Use These Notes to Help You Fill in the Self Employment Full 2024-2026

Understanding the SA103F Form

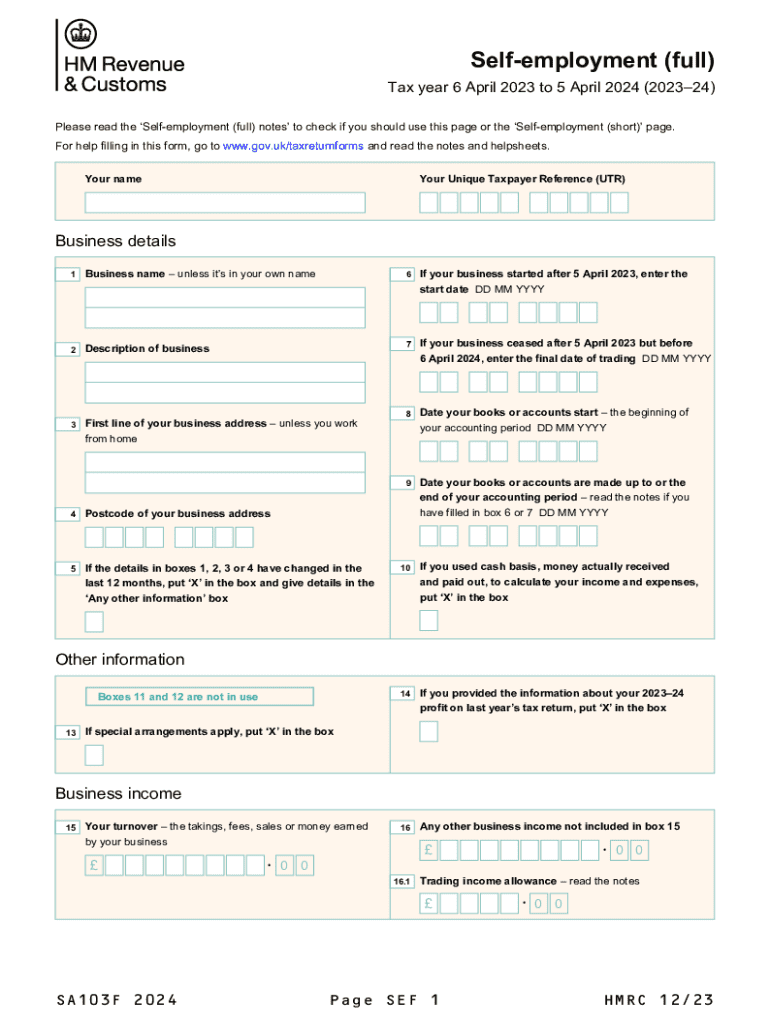

The SA103F form is a self-employment tax form used in the United Kingdom for individuals who operate as sole traders. This form is essential for reporting income and expenses to HM Revenue and Customs (HMRC). It helps self-employed individuals calculate their taxable profits and determine the tax they owe. The SA103F is specifically designed for those with a more complex business structure or higher income levels, ensuring that all relevant financial details are accurately captured.

Key Elements of the SA103F Form

When filling out the SA103F form, several key elements must be included:

- Personal Information: This includes your name, address, and National Insurance number.

- Business Information: Details about your business, including the type of work you do and the date you started trading.

- Income: Total income from your self-employment, including sales and any other earnings.

- Expenses: All allowable business expenses, such as materials, travel costs, and other operational expenses.

- Tax Calculation: The form will guide you in calculating your taxable profit based on the income and expenses reported.

Steps to Complete the SA103F Form

Completing the SA103F form involves several steps:

- Gather all necessary documents, including records of income and expenses.

- Fill in your personal information accurately.

- Provide detailed information about your business activities.

- Report your total income and list all allowable expenses.

- Calculate your taxable profit based on the information provided.

- Review the form for accuracy before submission.

Filing Deadlines for the SA103F Form

It is crucial to be aware of the filing deadlines for the SA103F form to avoid penalties. The form must be submitted by the following dates:

- For paper submissions: October 31 following the end of the tax year.

- For online submissions: January 31 following the end of the tax year.

Late submissions may incur fines, so timely filing is essential for compliance.

Legal Use of the SA103F Form

The SA103F form is legally required for self-employed individuals in the UK. Accurate completion and submission ensure compliance with tax laws and regulations. Failure to submit the form can lead to penalties, including fines and interest on unpaid taxes. It is advisable to keep records of all submitted forms and any correspondence with HMRC for future reference.

Examples of Using the SA103F Form

Here are a few scenarios where the SA103F form is applicable:

- A freelance graphic designer who earns income from multiple clients must report their earnings and expenses using the SA103F.

- A self-employed consultant who incurs costs for travel and materials related to their business needs to complete the form to claim these expenses.

- A sole trader running a small retail business must use the SA103F to report their sales and operational costs accurately.

Quick guide on how to complete use these notes to help you fill in the self employment full

Complete Use These Notes To Help You Fill In The Self employment full effortlessly on any device

Digital document management has become increasingly prevalent among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Use These Notes To Help You Fill In The Self employment full on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related task today.

How to modify and electronically sign Use These Notes To Help You Fill In The Self employment full with ease

- Locate Use These Notes To Help You Fill In The Self employment full and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to share your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Use These Notes To Help You Fill In The Self employment full and maintain excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct use these notes to help you fill in the self employment full

Create this form in 5 minutes!

How to create an eSignature for the use these notes to help you fill in the self employment full

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the sa103f self form printable?

The sa103f self form printable is a tax form used by self-employed individuals in the UK to report their income and expenses. It simplifies the process of filing taxes by allowing users to fill out the form digitally and print it for submission. This form is essential for ensuring compliance with HMRC regulations.

-

How can I access the sa103f self form printable?

You can easily access the sa103f self form printable through our airSlate SignNow platform. Simply navigate to the forms section, and you will find the option to download or fill out the form online. This user-friendly approach ensures that you can complete your tax filing efficiently.

-

Is the sa103f self form printable free to use?

While the sa103f self form printable can be accessed for free, using airSlate SignNow's features may involve a subscription fee. Our platform offers various pricing plans that cater to different business needs, ensuring you get the best value for your document management and eSigning requirements.

-

What are the benefits of using the sa103f self form printable with airSlate SignNow?

Using the sa103f self form printable with airSlate SignNow provides numerous benefits, including ease of use, time-saving features, and secure document handling. Our platform allows you to fill out, sign, and send your forms electronically, streamlining the entire process and reducing the risk of errors.

-

Can I integrate the sa103f self form printable with other software?

Yes, airSlate SignNow allows for seamless integration with various software applications, enhancing your workflow. You can connect the sa103f self form printable with accounting software, CRM systems, and more, ensuring that your documents are easily accessible and manageable across platforms.

-

How secure is the sa103f self form printable on airSlate SignNow?

Security is a top priority at airSlate SignNow. The sa103f self form printable is protected with advanced encryption and secure access controls, ensuring that your sensitive information remains confidential. You can trust our platform to keep your documents safe throughout the signing process.

-

What features does airSlate SignNow offer for the sa103f self form printable?

AirSlate SignNow offers a variety of features for the sa103f self form printable, including customizable templates, electronic signatures, and real-time tracking. These features enhance your document management experience, making it easier to complete and submit your forms efficiently.

Get more for Use These Notes To Help You Fill In The Self employment full

Find out other Use These Notes To Help You Fill In The Self employment full

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure