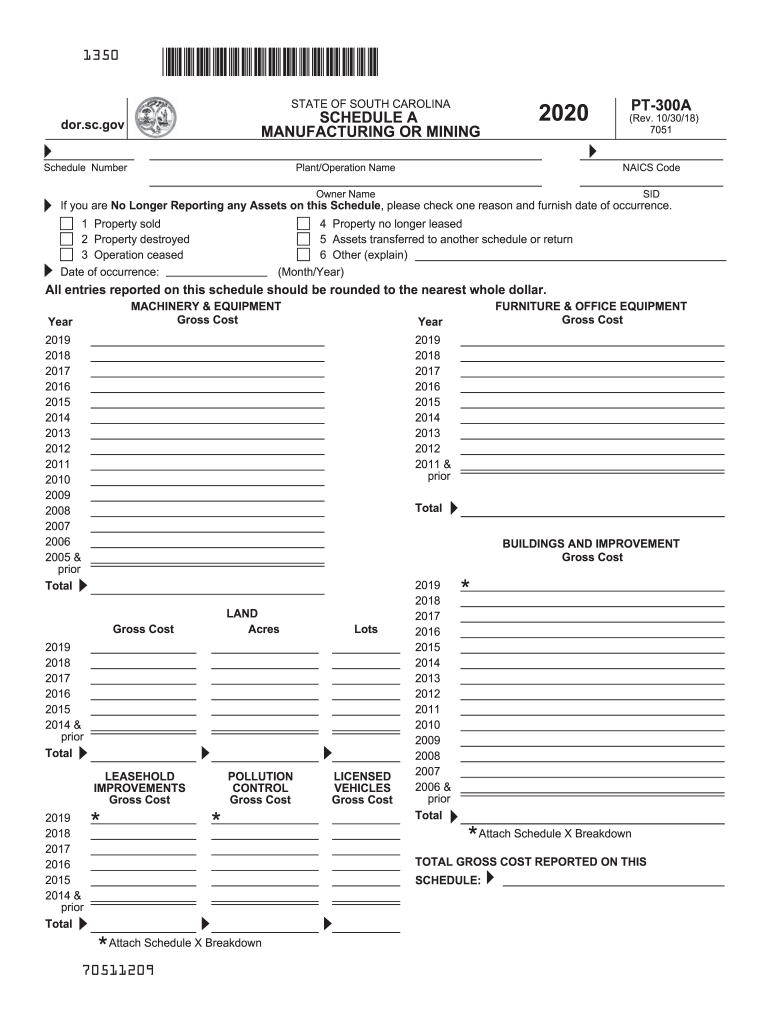

The SC PT 300 is a tax form used by South Carolina residents to report income and calculate their state tax liability. It is specifically designed for taxpayers who need to provide detailed information about their income, deductions, and credits. The form is essential for ensuring compliance with state tax laws and is a crucial part of the annual tax filing process for individuals and businesses operating within South Carolina.

Steps to Complete the SC PT 300

Completing the SC PT 300 involves several key steps to ensure accuracy and compliance:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, such as your name, address, and Social Security number.

- Report all sources of income, including wages, interest, and dividends, in the designated sections.

- Claim any eligible deductions and credits to reduce your taxable income.

- Calculate your total tax liability based on the information provided.

- Review the completed form for accuracy before submission.

Legal Use of the SC PT 300

The SC PT 300 is legally recognized by the South Carolina Department of Revenue and must be completed accurately to avoid penalties. Taxpayers are responsible for ensuring that all information reported is truthful and complies with state tax regulations. Utilizing this form correctly helps to maintain good standing with tax authorities and avoids potential legal issues.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the SC PT 300 to avoid late fees and penalties. Generally, the form must be submitted by April 15 of the year following the tax year. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Taxpayers should also be aware of any changes in deadlines due to special circumstances, such as natural disasters or government announcements.

Form Submission Methods

The SC PT 300 can be submitted through various methods to accommodate different preferences:

- Online: Taxpayers can complete and submit the form electronically through the South Carolina Department of Revenue's website.

- Mail: The completed form can be printed and mailed to the appropriate address as specified in the form instructions.

- In-Person: Taxpayers may also submit the form in person at designated state revenue offices.

Key Elements of the SC PT 300

The SC PT 300 includes several critical components that taxpayers must address:

- Personal Information: Name, address, and Social Security number.

- Income Reporting: Detailed sections for various income sources.

- Deductions and Credits: Areas to claim eligible tax benefits.

- Tax Calculation: A section for determining total tax owed.

Examples of Using the SC PT 300

Taxpayers may encounter various scenarios when using the SC PT 300. For instance, self-employed individuals must report their business income and may claim specific deductions related to their business expenses. Similarly, retirees will need to account for pension income and any applicable tax credits. Understanding these examples can help taxpayers accurately complete the form and maximize their potential refunds or minimize their liabilities.

Quick guide on how to complete sc1065 south carolina department of revenue scgov

Your assistance manual on how to prepare your Sc Pt 300

If you’re wondering how to finalize and submit your Sc Pt 300, here are some brief recommendations on how to simplify tax processing signNowly.

Initially, you simply need to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an extremely intuitive and powerful document management solution that allows you to modify, create, and finalize your income tax documents effortlessly. Utilizing its editor, you can switch between text, check boxes, and eSignatures, and return to edit responses as necessary. Enhance your tax administration with advanced PDF editing, eSigning, and easy sharing.

Follow these steps to complete your Sc Pt 300 in just a few minutes:

- Create your account and start working on PDFs in no time.

- Utilize our directory to find any IRS tax form; browse through variants and schedules.

- Click Obtain form to access your Sc Pt 300 in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Use the Signature Tool to insert your legally-recognized eSignature (if necessary).

- Review your document and rectify any inaccuracies.

- Save changes, print your version, forward it to your recipient, and download it to your device.

Make use of this guide to electronically file your taxes using airSlate SignNow. Keep in mind that submitting paper forms can lead to more mistakes and delays in refunds. Be sure to check the IRS website for filing regulations in your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct sc1065 south carolina department of revenue scgov

FAQs

-

How long does it take to receive a South Carolina driver's license after submitting the appropriate paper work with the DMV when moving from out of state into SC?

I can’t speak for SC, but when I moved from NY to PA, it took 6 weeks. I understand that most DMV’s have similar delays.

Create this form in 5 minutes!

How to create an eSignature for the sc1065 south carolina department of revenue scgov

How to generate an electronic signature for the Sc1065 South Carolina Department Of Revenue Scgov in the online mode

How to generate an electronic signature for the Sc1065 South Carolina Department Of Revenue Scgov in Google Chrome

How to create an electronic signature for signing the Sc1065 South Carolina Department Of Revenue Scgov in Gmail

How to create an eSignature for the Sc1065 South Carolina Department Of Revenue Scgov from your smart phone

How to generate an electronic signature for the Sc1065 South Carolina Department Of Revenue Scgov on iOS devices

How to make an eSignature for the Sc1065 South Carolina Department Of Revenue Scgov on Android

People also ask

-

What is SC PT 300 2020 in relation to airSlate SignNow?

SC PT 300 2020 refers to a specific document type that can be easily handled within the airSlate SignNow platform. With this solution, businesses can efficiently send and eSign documents, ensuring compliance and ease of use.

-

How much does airSlate SignNow cost for SC PT 300 2020 workflows?

The pricing for using airSlate SignNow for SC PT 300 2020 workflows is competitive and designed to fit various business needs. Customers can choose from different subscription plans that provide flexibility and scalability as their document signing needs grow.

-

What are the key features of airSlate SignNow for SC PT 300 2020?

AirSlate SignNow offers features such as custom templates, real-time notifications, and secure cloud storage specifically tailored for SC PT 300 2020 documents. These features help streamline your document management process and enhance productivity.

-

How can airSlate SignNow benefit my business when managing SC PT 300 2020?

Using airSlate SignNow for SC PT 300 2020 improves workflow efficiency by simplifying document sending and signing processes. This solution not only saves time but also reduces the likelihood of errors, ultimately enhancing your business operations.

-

Can airSlate SignNow integrate with other applications for SC PT 300 2020?

Yes, airSlate SignNow supports several integrations with popular tools and CRM systems to facilitate the management of SC PT 300 2020 documents. This capability allows users to streamline their workflows and keep all essential applications connected for optimal efficiency.

-

What security measures does airSlate SignNow implement for SC PT 300 2020 documents?

AirSlate SignNow prioritizes the security of SC PT 300 2020 documents with advanced encryption and compliance with various regulatory standards. Users can trust that their sensitive information is protected while utilizing the platform for eSigning.

-

Is there a mobile app for airSlate SignNow that supports SC PT 300 2020?

Yes, airSlate SignNow provides a mobile app that allows users to manage SC PT 300 2020 documents on-the-go. This app ensures that businesses can send and eSign documents anytime, enhancing flexibility and accessibility for users.

Get more for Sc Pt 300

Find out other Sc Pt 300

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT