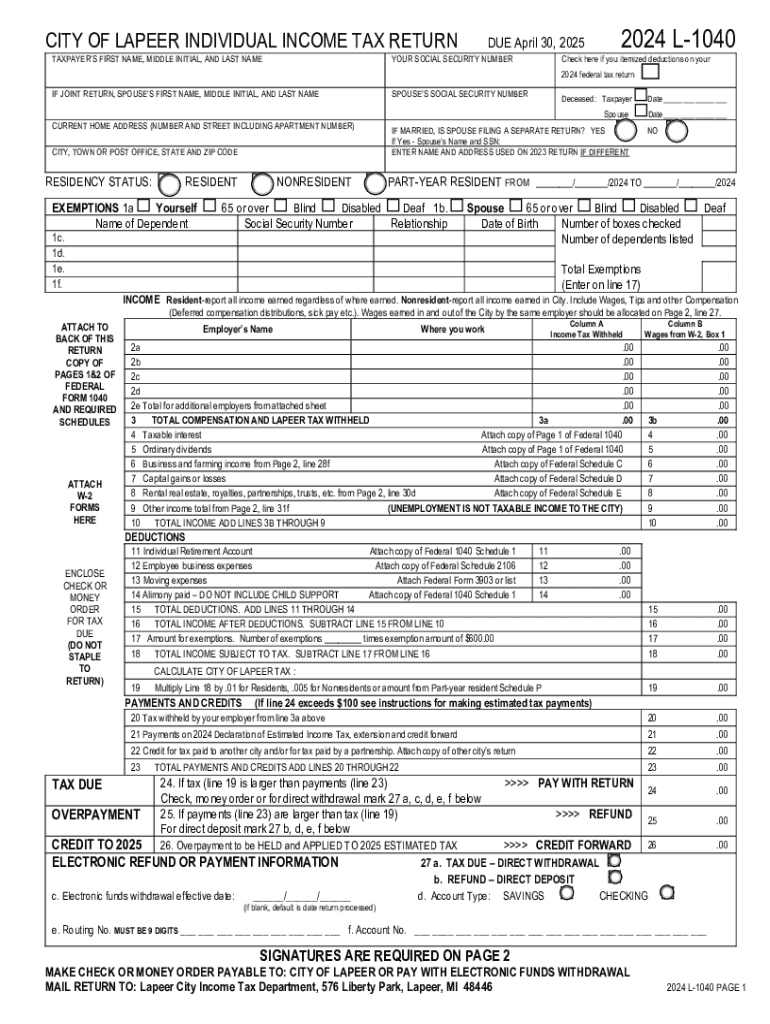

CITY of LAPEER INDIVIDUAL INCOME TAX RETURN DUE APRIL 30, L 1040 2024-2026

Understanding the individual income tax return form

The individual income tax return form is a crucial document used by taxpayers in the United States to report their annual income to the Internal Revenue Service (IRS). This form allows individuals to calculate their tax obligations based on their income, deductions, and credits. The most commonly used form for this purpose is the Form 1040, which accommodates various income types and tax situations, including self-employment income and investment earnings.

Steps to complete the individual income tax return form

Completing the individual income tax return form involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and records of deductions.

- Choose the appropriate form variant, such as Form 1040, based on your filing needs.

- Fill out personal information, including your name, address, and Social Security number.

- Report your income by entering amounts from your documents into the designated sections.

- Claim deductions and credits to reduce your taxable income.

- Calculate your total tax liability and determine if you owe taxes or are due a refund.

- Review the completed form for accuracy before submission.

Filing deadlines and important dates

It is essential to be aware of the filing deadlines associated with the individual income tax return form. Typically, the deadline for submitting your tax return is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers can also request an extension, but this does not extend the time to pay any taxes owed.

Required documents for filing

To complete the individual income tax return form accurately, you will need various documents, including:

- W-2 forms from employers showing wages and tax withheld.

- 1099 forms for other income sources, such as freelance work or interest earned.

- Records of deductible expenses, such as medical bills or mortgage interest.

- Statements for any tax credits you plan to claim.

Form submission methods

Taxpayers have several options for submitting their individual income tax return form. These methods include:

- Filing electronically through tax preparation software or IRS e-file.

- Mailing a paper version of the form to the appropriate IRS address.

- In-person submission at designated IRS offices, if applicable.

IRS guidelines for filing

The IRS provides specific guidelines for completing and submitting the individual income tax return form. These guidelines include instructions on how to fill out each section of the form, eligibility requirements for various deductions and credits, and information on how to correct errors after submission. It is advisable to review these guidelines to ensure compliance and avoid potential penalties.

Create this form in 5 minutes or less

Find and fill out the correct city of lapeer individual income tax return due april 30 l 1040

Create this form in 5 minutes!

How to create an eSignature for the city of lapeer individual income tax return due april 30 l 1040

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an individual income tax return form?

An individual income tax return form is a document used by taxpayers to report their income, expenses, and other relevant financial information to the IRS. This form is essential for calculating tax liability and ensuring compliance with federal tax laws. Using airSlate SignNow, you can easily eSign and send your individual income tax return form securely.

-

How can airSlate SignNow help with my individual income tax return form?

airSlate SignNow simplifies the process of preparing and submitting your individual income tax return form by allowing you to eSign documents quickly and securely. Our platform ensures that your forms are completed accurately and submitted on time, reducing the risk of errors. Additionally, you can track the status of your documents in real-time.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers flexible pricing plans to accommodate various needs, including those who need to manage individual income tax return forms. Our plans are designed to be cost-effective, ensuring you get the best value for your investment. You can choose from monthly or annual subscriptions based on your usage requirements.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes the security of your documents, including individual income tax return forms. We utilize advanced encryption and secure cloud storage to protect your sensitive information. Our platform complies with industry standards to ensure that your data remains confidential and secure.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers seamless integrations with various tax preparation software, making it easy to manage your individual income tax return form alongside your other financial documents. This integration streamlines your workflow and enhances productivity, allowing you to focus on what matters most.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow provides a range of features tailored for managing tax documents, including templates for individual income tax return forms, automated reminders, and real-time tracking. These features help ensure that your documents are completed accurately and submitted on time. Additionally, our user-friendly interface makes it easy for anyone to navigate.

-

How does eSigning an individual income tax return form work?

eSigning an individual income tax return form with airSlate SignNow is a straightforward process. You simply upload your document, add the necessary fields for signatures, and send it to the relevant parties for signing. Once all signatures are collected, you receive a fully executed copy for your records.

Get more for CITY OF LAPEER INDIVIDUAL INCOME TAX RETURN DUE APRIL 30, L 1040

- Assignment of contract for deed by seller ohio form

- Notice of assignment of contract for deed ohio form

- Oh purchase form

- Oh checklist form

- Sellers information for appraiser provided to buyer ohio

- Ohio subcontractors form

- Option to purchase addendum to residential lease lease or rent to own ohio form

- This doesnt usually happen desertrose07 form

Find out other CITY OF LAPEER INDIVIDUAL INCOME TAX RETURN DUE APRIL 30, L 1040

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form