CITY of LAPEER INDIVIDUAL INCOME TAX RETURN DUE APRIL 30 2017

Understanding the CITY OF LAPEER INDIVIDUAL INCOME TAX RETURN DUE APRIL 30

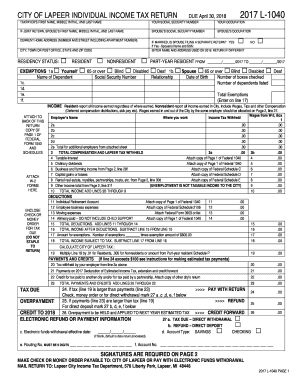

The CITY OF LAPEER INDIVIDUAL INCOME TAX RETURN is a form that residents of Lapeer, Michigan, must complete to report their individual income for tax purposes. This return is crucial for determining the amount of local income tax owed to the city. The due date for this return is April 30 each year, aligning with the end of the tax season for many individuals. It is essential for residents to be aware of this deadline to avoid penalties and ensure compliance with local tax regulations.

Steps to Complete the CITY OF LAPEER INDIVIDUAL INCOME TAX RETURN

Completing the CITY OF LAPEER INDIVIDUAL INCOME TAX RETURN involves several key steps:

- Gather necessary documents, including W-2 forms, 1099 forms, and any other income statements.

- Download the tax return form from the city’s official website or obtain a physical copy from the local tax office.

- Fill out the form accurately, ensuring all income sources are reported and deductions are applied where applicable.

- Review the completed form for accuracy and completeness before submission.

- Submit the form by the April 30 deadline, either online, by mail, or in person at the local tax office.

Required Documents for the CITY OF LAPEER INDIVIDUAL INCOME TAX RETURN

To successfully complete the CITY OF LAPEER INDIVIDUAL INCOME TAX RETURN, individuals must gather specific documents. These typically include:

- W-2 forms from employers that detail annual earnings and taxes withheld.

- 1099 forms for any freelance or contract work that provides income outside of traditional employment.

- Records of other income sources, such as rental income or investment earnings.

- Documentation for any tax deductions or credits being claimed, such as charitable contributions or education expenses.

Filing Deadlines for the CITY OF LAPEER INDIVIDUAL INCOME TAX RETURN

The filing deadline for the CITY OF LAPEER INDIVIDUAL INCOME TAX RETURN is April 30 each year. It is important for residents to mark this date on their calendars to avoid late fees or penalties. If April 30 falls on a weekend or holiday, the deadline may be extended to the next business day. Staying informed about these deadlines is crucial for timely compliance.

Form Submission Methods for the CITY OF LAPEER INDIVIDUAL INCOME TAX RETURN

Residents of Lapeer have several options for submitting their CITY OF LAPEER INDIVIDUAL INCOME TAX RETURN. These include:

- Online Submission: Many residents prefer to file electronically through the city’s online portal, which offers a streamlined process.

- Mail: Individuals can print the completed form and send it via postal service to the designated tax office address.

- In-Person: Residents may also choose to deliver their forms directly to the local tax office for immediate processing.

Penalties for Non-Compliance with the CITY OF LAPEER INDIVIDUAL INCOME TAX RETURN

Failure to file the CITY OF LAPEER INDIVIDUAL INCOME TAX RETURN by the April 30 deadline can result in penalties. These may include:

- Late filing fees that accumulate over time.

- Interest on any unpaid taxes, which can increase the total amount owed.

- Potential legal action for continued non-compliance, which may lead to further financial consequences.

Quick guide on how to complete city of lapeer individual income tax return due april 30

Effortlessly Prepare CITY OF LAPEER INDIVIDUAL INCOME TAX RETURN DUE APRIL 30 on Any Device

Managing documents online has become increasingly favored by both companies and individuals. It represents an ideal environmentally-friendly substitute for conventional printed and signed papers, as you can easily find the needed form and securely store it online. airSlate SignNow provides all the tools necessary to generate, modify, and eSign your documents swiftly without any delays. Handle CITY OF LAPEER INDIVIDUAL INCOME TAX RETURN DUE APRIL 30 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Modify and eSign CITY OF LAPEER INDIVIDUAL INCOME TAX RETURN DUE APRIL 30 with Ease

- Obtain CITY OF LAPEER INDIVIDUAL INCOME TAX RETURN DUE APRIL 30 and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive data using tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your modifications.

- Choose your preferred method to send the form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors requiring new copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign CITY OF LAPEER INDIVIDUAL INCOME TAX RETURN DUE APRIL 30 while ensuring outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct city of lapeer individual income tax return due april 30

Create this form in 5 minutes!

How to create an eSignature for the city of lapeer individual income tax return due april 30

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the deadline for the CITY OF LAPEER INDIVIDUAL INCOME TAX RETURN?

The CITY OF LAPEER INDIVIDUAL INCOME TAX RETURN is due on April 30 each year. It is essential to file your return by this date to avoid any penalties or interest charges. Make sure to gather all necessary documents well in advance to ensure a smooth filing process.

-

How can airSlate SignNow help with filing the CITY OF LAPEER INDIVIDUAL INCOME TAX RETURN?

airSlate SignNow provides an easy-to-use platform for eSigning and sending documents, making it simpler to manage your CITY OF LAPEER INDIVIDUAL INCOME TAX RETURN. You can securely sign your tax documents online and send them directly to the appropriate authorities. This streamlines the process and ensures timely submission.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are beneficial for managing your CITY OF LAPEER INDIVIDUAL INCOME TAX RETURN. These features help you stay organized and ensure that all necessary documents are completed and submitted on time. Additionally, you can collaborate with tax professionals seamlessly.

-

Is there a cost associated with using airSlate SignNow for tax returns?

Yes, airSlate SignNow offers various pricing plans to suit different needs, including options for individuals and businesses. The cost is competitive and provides excellent value considering the features available for managing your CITY OF LAPEER INDIVIDUAL INCOME TAX RETURN. You can choose a plan that fits your budget and requirements.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow integrates with various accounting and tax software, making it easier to manage your CITY OF LAPEER INDIVIDUAL INCOME TAX RETURN. This integration allows for seamless data transfer and ensures that all your financial information is up to date and accurate.

-

What are the benefits of using airSlate SignNow for tax filing?

Using airSlate SignNow for your CITY OF LAPEER INDIVIDUAL INCOME TAX RETURN offers numerous benefits, including time savings, enhanced security, and ease of use. The platform simplifies the eSigning process, allowing you to complete your tax documents quickly and securely. This efficiency can help you avoid last-minute stress as the April 30 deadline approaches.

-

How secure is airSlate SignNow for handling sensitive tax documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your sensitive information. When managing your CITY OF LAPEER INDIVIDUAL INCOME TAX RETURN, you can trust that your data is safe and secure. This commitment to security allows you to focus on completing your tax return without worrying about data bsignNowes.

Get more for CITY OF LAPEER INDIVIDUAL INCOME TAX RETURN DUE APRIL 30

- Rti priority form a time bound reply see rule 41

- Sa670 form

- Flag football stat sheet 450010716 form

- Aae case difficulty assessment form

- Dv 109 notice of court hearing form

- Www pdffiller com410359142 sample letter forsample letter for traveling with medications pdffiller form

- Llc buy sell agreement template form

- Llc contribution agreement template form

Find out other CITY OF LAPEER INDIVIDUAL INCOME TAX RETURN DUE APRIL 30

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding