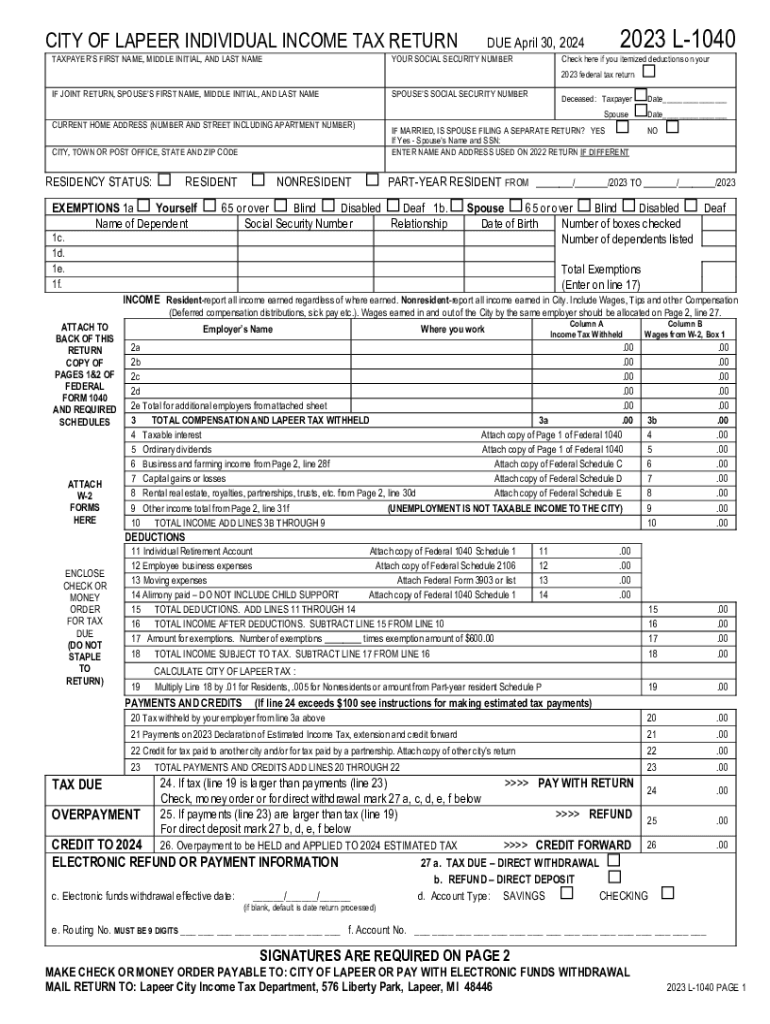

Income Tax Filing Dates Welcome to Lapeer, MI 2023

IRS Guidelines

The IRS provides comprehensive guidelines for completing the individual income tax return. These guidelines include instructions on eligibility, required documentation, and specific forms to use, such as the Form 1040. Taxpayers should review the IRS website for the most current information, as rules and requirements can change annually. Understanding these guidelines helps ensure compliance and reduces the risk of errors that could lead to penalties.

Filing Deadlines / Important Dates

Filing deadlines for the individual income tax return are crucial for taxpayers to meet. Typically, the deadline is April 15 for the previous tax year, but this may vary if it falls on a weekend or holiday. Extensions can be requested, allowing additional time to file, but any taxes owed must still be paid by the original deadline to avoid penalties and interest. Keeping track of these dates is essential for timely submissions.

Required Documents

To complete an individual income tax return, taxpayers need several key documents. These include W-2 forms from employers, 1099 forms for other income, and documentation for deductions such as mortgage interest or medical expenses. Collecting these documents beforehand streamlines the filing process and ensures that all income and deductions are accurately reported, which can lead to potential tax savings.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have various options for submitting their individual income tax return. The most common methods include filing online through IRS-approved software, mailing a paper return, or submitting in-person at designated IRS offices. Each method has its advantages, such as faster processing times for online submissions. Understanding these options helps taxpayers choose the most convenient and efficient way to file their returns.

Penalties for Non-Compliance

Failing to file an individual income tax return or not paying owed taxes can result in significant penalties. The IRS imposes fines based on the amount owed and the duration of non-compliance. Additionally, interest accrues on unpaid taxes. Being aware of these penalties emphasizes the importance of timely filing and payment to avoid unnecessary financial burdens.

Taxpayer Scenarios (e.g., self-employed, retired, students)

Different taxpayer scenarios require unique considerations when filing an individual income tax return. For example, self-employed individuals may need to report additional income and pay self-employment tax, while retirees might have different sources of income such as pensions or Social Security. Students may qualify for education-related tax credits. Understanding these scenarios ensures that all taxpayers maximize their benefits and comply with tax regulations.

Quick guide on how to complete income tax filing dates welcome to lapeer mi

Complete Income Tax Filing Dates Welcome To Lapeer, MI easily on any device

Online document management has gained popularity with organizations and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly and without interruptions. Handle Income Tax Filing Dates Welcome To Lapeer, MI on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Income Tax Filing Dates Welcome To Lapeer, MI effortlessly

- Find Income Tax Filing Dates Welcome To Lapeer, MI and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and hit the Done button to save your modifications.

- Choose how you prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, cumbersome form navigation, or errors that require reprinting. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and eSign Income Tax Filing Dates Welcome To Lapeer, MI and ensure smooth communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct income tax filing dates welcome to lapeer mi

Create this form in 5 minutes!

How to create an eSignature for the income tax filing dates welcome to lapeer mi

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an individual income tax return?

An individual income tax return is a form used by individuals to report their income, expenses, and other tax-related information to the IRS. It is essential for determining how much tax an individual owes or the refund they may receive. airSlate SignNow can help streamline the process of signing and submitting your individual income tax return.

-

How can airSlate SignNow assist with my individual income tax return?

airSlate SignNow provides a user-friendly platform for electronically signing and sending your individual income tax return documents. With its secure eSignature capabilities, you can ensure that your tax documents are signed and submitted quickly and efficiently, reducing the risk of delays.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different needs, including options for individuals and businesses. Each plan provides access to essential features for managing your individual income tax return and other documents. You can choose a plan that best fits your budget and requirements.

-

Are there any features specifically for tax professionals using airSlate SignNow?

Yes, airSlate SignNow includes features tailored for tax professionals, such as bulk sending, templates for individual income tax return documents, and advanced tracking options. These features help streamline the workflow, making it easier to manage multiple clients' tax returns efficiently.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, allowing you to manage your individual income tax return alongside your financial records. This integration enhances productivity by enabling you to access all necessary documents in one place.

-

What are the benefits of using airSlate SignNow for my individual income tax return?

Using airSlate SignNow for your individual income tax return offers numerous benefits, including time savings, enhanced security, and ease of use. The platform simplifies the signing process, ensuring that your documents are completed accurately and submitted on time.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your individual income tax return and other sensitive documents are protected. The platform uses advanced encryption and security measures to safeguard your information throughout the signing process.

Get more for Income Tax Filing Dates Welcome To Lapeer, MI

- City of milwaukee property search form

- Declaration of homestead form

- Application for long term care services bhsf form1 1 rev8 15

- Modifier 22 explanation form

- U s air force form af781 download

- 740 mentally ill persons office of preparation form

- Spec pro cases habeas corpus and prerogative writs 4 14 form

- Www dshs state tx usfoodestablishmentspdfproposed retail food establishment inspection report form

Find out other Income Tax Filing Dates Welcome To Lapeer, MI

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation